MetLife 2006 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

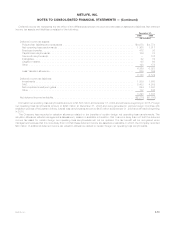

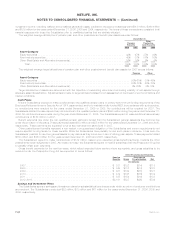

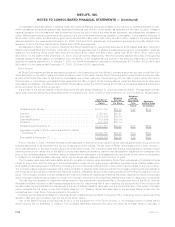

Obligations, Funded Status and Net Periodic Benefit Costs

2006 2005 2006 2005

Pension

Benefits

Other

Postretirement

Benefits

December 31,

(In millions)

Change in benefit obligation:

Benefitobligationatbeginningofyear ................................ $5,766 $5,523 $2,176 $1,975

Servicecost ............................................... 163 142 35 37

Interestcost................................................ 335 318 117 121

Planparticipants’contributions.................................... — — 29 28

Acquisitionsanddivestitures..................................... (4) (1) — 1

Netactuarial(gains)losses...................................... 27 90 1 172

Changeinbenefits ........................................... (6) — (143) 7

Transfersin(out)ofcontrolledgroup................................ — 6 — (5)

Prescriptiondrugsubsidy....................................... — — 10 —

Benefitspaid............................................... (322) (312) (152) (160)

Benefitobligationatendofyear .................................... 5,959 5,766 2,073 2,176

Change in plan assets:

Fairvalueofplanassetsatbeginningofyear............................ 5,518 5,392 1,093 1,062

Actualreturnonplanassets ..................................... 725 404 104 60

Divestitures................................................ (4) (1) — —

Employercontribution ......................................... 388 35 2 2

Benefitspaid............................................... (322) (312) (27) (31)

Fairvalueofplanassetsatendofyear................................ 6,305 5,518 1,172 1,093

Fundedstatusatendofyear ...................................... $ 346 (248) $ (901) (1,083)

Unrecognizednetactuarial(gains)losses............................. 1,528 377

Unrecognizedpriorservicecost(credit).............................. 54 (122)

Unrecognizednetassetattransition................................ — 1

Netprepaid(accrued)benefitcostrecognized........................... $1,334 $ (827)

Components of net amount recognized:

Qualifiedplanprepaidbenefitcost ................................. $1,696 $ —

Non-qualifiedplanaccruedbenefitcost.............................. (362) (827)

Netprepaid(accrued)benefitcostrecognized.......................... 1,334 (827)

Intangibleasset ............................................. 12 —

Additionalminimumpensionliability................................. (78) —

Netamountrecognized ........................................ $1,268 $ (827)

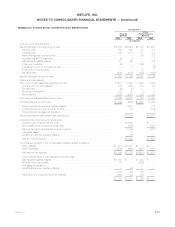

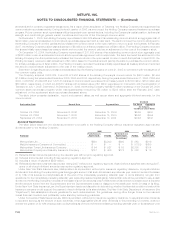

Amounts recognized in the consolidated balance sheet consist of:

Otherassets ............................................... $ 944 $1,708 $ — $ —

Otherliabilities.............................................. (598) (440) (901) (827)

Netamountrecognized ........................................ $ 346 $1,268 $ (901) $ (827)

Accumulated other comprehensive (income) loss:

Netactuarial(gains)losses...................................... $1,123 $ — $ 328 $ —

Priorservicecost(credit) ....................................... 41 — (230) —

Netassetattransition ......................................... — — 1 —

Additionalminimumpensionliability................................. — 66 — —

1,164 66 99 —

Deferredincometaxandminorityinterest............................. (423) (25) (37) —

$ 741 $ 41 $ 62 $ —

F-61MetLife, Inc.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)