MetLife 2006 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

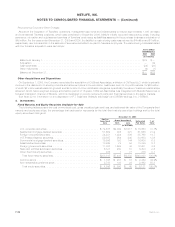

Securities Lending

The Company participates in a securities lending program whereby blocks of securities, which are included in fixed maturity and equity

securities, are loaned to third parties, primarily major brokerage firms. The Company requires a minimum of 102% of the fair value of the

loaned securities to be separately maintained as collateral for the loans. Securities with a cost or amortized cost of $43.3 billion and

$32.1 billion and an estimated fair value of $44.1 billion and $33.0 billion were on loan under the program at December 31, 2006 and 2005,

respectively. Securities loaned under such transactions may be sold or repledged by the transferee. The Company was liable for cash

collateral under its control of $45.4 billion and $33.9 billion at December 31, 2006 and 2005, respectively. Security collateral of $100 million

and $207 million on deposit from customers in connection with the securities lending transactions at December 31, 2006 and 2005,

respectively, may not be sold or repledged and is not reflected in the consolidated financial statements.

Assets on Deposit and Held in Trust

The Company had investment assets on deposit with regulatory agencies with a fair market value of $1.3 billion and $1.6 billion at

December 31, 2006 and 2005, respectively, consisting primarily of fixed maturity and equity securities. Company securities held in trust to

satisfy collateral requirements had an amortized cost of $3.0 billion and $2.2 billion at December 31, 2006 and 2005, respectively,

consisting primarily of fixed maturity and equity securities.

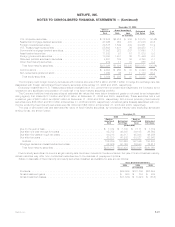

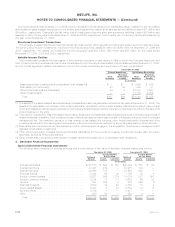

Mortgage and Consumer Loans

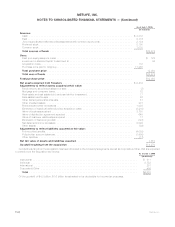

Mortgage and consumer loans are categorized as follows:

Amount Percent Amount Percent

2006 2005

December 31,

(In millions)

Commercialmortgageloans...................................... $32,000 75% $28,169 75%

Agriculturalmortgageloans ...................................... 9,231 22 7,711 21

Consumerloans.............................................. 1,190 3 1,482 4

Subtotal ................................................. 42,421 100% 37,362 100%

Less:Valuationallowances....................................... 182 172

Mortgageandconsumerloans................................... $42,239 $37,190

Mortgage loans are collateralized by properties primarily located in the United States. At December 31, 2006, 20%, 6% and 6% of the

value of the Company’s mortgage and consumer loans were located in California, New York and Texas, respectively. Generally, the

Company, as the lender, only loans up to 75% of the purchase price of the underlying real estate.

Certain of the Company’s real estate joint ventures have mortgage loans with the Company. The carrying values of such mortgages

were $372 million and $379 million at December 31, 2006 and 2005, respectively.

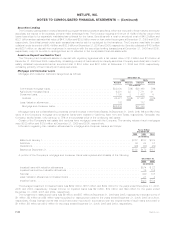

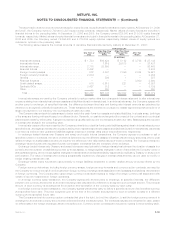

Information regarding loan valuation allowances for mortgage and consumer loans is as follows:

2006 2005 2004

Years Ended

December 31,

(In millions)

BalanceatJanuary1,...................................................... $172 $157 $129

Additions.............................................................. 36 64 57

Deductions............................................................. (26) (49) (29)

BalanceatDecember31, ................................................... $182 $172 $157

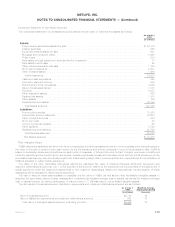

A portion of the Company’s mortgage and consumer loans was impaired and consists of the following:

2006 2005

December 31,

(In millions)

Impairedloanswithvaluationallowances............................................... $374 $ 22

Impairedloanswithoutvaluationallowances............................................. 75 116

Subtotal.................................................................... 449 138

Less:Valuationallowancesonimpairedloans............................................ 21 4

Impairedloans................................................................ $428 $134

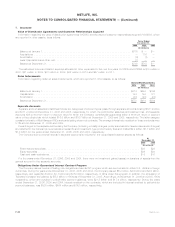

The average investment in impaired loans was $202 million, $187 million and $404 million for the years ended December 31, 2006,

2005 and 2004, respectively. Interest income on impaired loans was $2 million, $12 million and $29 million for the years ended

December 31, 2006, 2005 and 2004, respectively.

The investment in restructured loans was $9 million and $37 million at December 31, 2006 and 2005, respectively. Interest income of

$1 million, $2 million and $9 million was recognized on restructured loans for the years ended December 31, 2006, 2005 and 2004,

respectively. Gross interest income that would have been recorded in accordance with the original terms of such loans amounted to

$1 million, $3 million and $12 million for the years ended December 31, 2006, 2005 and 2004, respectively.

F-30 MetLife, Inc.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)