MetLife 2006 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

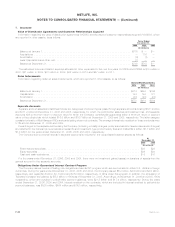

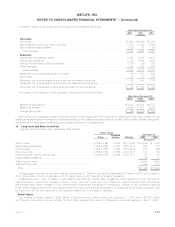

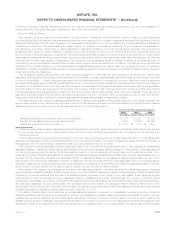

Committed Facilities. Information on the capacity and outstanding balances of all committed facilities as of December 31, 2006 is as

follows:

Account Party Expiration Capacity

Letter of

Credit

Issuances Unused

Commitments Maturity

(Years)

(In millions)

MetLife Reinsurance Company of South Carolina . . . . . . . . . . . . July 2010(1) $2,000 $2,000 $ — 4

Exeter Reassurance Company Ltd., MetLife, Inc., & Missouri Re . . June 2016(2) 500 490 10 10

Exeter Reassurance Company Ltd. . . . . . . . . . . . . . . . . . . . . . June 2025(1)(3) 225 225 — 19

Exeter Reassurance Company Ltd. . . . . . . . . . . . . . . . . . . . . . March 2025(1)(3) 250 250 — 19

Exeter Reassurance Company Ltd. . . . . . . . . . . . . . . . . . . . . . June 2025(1)(3) 325 58 267 19

Exeter Reassurance Company Ltd. . . . . . . . . . . . . . . . . . . . . . December 2026(1) 901 140 761 20

Exeter Reassurance Company Ltd. . . . . . . . . . . . . . . . . . . . . . December 2027(1) 650 330 320 21

Total ....................................... $4,851 $3,493 $1,358

(1) The Holding Company is a guarantor under this agreement.

(2) Letters of credit and replacements or renewals thereof issued under this facility of $280 million, $10 million and $200 million will expire no

later than December 2015, March 2016 and June 2016, respectively.

(3) On June 1, 2006, the letter of credit issuer elected to extend the initial stated termination date of each respective letter of credit to the

respective dates indicated.

Letters of Credit. At December 31, 2006, the Company had outstanding $5.0 billion in letters of credit from various banks, of which

$4.8 billion were part of committed and credit facilities. Since commitments associated with letters of credit and financing arrangements

may expire unused, these amounts do not necessarily reflect the Company’s actual future cash funding requirements.

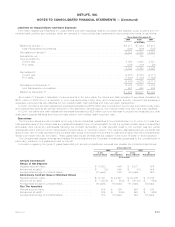

11. Junior Subordinated Debentures

Junior Subordinated Debentures Underlying Common Equity Units

In connection with the acquisition of Travelers on July 1, 2005, the Holding Company issued on June 21, 2005 $1,067 million 4.82%

Series A and $1,067 million 4.91% Series B junior subordinated debentures due no later than February 15, 2039 and February 15, 2040,

respectively, for a total of $2,134 million in connection with the common equity units more fully described in Note 12.

Interest expense related to the junior subordinated debentures underlying common equity units was $104 million and $55 million for the

years ended December 31, 2006 and 2005, respectively.

Other Junior Subordinated Debentures Issued by the Holding Company

On December 21, 2006, the Holding Company issued junior subordinated debentures with a face amount of $1.25 billion. The

debentures are scheduled for redemption on December 15, 2036; the final maturity of the debentures is December 15, 2066. The Holding

Company may redeem the debentures (i) in whole or in part, at any time on or after December 15, 2031 at their principal amount plus

accrued and unpaid interest to the date of redemption, or (ii) in certain circumstances, in whole or in part, prior to December 15, 2031 at

their principal amount plus accrued and unpaid interest to the date of redemption or, if greater, a make-whole price. Interest is payable

semi-annually at a fixed rate of 6.40% up to, but not including, the scheduled redemption date. In the event the debentures are not

redeemed on or before the scheduled redemption date, interest will accrue at an annual rate of three-month LIBOR plus a margin equal to

2.205%, payable quarterly in arrears. The Holding Company has the right to, and in certain circumstances the requirement to, defer interest

payments on the debentures for a period up to ten years. Interest compounds during periods of deferral. In connection with the issuance of

the debentures, the Holding Company entered into a replacement capital covenant (“RCC”). As part of the RCC, the Holding Company

agreed that it will not repay, redeem, or purchase the debentures on or before December 15, 2056, unless, subject to certain limitations, it

has received proceeds from the sale of specified capital securities. The RCC will terminate upon the occurrence of certain events,

including an acceleration of the debentures due to the occurrence of an event of default. The RCC is not intended for the benefit of holders

of the debentures and may not be enforced by them. The RCC is for the benefit of holders of one or more other designated series of its

indebtedness (which will initially be its 5.70% senior notes due June 15, 2035). Issuance costs associated with the offering of the

debentures of $13 million have been capitalized, are included in other assets, and will be amortized using the effective interest method over

the period from the issuance date of the debentures until their scheduled redemption.

Interest expense on the debentures was $2 million for the year ended December 31, 2006.

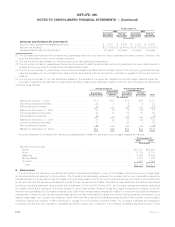

Other Junior Subordinated Debentures Issued by a Subsidiary

On December 8, 2005, RGA issued junior subordinated debentures with a face amount of $400 million. Interest is payable semi-

annually at a fixed rate of 6.75% up to but not including the scheduled redemption date. The securities may be redeemed (i) in whole or in

part, at any time on or after December 15, 2015 at their principal amount plus accrued and unpaid interest to the date of redemption, or

(ii) in whole or in part, prior to December 15, 2015 at their principal amount plus accrued and unpaid interest to the date of redemption or, if

greater, a make-whole price. In the event the junior subordinated debentures are not redeemed on or before the scheduled redemption

date of December 15, 2015, interest on these junior subordinated debentures will accrue at an annual rate of three-month LIBOR plus a

margin equal to 2.665%, payable quarterly in arrears. The final maturity of the debentures is December 15, 2065. RGA has the right to, and

in certain circumstances the requirement to, defer interest payments on the debentures for a period up to ten years. Interest compounds

during periods of deferral. Issuance costs associated with the offering of the junior subordinated debentures of $6 million have been

F-47MetLife, Inc.

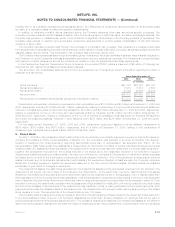

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)