MetLife 2006 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

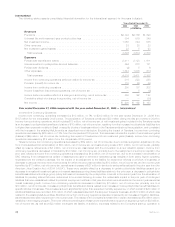

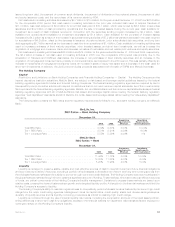

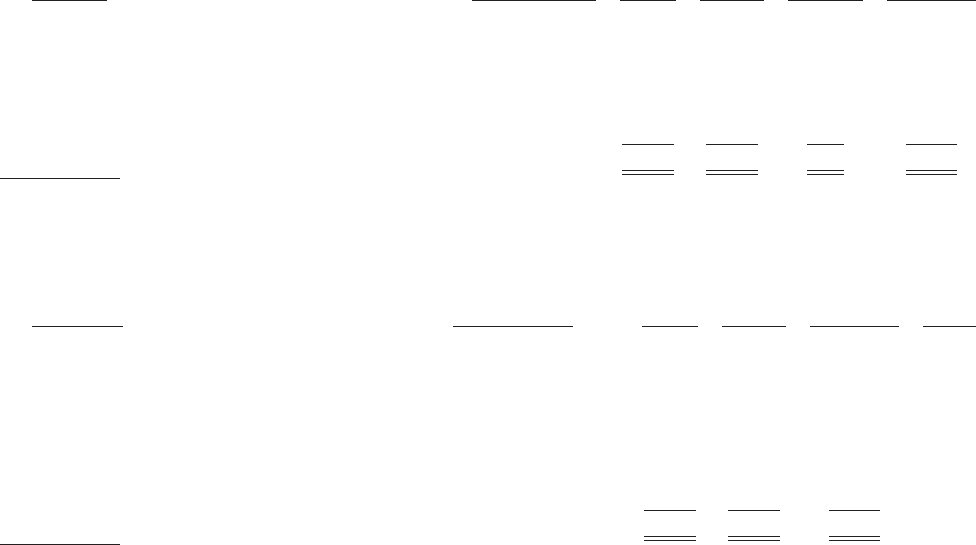

for general corporate purposes and at December 31, 2006, $3.0 billion of the facilities also served as back-up lines of credit for the

Company’s commercial paper programs. Information on these facilities as of December 31, 2006 is as follows:

Borrower(s) Expiration Capacity

Letter of

Credit

Issuances Drawdowns Unused

Commitments

(In millions)

MetLife, Inc. and MetLife Funding, Inc. . . . . . . . . . . . . April 2009 $1,500(1) $ 487 $ — $1,013

MetLife, Inc. and MetLife Funding, Inc. . . . . . . . . . . . . April 2010 1,500(1) 483 — 1,017

MetLife Bank, N.A . . . . . . . . . . . . . . . . . . . . . . . . . . July 2007 200 — — 200

Reinsurance Group of America, Incorporated . . . . . . . . May 2007 29 — 29 —

Reinsurance Group of America, Incorporated . . . . . . . . September 2010 600 315 50 235

Reinsurance Group of America, Incorporated . . . . . . . . March 2011 39 — 28 11

Total ................................. $3,868 $1,285 $107 $2,476

(1) These facilities serve as back up lines of credit for the Company’s commercial paper programs.

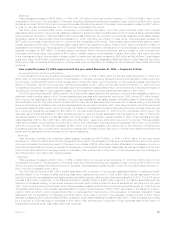

Committed Facilities. Information on the capacity and outstanding balances of all committed facilities as of December 31, 2006 is as

follows:

Account Party Expiration Capacity

Letter of

Credit

Issuances Unused

Commitments Maturity

(Years)

(In millions)

MetLife Reinsurance Company of South Carolina . . . . July 2010 (1) $2,000 $2,000 $ — 4

Exeter Reassurance Company Ltd., MetLife, Inc., &

Missouri Re . . . . . . . . . . . . . . . . . . . . . . . . . . . June 2016 (2) 500 490 10 10

Exeter Reassurance Company Ltd. . . . . . . . . . . . . . June 2025 (1)(3) 225 225 — 19

Exeter Reassurance Company Ltd. . . . . . . . . . . . . . March 2025 (1)(3) 250 250 — 19

Exeter Reassurance Company Ltd. . . . . . . . . . . . . . June 2025 (1)(3) 325 58 267 19

Exeter Reassurance Company Ltd. . . . . . . . . . . . . . December 2026 (1) 901 140 761 20

Exeter Reassurance Company Ltd. . . . . . . . . . . . . . December 2027 (1) 650 330 320 21

Total ............................... $4,851 $3,493 $1,358

(1) The Holding Company is a guarantor under this agreement.

(2) Letters of credit and replacements or renewals thereof issued under this facility of $280 million, $10 million and $200 million will expire

no later than December 2015, March 2016 and June 2016, respectively.

(3) On June 1, 2006, the letter of credit issuer elected to extend the initial stated termination date of each respective letter of credit to the

respective dates indicated.

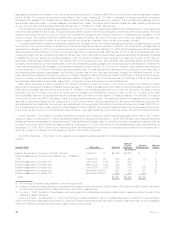

Letters of Credit. At December 31, 2006, the Company had outstanding $5.0 billion in letters of credit from various banks, of which

$4.8 billion were part of credit and committed facilities. Since commitments associated with letters of credit and financing arrangements

may expire unused, these amounts do not necessarily reflect the Company’s actual future cash funding requirements.

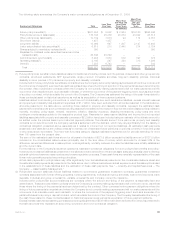

Liquidity Uses

Debt Repayments. The Holding Company repaid a $500 million 5.25% senior note which matured on December 1, 2006 and a

$1,006 million 3.911% senior note which matured on May 15, 2005.

Metropolitan Life repaid a $250 million 7% surplus note which matured on November 1, 2005.

Insurance Liabilities. The Company’s principal cash outflows primarily relate to the liabilities associated with its various life insurance,

property and casualty, annuity and group pension products, operating expenses and income tax, as well as principal and interest on its

outstanding debt obligations. Liabilities arising from its insurance activities primarily relate to benefit payments under the aforementioned

products, as well as payments for policy surrenders, withdrawals and loans.

Investment and Other. Additional cash outflows include those related to obligations of securities lending and dollar roll activities,

investments in real estate, limited partnerships and joint ventures, as well as litigation-related liabilities.

38 MetLife, Inc.