MetLife 2006 Annual Report Download - page 36

Download and view the complete annual report

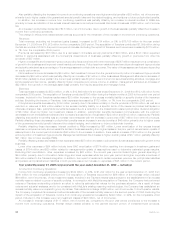

Please find page 36 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Expenses

Total expenses increased by $554 million, or 13%, to $4,971 million for the year ended December 31, 2006 from $4,417 million for the

comparable 2005 period.

The increase in total expenses was commensurate with the growth in revenues and was primarily attributable to an increase of

$284 million in policyholder benefits and claims, primarily associated with growth in insurance in-force of $245 billion, and a $34 million

increase in interest credited due to growth in PABs associated with the coinsurance of annuity products, which is generally offset by a

corresponding increase in net investment income. The increase in policyholder benefits and claims of $284 million was partially offset by

favorable underwriting results in RGA’s international operations in the current year period, unfavorable mortality experience in the U.S. and

the United Kingdom in the prior-year period, and a $33 million increase in the liabilities associated with the Argentine pension business in

the prior year period.

Other expenses increased by $236 million due to a $92 million increase in expenses associated with DAC, including reinsurance

allowances paid, a $47 million increase in interest expense primarily associated with RGA’s issuance of $850 million 30-year notes in June

2006 and $400 million of junior subordinated notes in December 2005, as well as a $47 million increase in minority interest expense on the

larger earnings base in the current period. The remaining increase of $50 million was primarily related to overhead-related expenses

associated with RGA’s international expansion and general growth in operations, including equity compensation expense.

Additionally, a component of the increase in total expenses was a $33 million increase associated with foreign currency exchange rate

movements.

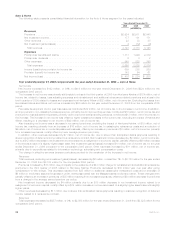

Year ended December 31, 2005 compared with the year ended December 31, 2004 — Reinsurance

Net Income

Net income increased by $1 million, or 1%, to $92 million for the year ended December 31, 2005 from $91 million for the comparable

2004 period.

This increase was attributable to a 14% increase in revenues, primarily due to new premiums from facultative and automatic treaties and

renewal premiums on existing blocks of business in the U.S. and international operations, as well as an increase in net investment income

due to growth in RGA’s operations and invested asset base.

The increase in net income was partially offset by a reduction in net investment gains of $12 million, net of income tax and minority

interest, and a higher loss ratio in the 2005 period, primarily due to unfavorable mortality experience as a result of high claim levels in the

U.S. and the United Kingdom. during the first six months of the year. Reserve strengthening in RGA’s Argentine pension business in 2005

reduced net income by $11 million, net of income tax and minority interest. The comparable 2004 period included a negotiated claim

settlement in RGA’s accident and health business, reducing net income by $8 million, net of income tax and minority interest. The Argentine

pension business and the accident and health business are in run-off.

Revenues

Total revenues, excluding net investment gains (losses), increased by $591 million, or 15%, to $4,533 million for the year ended

December 31, 2005 from $3,942 million for the comparable 2004 period primarily due to a $521 million, or 16%, increase in premiums and

a $68 million, or 13%, increase in net investment income.

New premiums from facultative and automatic treaties and renewal premiums on existing blocks of business in the U.S. and

international operations contributed to the premium growth. Premium levels were significantly influenced by large transactions and

reporting practices of ceding companies and, as a result, can fluctuate from period to period.

The growth in net investment income was the result of the growth in RGA’s operations and invested asset base.

Additionally, a component of the total revenue increase was attributable to foreign currency exchange rate movements contributing an

estimated $49 million.

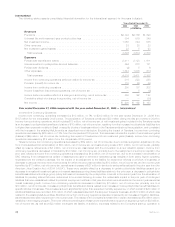

Expenses

Total expenses increased by $553 million, or 14%, to $4,417 million for the year ended December 31, 2005 from $3,864 million for the

comparable 2004 period.

This increase was commensurate with growth in revenues and was primarily attributable to an increase of $520 million in policyholder

benefits and claims and interest credited to PABs, primarily associated with RGA’s growth in insurance in force of $270 billion, the

aforementioned unfavorable mortality experience in the U.S. and the United Kingdom during the first six months of the 2005 period, and

strengthening of reserves of $33 million for the Argentine pension business. The comparable 2004 period included a negotiated claim

settlement in RGA’s accident and health business of $24 million and $18 million in policy benefits and claims as a result of the Indian Ocean

tsunami on December 26, 2004 and claims development associated with the reinsurance of the Argentine pension business, respectively.

Other expenses increased by $34 million, or 4%, primarily due to an increase in the amortization of DAC. Changes in DAC, included in

other expenses, can vary from period to period primarily due to changes in the mixture of the business being reinsured.

Additionally, $46 million of the total expense increase was attributable to foreign currency exchange rate movements.

33MetLife, Inc.