MetLife 2006 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

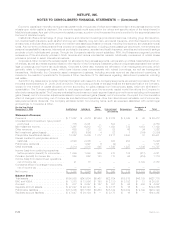

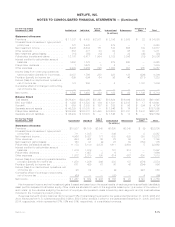

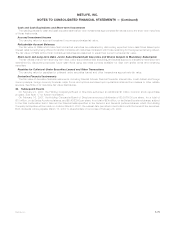

Amounts related to the Company’s financial instruments are as follows:

December 31, 2006

Notional

Amount Carrying

Value Estimated

Fair Value

(In millions)

Assets:

Fixedmaturitysecurities ........................................... $243,428 $243,428

Tradingsecurities................................................ $ 759 $ 759

Equitysecurities................................................. $ 5,131 $ 5,131

Mortgageandconsumerloans ....................................... $ 42,239 $ 42,451

Policyloans ................................................... $ 10,228 $ 10,228

Short-terminvestments............................................ $ 2,709 $ 2,709

Cashandcashequivalents ......................................... $ 7,107 $ 7,107

Accruedinvestmentincome......................................... $ 3,347 $ 3,347

Mortgageloancommitments......................................... $4,022 $ — $ 4

Commitmentstofundbankcreditfacilitiesandbridgeloans .................... $1,908 $ — $ —

Liabilities:

Policyholderaccountbalances ....................................... $112,438 $108,318

Short-termdebt................................................. $ 1,449 $ 1,449

Long-termdebt................................................. $ 9,979 $ 10,149

Juniorsubordinateddebtsecurities.................................... $ 3,780 $ 3,759

Sharessubjecttomandatoryredemption................................. $ 278 $ 357

Payables for collateral under securities loaned and other transactions . . . . . . . . . . . . . . $ 45,846 $ 45,846

December 31, 2005

Notional

Amount Carrying

Value Estimated

Fair Value

(In millions)

Assets:

Fixedmaturitysecurities ........................................... $230,050 $230,050

Tradingsecurities................................................ $ 825 $ 825

Equitysecurities................................................. $ 3,338 $ 3,338

Mortgageandconsumerloans ....................................... $ 37,190 $ 37,820

Policyloans ................................................... $ 9,981 $ 9,981

Short-terminvestments............................................ $ 3,306 $ 3,306

Cashandcashequivalents ......................................... $ 4,018 $ 4,018

Accruedinvestmentincome......................................... $ 3,036 $ 3,036

Mortgageloancommitments......................................... $2,974 $ — $ (4)

Commitmentstofundbankcreditfacilitiesandbridgeloans .................... $ 346 $ — $ —

Liabilities:

Policyholderaccountbalances ....................................... $108,591 $106,237

Short-termdebt................................................. $ 1,414 $ 1,414

Long-termdebt................................................. $ 9,489 $ 9,890

Juniorsubordinateddebtsecurities.................................... $ 2,533 $ 2,504

Sharessubjecttomandatoryredemption................................. $ 278 $ 362

Payables for collateral under securities loaned and other transactions . . . . . . . . . . . . . . $ 34,515 $ 34,515

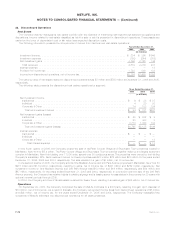

The methods and assumptions used to estimate the fair value of financial instruments are summarized as follows:

Fixed Maturity Securities, Trading Securities and Equity Securities

The fair values of publicly held fixed maturity securities and publicly held equity securities are based on quoted market prices or

estimates from independent pricing services. However, in cases where quoted market prices are not available, such as for private fixed

maturity securities, fair values are estimated using present value or valuation techniques. The determination of fair values is based on:

(i) valuation methodologies; (ii) securities the Company deems to be comparable; and (iii) assumptions deemed appropriate given the

circumstances. The fair value estimates based on available market information and judgments about financial instruments, including

estimates of the timing and amounts of expected future cash flows and the credit standing of the issuer or counterparty. Factors

considered in estimating fair value include; coupon rate, maturity, estimated duration, call provisions, sinking fund requirements, credit

rating, industry sector of the issuer, and quoted market prices of comparable securities.

Mortgage and Consumer Loans, Mortgage Loan Commitments and Commitments to Fund Bank Credit Facilities and

Bridge Loans

Fair values for mortgage and consumer loans are estimated by discounting expected future cash flows, using current interest rates for

similar loans with similar credit risk. For mortgage loan commitments and commitments to fund bank credit facilities and bridge loans, the

estimated fair value is the net premium or discount of the commitments.

Policy Loans

The carrying values for policy loans approximate fair value.

F-78 MetLife, Inc.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)