MetLife 2006 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

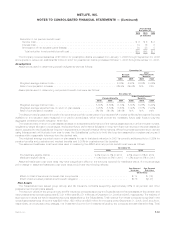

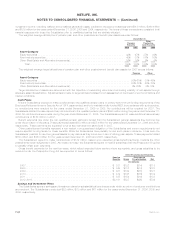

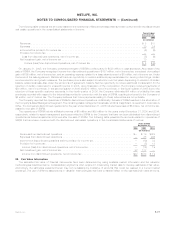

by individual state laws and permitted practices. Modifications by the various state insurance departments may impact the effect of

Codification on the statutory capital and surplus of Metropolitan Life and the Holding Company’s other insurance subsidiaries.

Statutory accounting principles differ from GAAP primarily by charging policy acquisition costs to expense as incurred, establishing

future policy benefit liabilities using different actuarial assumptions, reporting surplus notes as surplus instead of debt and valuing

securities on a different basis.

Statutory net income of Metropolitan Life, a New York domiciled insurer, was $1.0 billion, $2.2 billion and $2.6 billion for the years ended

December 31, 2006, 2005 and 2004, respectively. Statutory capital and surplus, as filed with the Department, was $9.2 billion and

$8.8 billion at December 31, 2006 and 2005, respectively. Due to the mergers of Paragon Life Insurance Company, Citicorp Life Insurance

Company and First Citicorp Life Insurance Company with Metropolitan Life, the 2005 statutory net income and statutory capital and surplus

balances were adjusted.

Statutory net income of MICC, a Connecticut domiciled insurer, was $749 million for the year ended December 31, 2006 and

$470 million from the date of purchase, for the six month period ended December 31, 2005. Statutory capital and surplus, as filed with the

Connecticut Insurance Department, was $4.1 billion at both December 31, 2006 and 2005.

Statutory net income of MPC, a Rhode Island domiciled insurer, was $385 million, $289 million and $356 million for the years ended

December 31, 2006, 2005 and 2004, respectively. Statutory capital and surplus, as filed with the Insurance Department of Rhode Island,

was $1.9 billion and $1.8 billion at December 31, 2006 and 2005, respectively.

Statutory net income of MTL, a Delaware domiciled insurer, was $2.8 billion, $353 million and $144 million for the years ended

December 31, 2006, 2005 and 2004, respectively. Statutory capital and surplus, as filed with the Delaware Insurance Department was

$1.0 billion and $690 million as of December 31, 2006 and 2005, respectively.

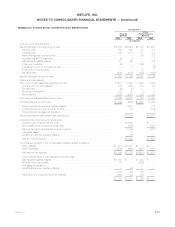

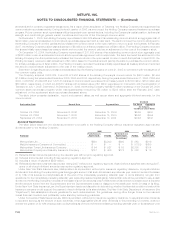

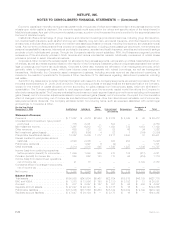

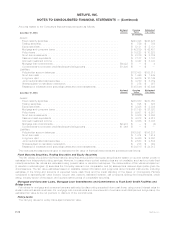

Other Comprehensive Income (Loss)

The following table sets forth the reclassification adjustments required for the years ended December 31, 2006, 2005 and 2004 in other

comprehensive income (loss) that are included as part of net income for the current year that have been reported as a part of other

comprehensive income (loss) in the current or prior year:

2006 2005 2004

Years Ended December 31,

(In millions)

Holdinggains(losses)oninvestmentsarisingduringtheyear......................... $(1,022) $(3,697) $832

Incometaxeffectofholdinggains(losses)..................................... 379 1,391 120

Reclassification adjustments:

Recognizedholding(gains)lossesincludedincurrentyearincome ................... 916 524 (537)

Amortization of premiums and accretion of discounts associated with investments . . . . . . . . . (600) (199) (94)

Incometaxeffect..................................................... (117) (122) (91)

Allocation of holding losses on investments relating to other policyholder amounts . . . . . . . . . . . 581 1,670 (182)

Incometaxeffectofallocationofholdinglossestootherpolicyholderamounts............. (215) (629) (26)

Unrealizedinvestmentgainsofsubsidiaryatdateofsale ........................... — 15 —

Deferred income tax on unrealized investment gains of subsidiary at date of sale . . . . . . . . . . . . — (5) —

Netunrealizedinvestmentgains(losses)...................................... (78) (1,052) 22

Foreigncurrencytranslationadjustmentsarisingduringtheyear....................... 46 (86) 144

Foreigncurrencytranslationadjustmentsofsubsidiaryatdateofsale ................... — 5 —

Foreigncurrencytranslationadjustment ...................................... 46 (81) 144

Minimumpensionliabilityadjustment ........................................ (18) 89 (2)

Othercomprehensiveincome(loss)......................................... $ (50) $(1,044) $164

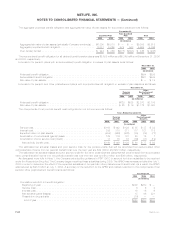

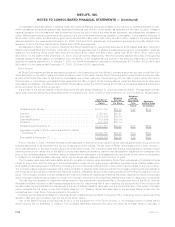

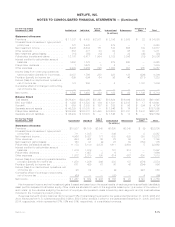

18. Other Expenses

Information on other expenses is as follows:

2006 2005 2004

Years Ended December 31,

(In millions)

Compensation..................................................... $ 3,430 $3,217 $2,915

Commissions...................................................... 3,811 3,510 3,090

Interestanddebtissuecost ............................................ 900 659 408

AmortizationofDACandVOBA .......................................... 2,421 2,451 1,908

CapitalizationofDAC................................................. (3,589) (3,604) (3,101)

Rent,netofsubleaseincome ........................................... 287 296 264

Minorityinterest .................................................... 234 154 152

Insurancetax...................................................... 712 530 443

Other........................................................... 2,591 2,054 1,734

Totalotherexpenses ............................................... $10,797 $9,267 $7,813

F-71MetLife, Inc.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)