MetLife 2006 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company’s deferred income tax liability related to leveraged leases was $670 million and $679 million at December 31, 2006 and

2005, respectively. The rental receivables set forth above are generally due in periodic installments. The payment periods generally range

from one to 15 years, but in certain circumstances are as long as 30 years.

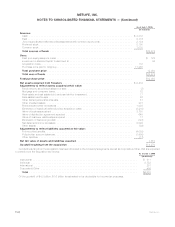

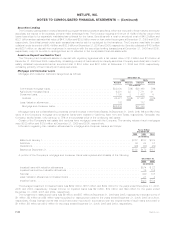

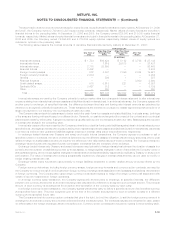

The components of net income from investment in leveraged leases are as follows:

2006 2005 2004

Years Ended

December 31,

(In millions)

Incomefrominvestmentinleveragedleases(includedinnetinvestmentincome) ................. $51 $54 $26

Incometaxexpenseonleveragedleases........................................... (18) (19) (9)

Netincomefromleveragedleases ............................................... $33 $35 $17

Funds Withheld at Interest

Funds withheld at interest, included in other invested assets, were $4.0 billion and $3.5 billion at December 31, 2006 and 2005,

respectively.

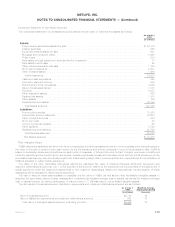

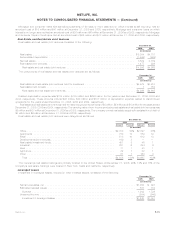

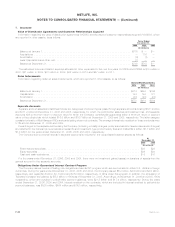

Net Investment Income

The components of net investment income are as follows:

2006 2005 2004

Years Ended December 31,

(In millions)

Fixedmaturitysecurities.............................................. $14,149 $11,400 $ 9,397

Equitysecurities................................................... 122 79 80

Mortgageandconsumerloans.......................................... 2,534 2,302 1,963

Policyloans...................................................... 603 572 541

Realestateandrealestatejointventures................................... 788 549 440

Otherlimitedpartnershipinterests ....................................... 945 709 324

Cash,cashequivalentsandshort-terminvestments............................ 519 400 167

Other.......................................................... 530 472 219

Totalinvestmentincome ............................................ 20,190 16,483 13,131

Less:Investmentexpenses............................................ 2,998 1,666 859

Netinvestmentincome ............................................. $17,192 $14,817 $12,272

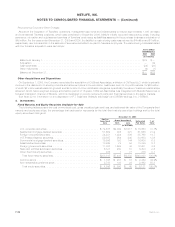

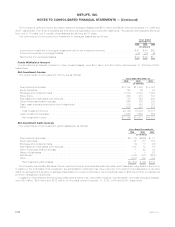

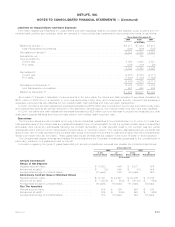

Net Investment Gains (Losses)

The components of net investment gains (losses) are as follows:

2006 2005 2004

Years Ended December 31,

(In millions)

Fixed maturity securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(1,119) $(868) $ 71

Equitysecurities....................................................... 84 117 155

Mortgageandconsumerloans.............................................. (8) 17 (47)

Realestateandrealestatejointventures....................................... 102 14 16

Otherlimitedpartnershipinterests ........................................... 1 42 53

Salesofbusinesses .................................................... — 8 23

Derivatives........................................................... (169) 384 (255)

Other.............................................................. (241) 193 159

Netinvestmentgains(losses)............................................. $(1,350) $ (93) $175

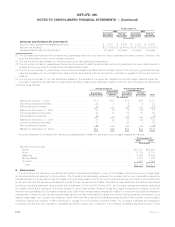

The Company periodically disposes of fixed maturity and equity securities at a loss. Generally, such losses are insignificant in amount or

in relation to the cost basis of the investment, are attributable to declines in fair value occurring in the period of the disposition or are as a

result of management’s decision to sell securities based on current conditions or the Company’s need to shift the portfolio to maintain its

portfolio management objectives.

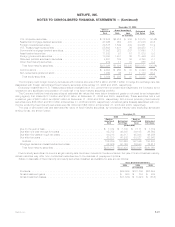

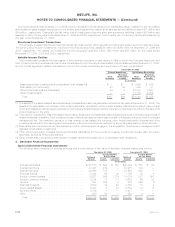

Losses from fixed maturity and equity securities deemed other-than-temporarily impaired, included within net investment gains (losses),

were $82 million, $64 million and $102 million for the years ended December 31, 2006, 2005 and 2004, respectively.

F-32 MetLife, Inc.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)