MetLife 2006 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Liquidity Sources

Dividends. The primary source of the Holding Company’s liquidity is dividends it receives from its insurance subsidiaries. The Holding

Company’s insurance subsidiaries are subject to regulatory restrictions on the payment of dividends imposed by the regulators of their

respective domiciles. The dividend limitation for U.S. insurance subsidiaries is based on the surplus to policyholders as of the immediately

preceding calendar year and statutory net gain from operations for the immediately preceding calendar year. Statutory accounting

practices, as prescribed by insurance regulators of various states in which the Company conducts business, differ in certain respects from

accounting principles used in financial statements prepared in conformity with GAAP. The significant differences relate to the treatment of

DAC, certain deferred income tax, required investment reserves, reserve calculation assumptions, goodwill and surplus notes.

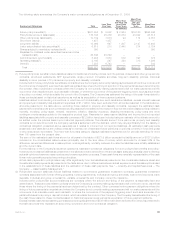

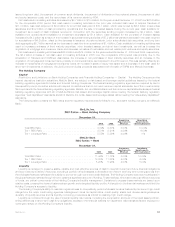

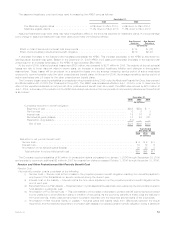

The table below sets forth the dividends permitted to be paid to the Holding Company without insurance regulatory approval and

dividends paid to the Holding Company:

Company Permitted w/o

Approval(1) Paid(2) Permitted w/o

Approval(1) Paid(2) Permitted w/o

Approval(5)

2005 2006 2007

MetropolitanLife ......................... $880 $3,200 $863 $ 863 $919

MetLife Insurance Company of Connecticut . . . . . . . . $ — $ — $ — $ 917(3) $690

Metropolitan Tower Life Insurance Company . . . . . . . . $ 54 $ 927 $ 85 $2,300(4) $104

Metropolitan Property and Casualty Insurance

Company............................. $187 $ 400 $178 $ 300 $ 16

(1) Reflects dividend amounts paid during the relevant year without prior regulatory approval.

(2) Includes amounts paid including those requiring regulatory approval.

(3) Includes a return of capital of $259 million.

(4) This dividend reflects the proceeds associated with the sale of Peter Cooper Village and Stuyvesant Town properties to be used for

general corporate purposes.

(5) Reflects dividend amounts that may be paid during 2007 without prior regulatory approval. If paid before a specified date during 2007,

some or all of such dividend amount may require regulatory approval.

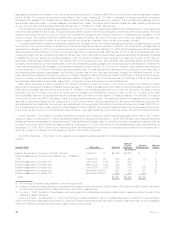

MetLife Mexico S.A. paid $116 million in dividends to the Holding Company for the year ended December 31, 2006. For the year ended

December 31, 2006, there were returns of capital of $154 million to the Holding Company from other subsidiaries.

Liquid Assets. An integral part of the Holding Company’s liquidity management is the amount of liquid assets it holds. Liquid assets

include cash, cash equivalents, short-term investments and marketable fixed maturity securities. At December 31, 2006 and 2005, the

Holding Company had $3.9 billion and $668 million in liquid assets, respectively.

Global Funding Sources. Liquidity is also provided by a variety of both short-term and long-term instruments, commercial paper,

medium- and long-term debt, capital securities and stockholders’ equity. The diversity of the Holding Company’s funding sources

enhances funding flexibility and limits dependence on any one source of funds and generally lowers the cost of funds. Other sources of the

Holding Company’s liquidity include programs for short- and long-term borrowing, as needed.

At December 31, 2006 and 2005, the Holding Company had $616 million and $961 million in short-term debt outstanding, respectively.

At December 31, 2006 and 2005, the Holding Company had $7.0 billion and $7.3 billion of unaffiliated long-term debt outstanding,

respectively. At December 31, 2006 and 2005, the Holding Company had $500 million and $286 million of affiliated long-term debt

outstanding, respectively.

On April 27, 2005, the Holding Company filed a shelf registration statement (the “2005 Registration Statement”) with the SEC, covering

$11 billion of securities. On May 27, 2005, the 2005 Registration Statement became effective, permitting the offer and sale, from time to

time, of a wide range of debt and equity securities. In addition to the $11 billion of securities registered on the 2005 Registration Statement,

$3.9 billion of registered but unissued securities remained available for issuance by the Holding Company as of such date, from the

$5.0 billion shelf registration statement filed with the SEC during the first quarter of 2004, permitting the Holding Company to issue an

aggregate of $14.9 billion of registered securities. The terms of any offering will be established at the time of the offering.

During December 2006, the Holding Company issued $1.25 billion of junior subordinated debentures under the 2005 Registration

Statement. During June 2005, in connection with the Holding Company’s acquisition of Travelers, the Holding Company issued $2.0 billion

senior notes, $2.07 billion of common equity units and $2.1 billion of preferred stock under the 2005 Registration Statement. In addition,

$0.7 billion of senior notes were sold outside the United States in reliance upon Regulation S under the Securities Act of 1933, as

amended, a portion of which may be resold in the United States under the 2005 Registration Statement. Remaining capacity under the

2005 Registration Statement after such issuances is $5.4 billion.

Debt Issuances. On December 21, 2006, the Holding Company issued junior subordinated debentures with a face amount of

$1.25 billion. See “— Liquidity and Capital Resources — The Company — Liquidity Sources — Debt Issuances” for further information.

On September 29, 2006, the Holding Company issued $204 million of affiliated long-term debt with an interest rate of 6.07% maturing in

2016.

On March 31, 2006, the Holding Company issued $10 million of affiliated long-term debt with an interest rate of 5.70% maturing in

2016.

On December 30, 2005, the Holding Company issued $286 million of affiliated long-term debt with an interest rate of 5.24% maturing in

2015.

On June 23, 2005, the Holding Company issued in the United States public market $1,000 million aggregate principal amount of

5.00% senior notes due June 15, 2015 at a discount of $2.7 million ($997.3 million), and $1,000 million aggregate principal amount of

5.70% senior notes due June 15, 2035 at a discount of $2.4 million ($997.6 million).

44 MetLife, Inc.