MetLife 2006 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

impaired, insolvent or failed insurer engaged. Some states permit member insurers to recover assessments paid through full or partial

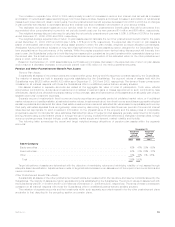

premium tax offsets. Assets and liabilities held for insolvency assessments are as follows:

2006 2005

December 31,

(In millions)

Other Assets:

Premiumtaxoffsetforfutureundiscountedassessments .............................. $45 $45

Premiumtaxoffsetscurrentlyavailableforpaidassessments............................ 7 8

Receivableforreimbursementofpaidassessments(1)................................ 10 10

$62 $63

Liability:

Insolvencyassessments ................................................... $90 $90

(1) The Company holds a receivable from the seller of a prior acquisition in accordance with the purchase agreement.

Assessments levied against the Company were $2 million, $4 million and $10 million for the years ended December 31, 2006, 2005 and

2004, respectively.

Effects of Inflation

The Company does not believe that inflation has had a material effect on its consolidated results of operations, except insofar as

inflation may affect interest rates.

Adoption of New Accounting Pronouncements

Defined Benefit and Other Postretirement Plans

Effective December 31, 2006, the Company adopted SFAS 158. The pronouncement revises financial reporting standards for defined

benefit pension and other postretirement plans by requiring the:

(i) recognition in the statement of financial position of the funded status of defined benefit plans measured as the difference

betweenthefairvalueofplanassetsandthebenefitobligation,whichistheprojectedbenefitobligationforpensionplans

and the accumulated postretirement benefit obligation for other postretirement plans;

(ii) recognition as an adjustment to accumulated other comprehensive income (loss), net of income tax, those amounts of

actuarial gains and losses, prior service costs and credits, and net asset or obligation at transition that have not yet been

included in net periodic benefit costs as of the end of the year of adoption;

(iii) recognition of subsequent changes in funded status as a component of other comprehensive income;

(iv) measurement of benefit plan assets and obligations as of the date of the statement of financial position; and

(v) disclosure of additional information about the effects on the employer’s statement of financial position.

The adoption of SFAS 158 resulted in a reduction of $744 million, net of income tax, to accumulated other comprehensive income,

which is included as a component of total consolidated stockholders’ equity. As the Company’s measurement date for its pension and

other postretirement benefit plans is already December 31 there is no impact of adoption due to changes in measurement date.

Stock Compensation Plans

As described previously, effective January 1, 2006, the Company adopted SFAS 123(r) including supplemental application guidance

issued by the SEC in Staff Accounting Bulletin (“SAB”) No. 107, Share-Based Payment (“SAB 107”) — using the modified prospective

transition method. In accordance with the modified prospective transition method, results for prior periods have not been restated.

SFAS 123(r) requires that the cost of all stock-based transactions be measured at fair value and recognized over the period during which a

grantee is required to provide goods or services in exchange for the award. The Company had previously adopted the fair value method of

accounting for stock-based awards as prescribed by SFAS 123 on a prospective basis effective January 1, 2003, and prior to January 1,

2003, accounted for its stock-based awards to employees under the intrinsic value method prescribed by APB 25. The Company did not

modify the substantive terms of any existing awards prior to adoption of SFAS 123(r).

Under the modified prospective transition method, compensation expense recognized during the year ended December 31, 2006

includes: (a) compensation expense for all stock-based awards granted prior to, but not yet vested as of January 1, 2006, based on the

grant date fair value estimated in accordance with the original provisions of SFAS 123, and (b) compensation expense for all stock-based

awards granted beginning January 1, 2006, based on the grant date fair value estimated in accordance with the provisions of SFAS 123(r).

The adoption of SFAS 123(r) did not have a significant impact on the Company’s financial position or results of operations as all stock-

based awards accounted for under the intrinsic value method prescribed by APB 25 had vested prior to the adoption date and the

Company had adopted the fair value recognition provisions of SFAS 123 on January 1, 2003. As required by SFAS 148, and carried

forward in the provisions of SFAS 123(r), the Company discloses the pro forma impact as if stock-based awards accounted for under

APB 25 had been accounted for under the fair value method.

SFAS 123 allowed forfeitures of stock-based awards to be recognized as a reduction of compensation expense in the period in which

the forfeiture occurred. Upon adoption of SFAS 123(r), the Company changed its policy and now incorporates an estimate of future

forfeitures into the determination of compensation expense when recognizing expense over the requisite service period. The impact of this

change in accounting policy was not significant to the Company’s consolidated financial position or results of operations for the year ended

December 31, 2006.

Additionally, for awards granted after adoption, the Company changed its policy from recognizing expense for stock-based awards over

the requisite service period to recognizing such expense over the shorter of the requisite service period or the period to attainment of

retirement-eligibility.

Prior to the adoption of SFAS 123(r), the Company presented tax benefits of deductions resulting from the exercise of stock options

within operating cash flows in the consolidated statements of cash flows. SFAS 123(r) requires tax benefits resulting from tax deductions in

57MetLife, Inc.