MetLife 2006 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the issuance of stock options as the exercise price was equivalent to thefairmarketvalueatthedateofgrant.Compensationexpensewas

recognized under the Long-Term Performance Compensation Plan (“LTPCP”), as described more fully in Note 17.

Stock-based awards granted after December 31, 2002 but prior to January 1, 2006 were accounted for on a prospective basis using

the fair value accounting method prescribed by SFAS No. 123, Accounting for Stock-Based Compensation (“SFAS 123”), as amended by

SFAS No. 148, Accounting for Stock-Based Compensation — Transition and Disclosure (“SFAS 148”). The fair value method of SFAS 123

required compensation expense to be measured based on the fair value of the equity instrument at the grant or award date. Stock-based

compensation was accrued over the vesting period of the grant or award, including grants or awards to retirement-eligible employees. As

required by SFAS 148, the Company discloses the pro forma impact as if the stock options granted prior to January 1, 2003 had been

accounted for using the fair value provisions of SFAS 123 rather than the intrinsic value method prescribed by APB 25. See Note 17.

Effective January 1, 2006, the Company adopted, using the modified prospective transition method, SFAS No. 123 (revised 2004),

Share-Based Payment (“SFAS 123(r)”), which replaces SFAS 123 and supersedes APB 25. The adoption of SFAS 123(r) did not have a

significant impact on the Company’s financial position or results of operations. SFAS 123(r) requires that the cost of all stock-based

transactions be measured at fair value and recognized over the period during which a grantee is required to provide goods or services in

exchange for the award. Although the terms of the Company’s stock-based plans do not accelerate vesting upon retirement, or the

attainment of retirement eligibility, the requisite service period subsequent to attaining such eligibility is considered nonsubstantive.

Accordingly, the Company recognizes compensation expense related to stock-based awards over the shorter of the requisite service

period or the period to attainment of retirement eligibility. SFAS 123(r) also requires an estimation of future forfeitures of stock-based

awards to be incorporated into the determination of compensation expense when recognizing expense over the requisite service period.

Foreign Currency

Balance sheet accounts of foreign operations are translated at the exchange rates in effect at each year-end and income and expense

accounts are translated at the average rates of exchange prevailing during the year. The local currencies of foreign operations are the

functional currencies unless the local economy is highly inflationary. Translation adjustments are charged or credited directly to other

comprehensive income or loss. Gains and losses from foreign currency transactions are reported as net investment gains (losses) in the

period in which they occur.

Discontinued Operations

The results of operations of a component of the Company that either has been disposed of or is classified as held-for-sale are reported

in discontinued operations if the operations and cash flows of the componenthavebeenorwillbeeliminatedfromtheongoingoperations

of the Company as a result of the disposal transaction and the Company will not have any significant continuing involvement in the

operations of the component after the disposal transaction.

Earnings Per Common Share

Basic earnings per common share are computed based on the weighted average number of common shares outstanding during the

period. The difference between the number of shares assumed issued and number of shares assumed purchased represents the dilutive

shares. Diluted earnings per common share include the dilutive effect of the assumed: (i) exercise or issuance of stock-based awards

using the treasury stock method; (ii) settlement of stock purchase contracts underlying common equity units using the treasury stock

method; and (iii) settlement of accelerated common stock repurchase contract. Under the treasury stockmethod,exerciseorissuanceof

stock-based awards and settlement of the stock purchase contracts underlying common equity units is assumed to occur with the

proceeds used to purchase common stock at the average market price for the period. See Notes 12, 17 and 19.

Litigation Contingencies

The Company is a party to a number of legal actions and is involved in a number of regulatory investigations. Given the inherent

unpredictability of these matters, it is difficult to estimate the impact on the Company’s consolidated financial position. Liabilities are

established when it is probable that a loss has been incurred and the amount of the loss can be reasonably estimated. On a quarterly and

annual basis, the Company reviews relevant information with respect to liabilities for litigation, regulatory investigations and litigation-

related contingencies to be reflected in the Company’s consolidated financial statements. It is possible that an adverse outcome in certain

of the Company’s litigation and regulatory investigations, or the use of different assumptions in the determination of amounts recorded

could have a material effect upon the Company’s consolidated net income or cash flows in particular quarterly or annual periods.

Adoption of New Accounting Pronouncements

Defined Benefit and Other Postretirement Plans

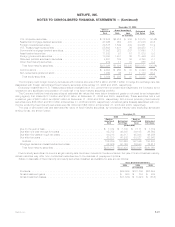

Effective December 31, 2006, the Company adopted SFAS 158. The pronouncement revises financial reporting standards for defined

benefit pension and other postretirement plans by requiring the:

(i) recognition in the statement of financial position of the funded status of defined benefit plans measured as the difference

between the fair value of plan assets and the benefit obligation, which is the projected benefit obligation for pension plans and

the accumulated postretirement benefit obligation for other postretirement plans;

(ii) recognition as an adjustment to accumulated other comprehensive income (loss), net of income tax, those amounts of actuarial

gains and losses, prior service costs and credits, and net asset or obligation at transition that have not yet been included in net

periodic benefit costs as of the end of the year of adoption;

(iii) recognition of subsequent changes in funded status as a component of other comprehensive income;

(iv) measurement of benefit plan assets and obligations as of the date of the statement of financial position; and

(v) disclosure of additional information about the effects on the employer’s statement of financial position.

F-18 MetLife, Inc.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)