MetLife 2006 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

currency fair value exposure of foreign currency denominated investments and liabilities; and (iii) interest rate futures to hedge against

changes in value of fixed rate securities.

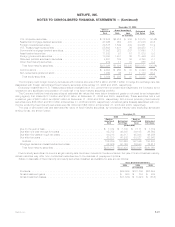

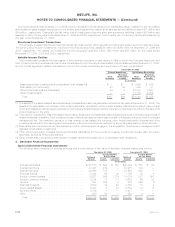

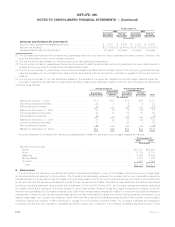

The Company recognized net investment gains (losses) representing the ineffective portion of all fair value hedges as follows:

2006 2005 2004

Years Ended

December 31,

(In millions)

Changes in the fair value of derivatives . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 276 $(118) $ 62

Changesinthefairvalueoftheitemshedged...................................... (276) 115 (48)

Netineffectivenessoffairvaluehedgingactivities ................................... $ — $ (3) $14

All components of each derivative’s gain or loss were included in the assessment of hedge ineffectiveness. There were no instances in

which the Company discontinued fair value hedge accounting due to a hedged firm commitment no longer qualifying as a fair value hedge.

Cash Flow Hedges

The Company designates and accounts for the following as cash flow hedges, when they have met the requirements of SFAS 133:

(i) interest rate swaps to convert floating rate investments to fixed rate investments; (ii) interest rate swaps to convert floating rate liabilities

intofixedrateliabilities;(iii)foreigncurrencyswapstohedgetheforeign currency cash flow exposure of foreign currency denominated

investments and liabilities; and (iv) financial forwards to buy and sell securities.

For the year ended December 31, 2006, the Company recognized no net investment gains (losses) as the ineffective portion of all cash

flow hedges. For the years ended December 31, 2005 and 2004, the Company recognized net investment gains (losses) of ($25) million

and ($45) million, respectively, which represent the ineffective portion of all cash flow hedges. All components of each derivative’s gain or

loss were included in the assessment of hedge ineffectiveness. In certain instances, the Company discontinued cash flow hedge

accounting because the forecasted transactions did not occur on the anticipated date or in the additional time period permitted by

SFAS 133. The net amounts reclassified into net investment gains (losses) for the years ended December 31, 2006, 2005 and 2004 related

to such discontinued cash flow hedges were $3 million, $42 million and $51 million, respectively. There were no hedged forecasted

transactions, other than the receipt or payment of variable interest payments for the years ended December 31, 2006, 2005 and 2004.

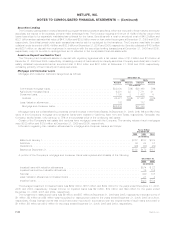

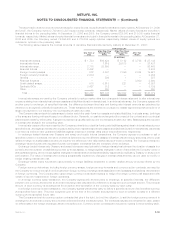

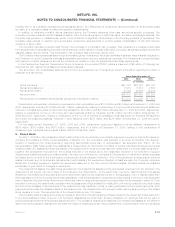

The following table presents the components of other comprehensive income (loss), before income tax, related to cash flow hedges:

2006 2005 2004

Years Ended December 31,

(In millions)

Other comprehensive income (loss) balance at January 1, . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(142) $(456) $(417)

Gains (losses) deferred in other comprehensive income (loss) on the effective portion of cash flow

hedges............................................................. (77) 270 (97)

Amountsreclassifiedtonetinvestmentgains(losses) ................................ (1) 44 63

Amountsreclassifiedtonetinvestmentincome .................................... 15 2 2

Amortizationoftransitionadjustment ........................................... (1) (2) (7)

Amountsreclassifiedtootherexpenses......................................... (2) — —

Other comprehensive income (loss) balance at December 31, . . . . . . . . . . . . . . . . . . . . . . . . . . . $(208) $(142) $(456)

At December 31, 2006, $24 million of the deferred net loss on derivatives accumulated in other comprehensive income (loss) is

expected to be reclassified to earnings during the year ending December 31, 2007.

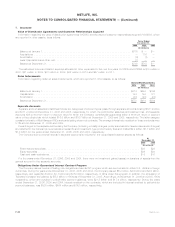

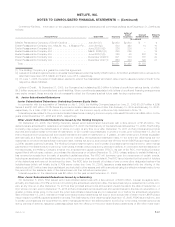

Hedges of Net Investments in Foreign Operations

The Company uses forward exchange contracts, foreign currency swaps, options and non-derivative financial instruments to hedge

portions of its net investments in foreign operations against adverse movements in exchange rates. The Company measures ineffec-

tiveness on the forward exchange contracts based upon the change in forward rates. There was no ineffectiveness recorded for the years

ended December 31, 2006, 2005 and 2004.

The Company’s consolidated statements of stockholders’ equity for the years ended December 31, 2006, 2005 and 2004 include gains

(losses) of ($17) million, ($115) million and ($47) million, respectively, related to foreign currency contracts and non-derivative financial

instruments used to hedge its net investments in foreign operations. At December 31, 2006 and 2005, the cumulative foreign currency

translation loss recorded in accumulated other comprehensive income related to these hedges was $189 million and $172 million,

respectively. When net investments in foreign operations are sold or substantially liquidated, the amounts in accumulated other com-

prehensive income are reclassified to the consolidated statements of income, while a pro rata portion will be reclassified upon partial sale

of the net investments in foreign operations.

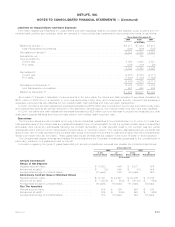

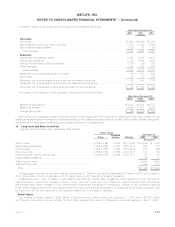

Non-qualifying Derivatives and Derivatives for Purposes Other Than Hedging

The Company enters into the following derivatives that do not qualify for hedge accounting under SFAS 133 or for purposes other than

hedging: (i) interest rate swaps, purchased caps and floors, and interest rate futures to economically hedge its exposure to interest rate

volatility; (ii) foreign currency forwards, swaps and option contracts to economically hedge its exposure to adverse movements in exchange

rates; (iii) swaptions to sell embedded call options in fixed rate liabilities; (iv) credit default swaps to minimize its exposure to adverse

movements in credit; (v) credit default swaps to diversify credit risk exposure to certain portfolios; (vi) equity futures, equity index options,

interest rate futures and equity variance swaps to economically hedge liabilities embedded in certain variable annuity products; (vii) swap

spread locks to economically hedge invested assets against the risk of changes in credit spreads; (viii) financial forwards to buy and sell

F-37MetLife, Inc.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)