MetLife 2006 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

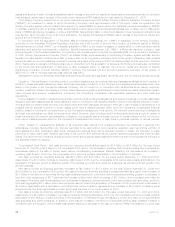

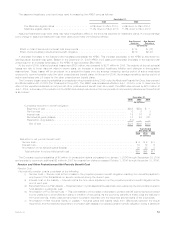

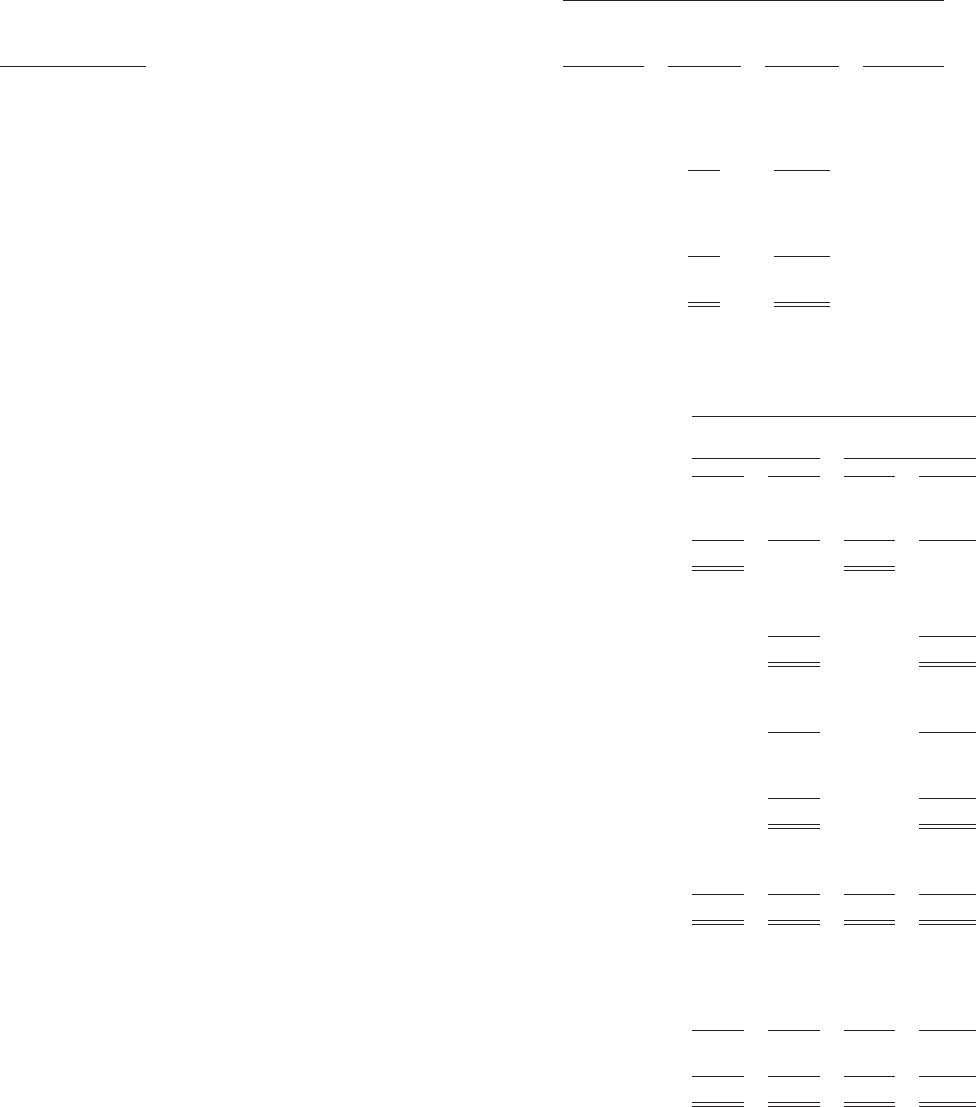

accumulated other comprehensive income, which is included as a component of total consolidated stockholders’ equity. The following

table summarizes the adjustments to the December 31, 2006 consolidated balance sheet in order to effect the adoption of SFAS 158.

Balance Sheet Caption

Pre

SFAS 158

Adjustments

Additional

Minimum

Pension

Liability

Adjustment

Adoption of

SFAS 158

Adjustment

Post

SFAS 158

Adjustments

December 31, 2006

(In millions)

Otherassets:Prepaidpensionbenefitcost .................... $1,937 $— $ (993) $ 944

Otherassets:Intangibleasset............................. $ 12 $(12) $ — $ —

Other liabilities: Accrued pension benefit cost . . . . . . . . . . . . . . . . . . . $ (505) $(14) $ (79) $ (598)

Other liabilities: Accrued other postretirement benefit cost . . . . . . . . . . . $ (802) $ — $ (99) $ (901)

Accumulated other comprehensive income (loss), before income tax:

Definedbenefitplans ................................. $ (66) $(26) $(1,171) $(1,263)

Minorityinterest ...................................... $— $ 8

Deferredincometax ................................... $ 8 $ 419

Accumulated other comprehensive income (loss), net of income tax:

Definedbenefitplans ................................. $ (41) $(18) $ (744) $ (803)

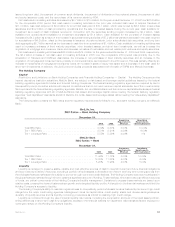

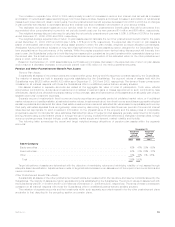

A December 31 measurement date is used for all the Company’s defined benefit pension and other postretirement benefit plans.

The benefit obligations and funded status of the Subsidiaries’ defined benefit pension and other postretirement benefit plans, as

determined in accordance with the applicable provisions described above, were as follows:

2006 2005 2006 2005

Pension Benefits

Other

Postretirement

Benefits

December 31, 2006

(In millions)

Benefitobligationatendofyear.......................................... $5,959 $5,766 $2,073 $2,176

Fairvalueofplanassetsatendofyear ..................................... 6,305 5,518 1,172 1,093

Fundedstatusatendofyear............................................ $ 346 (248) $ (901) (1,083)

Unrecognizednetactuarial(gains)losses .................................. 1,528 377

Unrecognizedpriorservicecost(credit).................................... 54 (122)

Unrecognizednetassetattransition...................................... — 1

Netprepaid(accrued)benefitcostrecognized................................. $1,334 $ (827)

Components of net amount recognized:

Qualifiedplanprepaidbenefitcost....................................... $1,696 $ —

Non-qualifiedplanaccruedbenefitcost ................................... (362) (827)

Netprepaid(accrued)benefitcostrecognized.............................. 1,334 (827)

Intangibleasset................................................... 12 —

Additionalminimumpensionliability ...................................... (78) —

Netamountrecognized............................................. $1,268 $ (827)

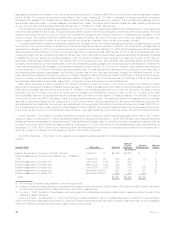

Amounts recognized in the consolidated balance sheet consist of:

Otherassets..................................................... $ 944 $1,708 $ — $ —

Otherliabilities.................................................... (598) (440) (901) (827)

Netamountrecognized............................................. $ 346 $1,268 $ (901) $ (827)

Accumulated other comprehensive (income) loss:

Netactuarial(gains)losses............................................ $1,123 $ — $ 328 $ —

Priorservicecost(credit)............................................. 41 — (230) —

Netassetattransition............................................... — — 1 —

Additionalminimumpensionliability ...................................... — 66 — —

1,164 66 99 —

Deferredincometaxandminorityinterest.................................... (423) (25) (37) —

$ 741 $ 41 $ 62 $ —

51MetLife, Inc.