MetLife 2006 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

On December 1, 2006, the Holding Company repurchased 3,993,024 shares of its outstanding common stock at an aggregate cost of

$232 million under an accelerated common stock repurchase agreement with a major bank. The bank borrowed the common stock sold to

the Holding Company from third parties and purchased the common stock in the open market to return to such third parties. In February

2007, the Holding Company paid a cash adjustment of $8 million for a final purchase price of $240 million. The Holding Company recorded

the shares initially repurchased as treasury stock and recorded the amount paid as an adjustment to the cost of the treasury stock.

On December 16, 2004, the Holding Company repurchased 7,281,553 shares of its outstanding common stock at an aggregate cost

of $300 million under an accelerated common stock repurchase agreement with a major bank. The bank borrowed the stock sold to the

Holding Company from third parties and purchased the common stock in the open market to return to such third parties. In April 2005, the

Holding Company received a cash adjustment of $7 million based on the actual amount paid by the bank to purchase the common stock,

for a final purchase price of $293 million. The Holding Company recorded the shares initially repurchased as treasury stock and recorded

the amount received as an adjustment to the cost of the treasury stock.

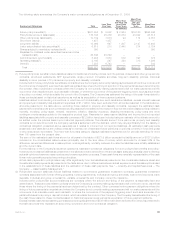

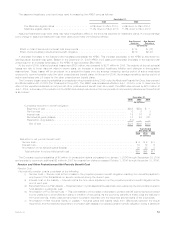

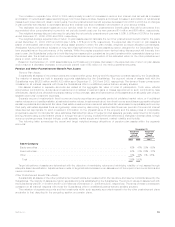

The following table summarizes the 2006, 2005 and 2004 common stock repurchase activity of the Holding Company, which includes

the accelerated common stock repurchase agreements in the fourth quarters of 2006 and 2004:

2006 2005 2004

December 31,

(In millions, except number of shares)

Shares repurchased . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8,608,824 — 26,373,952

Cost .................................................... $ 500 $ — $ 1,000

Future common stock repurchases will be dependent upon several factors, including the Company’s capital position, its financial

strength and credit ratings, general market conditions and the price of MetLife, Inc.’s common stock.

Support Agreements. The Holding Company has net worth maintenance agreements with two of its insurance subsidiaries, MetLife

Investors and First MetLife Investors Insurance Company. Under these agreements, as subsequently amended, the Holding Company

agreed, without limitation as to the amount, to cause each of these subsidiaries to have a minimum capital and surplus of $10 million, total

adjusted capital at a level not less than 150% of the company action level RBC, as defined by state insurance statutes, and liquidity

necessary to enable it to meet its current obligations on a timely basis. As of the date of the most recent statutory financial statements filed

with insurance regulators, the capital and surplus of each of these subsidiaries was in excess of the minimum capital and surplus amounts

referenced above, and their total adjusted capital was in excess of the most recent referenced RBC-based amount calculated at

December 31, 2006.

In connection with the acquisition of Travelers, the Holding Company committed to the South Carolina Department of Insurance to take

necessary action to maintain the minimum capital and surplus of MRSC, formerly The Travelers Life and Annuity Reinsurance Company, at

the greater of $250,000 or 10% of net loss reserves (loss reserves less deferred policy acquisition costs).

The Holding Company entered into a net worth maintenance agreement with MSMIC, an investment in Japan of which the Holding

Company owns approximately 50% of the equity. Under the agreement, the Holding Company agreed, without limitation as to amount, to

cause MSMIC to have the amount of capital and surplus necessary for MSMIC to maintain a solvency ratio of at least 400%, as calculated

in accordance with the Insurance Business Law of Japan, and to make such loans to MSMIC as may be necessary to ensure that MSMIC

has sufficient cash or other liquid assets to meet its payment obligations as they fall due. As of the date of the most recent calculation, the

capital and surplus of MSMIC was in excess of the minimum capital and surplus amount referenced above.

Based on management’s analysis and comparison of its current and future cash inflows from the dividends it receives from subsidiaries,

including Metropolitan Life, that are permitted to be paid without prior insurance regulatory approval, its portfolio of liquid assets,

anticipated securities issuances and other anticipated cash flows, management believes there will be sufficient liquidity to enable the

Holding Company to make payments on debt, make cash dividend payments on its common and preferred stock, contribute capital to its

subsidiaries, pay all operating expenses and meet its cash needs.

Subsequent Events

On February 27, 2007, the Holding Company’s Board of Directors authorized an additional $1 billion common stock repurchase

program. See “— Liquidity and Capital Resources — The Holding Company — Liquidity Uses — Share Repurchase” for further information.

On February 16, 2007, the Holding Company’s Board of Directors announced dividends of $0.3975000 per share, for a total of

$10 million, on its Series A preferred shares, and $0.4062500 per share, for a total of $24 million, on its Series B preferred shares, subject

to the final confirmation that it has met the financial tests specified in the Series A and Series B preferred shares, which the Holding

Company anticipates will be made on or about March 5, 2007, the earliest date permitted in accordance with the terms of the securities.

Both dividends will be payable March 15, 2007 to shareholders of record as of February 28, 2007.

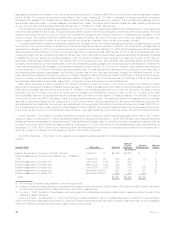

Off-Balance Sheet Arrangements

Commitments to Fund Partnership Investments

The Company makes commitments to fund partnership investments in the normal course of business for the purpose of enhancing the

Company’s total return on its investment portfolio. The amounts of these unfunded commitments were $3.0 billion and $2.7 billion at

December 31, 2006 and 2005, respectively. The Company anticipates that these amounts will be invested in partnerships over the next

five years. There are no other obligations or liabilities arising from such arrangements that are reasonably likely to become material.

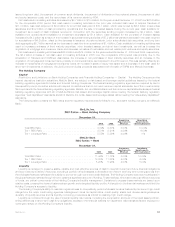

Mortgage Loan Commitments

The Company commits to lend funds under mortgage loan commitments. The amounts of these mortgage loan commitments were

$4.0 billion and $3.0 billion at December 31, 2006 and 2005, respectively. The purpose of these loans is to enhance the Company’s total

return on its investment portfolio. There are no other obligations or liabilities arising from such arrangements that are reasonably likely to

become material.

48 MetLife, Inc.