MetLife 2006 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.represented by this blanket lien provide that upon any event of default by MetLife Bank, the FHLB of NY’s recovery is limited to the amount

of MetLife Bank’s liability under the outstanding repurchase agreements. The amount of the Company’s liability for repurchase agreements

with the FHLB of NY was $998 million and $855 million at December 31, 2006 and 2005, respectively, which is included in long-term debt.

Metropolitan Life is a member of the FHLB of NY and holds $136 million of common stock of the FHLB of NY, which is included in equity

securities on the Company’s consolidated balance sheet. Metropolitan Life had no funding agreements with the FHLB of NY at

December 31, 2006 or 2005.

Collateral for Securities Lending

The Company has non-cash collateral for securities lending on deposit from customers, which cannot be sold or repledged, and which

has not been recorded on its consolidated balance sheets. The amount of this collateral was $100 million and $207 million at December 31,

2006 and 2005, respectively.

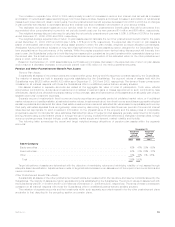

Pensions and Other Postretirement Benefit Plans

Description of Plans

Plan Description Overview

The Subsidiaries sponsor and/or administer various qualified and non-qualified defined benefit pension plans and other postretirement

employee benefit plans covering employees and sales representatives who meet specified eligibility requirements. Pension benefits are

provided utilizing either a traditional formula or cash balance formula. The traditional formula provides benefits based upon years of credited

service and either final average or career average earnings. The cash balance formula utilizes hypothetical or notional accounts which

credit participants with benefits equal to a percentage of eligible pay as well as earnings credits, determined annually based upon the

average annual rate of interest on 30-year U.S. Treasury securities, for each account balance. As of December 31, 2006, virtually all of the

Subsidiaries’ obligations have been calculated using the traditional formula. The non-qualified pension plans provide supplemental

benefits, in excess of amounts permitted by governmental agencies, to certain executive level employees.

The Subsidiaries also provide certain postemployment benefits and certain postretirement medical and life insurance benefits for retired

employees. Employees of the Subsidiaries who were hired prior to 2003 (or, in certain cases, rehired during or after 2003) and meet age

and service criteria while working for a covered subsidiary, may become eligible for these other postretirement benefits, at various levels, in

accordance with the applicable plans. Virtually all retirees or their beneficiaries contribute a portion of the total cost of postretirement

medical benefits. Employees hired after 2003 are not eligible for any employer subsidy postretirement medical benefits.

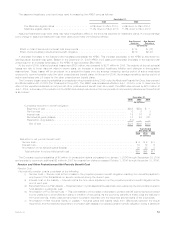

Financial Summary

Statement of Financial Accounting Standards (“SFAS”) No. 87, Employers’ Accounting for Pensions (“SFAS 87”), as amended,

establishes the accounting for pension plan obligations. Under SFAS 87, the projected pension benefit obligation (“PBO”) is defined

as the actuarially calculated present value of vested and non-vested pension benefits accrued based on future salary levels. The

accumulated pension benefit obligation (“ABO”) is the actuarial present value of vested and non-vested pension benefits accrued based on

current salary levels. The PBO and ABO of the pension plans are set forth in the following section.

Prior to December 31, 2006, SFAS 87 also required the recognition of an additional minimum pension liability and an intangible asset

(limited to unrecognized prior service cost) if the market value of pension plan assets was less than the ABO at the measurement date. The

excess of the additional minimum pension liability over the allowable intangible asset was charged, net of taxes, to accumulated other

comprehensive income. The Company’s additional minimum pension liability was $78 million, and the intangible asset was $12 million, at

December 31, 2005. The excess of the additional minimum pension liability over the intangible asset of $66 million ($41 million, net of

income tax) was recorded as a reduction of accumulated other comprehensive income. At December 31, 2006, the Company’s additional

minimum pension liability was $92 million. The minimum pension liability of $59 million, net of income tax of $33 million, was recorded as a

reduction of accumulated other comprehensive income.

SFAS No. 106, Employers Accounting for Postretirement Benefits Other than Pensions, as amended, (“SFAS 106”), establishes the

accounting for expected postretirement plan benefit obligations (“EPBO”) which represents the actuarial present value of all postretirement

benefits expected to be paid after retirement to employees and their dependents. Unlike the PBO for pensions, the EPBO is not recorded in

the financial statements but is used in measuring the periodic expense. The accumulated postretirement plan benefit obligations (“APBO”)

represents the actuarial present value of future postretirement benefits attributed to employee services rendered through a particular date.

The APBO is recorded in the financial statements and is set forth below.

As described more fully in “ — Adoption of New Accounting Pronouncements”, the Company adopted SFAS No. 158, Employers’

Accounting for Defined Benefit Pension and Other Postretirement Plans —an amendment of FASB Statements No. 87, 88, 106, and

SFAS No. 132(r) (“SFAS 158”), effective December 31, 2006. Upon adoption, the Company was required to recognize in the consolidated

balance sheet the funded status of defined benefit pension and other postretirement plans. Funded status is measured as the difference

between the fair value of plan assets and the benefit obligation, which is the PBO for pension plans and the APBO for other postretirement

plans. The change to recognize funded status eliminated the additional minimum pension liability provisions of SFAS 87. In addition, the

Company recognized as an adjustment to accumulated other comprehensive income, net of income tax, those amounts of actuarial gains

and losses, prior service costs and credits, and the remaining net transitionassetorobligationthathavenotyetbeenincludedinnet

periodic benefit cost as of the date of adoption. The adoption of SFAS 158 resulted in a reduction of $744 million, net of income tax, to

50 MetLife, Inc.