MetLife 2006 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

the life insurance industry. Larger market participants tend to have the capacity to invest in additional distribution capability and the

information technology needed to offer the superior customer service demanded by an increasingly sophisticated industry client base.

Regulatory Changes. The life insurance industry is regulated at the state level, with some products and services also subject to federal

regulation. As life insurers introduce new and often more complex products, regulators refine capital requirements and introduce new

reserving standards for the life insurance industry. Regulations recently adopted or currently under review can potentially impact the

reserve and capital requirements of the industry. In addition, regulators have undertaken market and sales practices reviews of several

markets or products, including equity-indexed annuities, variable annuities and group products.

Pension Plans. On August 17, 2006, President Bush signed the Pension Protection Act of 2006 (“PPA”) into law. This act is

considered to be the most sweeping pension legislation since the adoption of the Employee Retirement Income Security Act of 1974

(“ERISA”) on September 2, 1974. The provisions of the PPA may have a significant impact on demand for pension, retirement savings, and

lifestyle protection products in both the institutional and retail markets. This legislation, while not immediate, may have a positive impact on

the life insurance and financial services industries in the future.

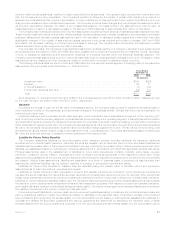

Impact of Hurricanes

On August 29, 2005, Hurricane Katrina made landfall in the states of Louisiana, Mississippi and Alabama, causing catastrophic damage

to these coastal regions. MetLife’s cumulative gross losses from Hurricane Katrina were $333 million and $335 million at December 31,

2006 and 2005, respectively, primarily arising from the Company’s homeowners business. During the years ended December 31, 2006

and 2005, the Company recognized total net losses, net of income tax and reinsurance recoverables and including reinstatement

premiums and other reinsurance-related premium adjustments related to the catastrophe as follows:

2006 2005 2006 2005 2006 2005

Auto & Home

Years Ended

December 31,

Institutional

Years Ended

December 31,

Total Co mp any

Years Ended

December 31,

(In millions)

NetultimatelossesatJanuary1, ..................... $120 $ — $14 $— $134 $ —

Totalnetlossesrecognized......................... (2) 120 — 14 (2) 134

NetultimatelossesatDecember31,................... $118 $120 $14 $14 $132 $134

On October 24, 2005, Hurricane Wilma made landfall across the state of Florida. MetLife’s cumulative gross losses from Hurricane

Wilma were $64 million and $57 million at December 31, 2006 and 2005, respectively, primarily arising from the Company’s homeowners

and automobile businesses. During the years ended December 31, 2006 and 2005, the Company’s Auto & Home segment recognized

total losses, net of income tax and reinsurance recoverables, of $29 million and $32 million, respectively, related to Hurricane Wilma.

Additional hurricane-related losses may be recorded in future periods as claims are received from insureds and claims to reinsurers are

processed. Reinsurance recoveries are dependent upon the continued creditworthiness of the reinsurers, which may be affected by their

other reinsured losses in connection with Hurricanes Katrina and Wilma and otherwise. In addition, lawsuits, including purported class

actions, have been filed in Louisiana and Mississippi challenging denial of claims for damages caused to property during Hurricane Katrina.

Metropolitan Property and Casualty Insurance Company (“MPC”) is a named party in some of these lawsuits. In addition, rulings in cases in

which MPC is not a party may affect interpretation of its policies. MPC intends to vigorously defend these matters. However, any adverse

rulings could result in an increase in the Company’s hurricane-related claim exposure and losses. Based on information known by

management, it does not believe that additional claim losses resulting from Hurricane Katrina will have a material adverse impact on the

Company’s consolidated financial statements.

Summary of Critical Accounting Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America

(“GAAP”) requires management to adopt accounting policies and make estimates and assumptions that affect amounts reported in the

consolidated financial statements. The most critical estimates include those used in determining:

i) the fair value of investments in the absence of quoted market values;

ii) investment impairments;

iii) the recognition of income on certain investments;

iv) application of the consolidation rules to certain investments;

v) the fair value of and accounting for derivatives;

vi) the capitalization and amortization of DAC and the establishment and amortization of VOBA;

vii) the measurement of goodwill and related impairment, if any;

viii) the liability for future policyholder benefits;

ix) accounting for income taxes and the valuation of deferred tax assets;

x) accounting for reinsurance transactions;

xi) accounting for employee benefit plans; and

xii) the liability for litigation and regulatory matters.

The application of purchase accounting requires the use of estimation techniques in determining the fair value of the assets acquired

and liabilities assumed — the most significant of which relate to the aforementioned critical estimates. In applying these policies,

management makes subjective and complex judgments that frequently require estimates about matters that are inherently uncertain.

Many of these policies, estimates and related judgments are common in the insurance and financial services industries; others are specific

to the Company’s businesses and operations. Actual results could differ from these estimates.

8MetLife, Inc.