MetLife 2006 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

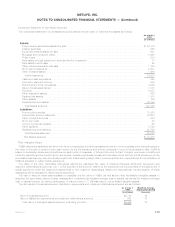

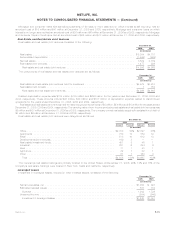

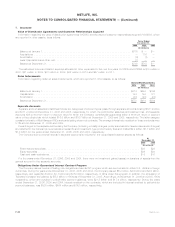

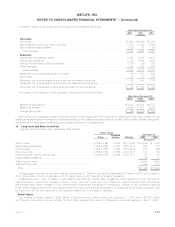

The above table does not include notional values for equity futures, equity financial forwards and equity options. At December 31, 2006

and 2005, the Company owned 2,749 and 3,305 equity futures contracts, respectively. Market values of equity futures are included in

financial futures in the preceding table. At December 31, 2006 and 2005, the Company owned 225,000 and 213,000 equity financial

forwards, respectively. Market values of equity financial forwards are included in financial forwards in the preceding table. At December 31,

2006 and 2005, the Company owned 74,864,483 and 4,720,254 equity options, respectively. Market values of equity options are

included in options in the preceding table.

The following table presents the notional amounts of derivative financial instruments by maturity at December 31, 2006:

One Year or

Less

After One Year

Through Five

Years

After Five Years

Through Ten

Years After Ten

Years Total

Remaining Life

(In millions)

Interest rate swaps . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,734 $16,424 $ 5,192 $ 3,798 $ 27,148

Interestratefloors .......................... — 7,619 29,818 — 37,437

Interestratecaps........................... 2,770 23,698 — — 26,468

Financialfutures ........................... 8,432 — — — 8,432

Foreign currency swaps . . . . . . . . . . . . . . . . . . . . . . 572 8,841 7,390 2,824 19,627

Foreigncurrencyforwards..................... 2,934 — — — 2,934

Options................................. — 586 1 — 587

Financialforwards .......................... — — — 3,800 3,800

Creditdefaultswaps......................... 518 5,618 221 — 6,357

SyntheticGICs ............................ 3,427 312 — — 3,739

Other................................... — 250 — — 250

Total.................................. $20,387 $63,348 $42,622 $10,422 $136,779

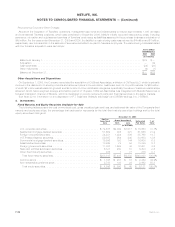

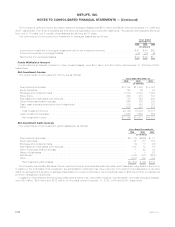

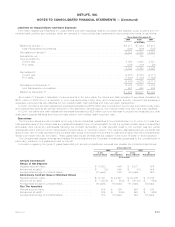

Interest rate swaps are used by the Company primarily to reduce market risks from changes in interest rates and to alter interest rate

exposure arising from mismatches between assets and liabilities (duration mismatches). In an interest rate swap, the Company agrees with

another party to exchange, at specified intervals, the difference between fixed rate and floating rate interest amounts as calculated by

reference to an agreed notional principal amount. These transactions are entered into pursuant to master agreements that provide for a

single net payment to be made by the counterparty at each due date.

The Company also enters into basis swaps to better match the cash flows from assets and related liabilities. In a basis swap, both legs

of the swap are floating with each based on a different index. Generally, no cash is exchanged at the outset of the contract and no principal

payments are made by either party. A single net payment is usually made by one counterparty at each due date. Basis swaps are included

in interest rate swaps in the preceding table.

Interest rate caps and floors are used by the Company primarily to protect its floating rate liabilities against rises in interest rates above a

specified level, and against interest rate exposure arising from mismatches between assets and liabilities (duration mismatches), as well as

to protect its minimum rate guarantee liabilities against declines in interest rates below a specified level, respectively.

In exchange-traded interest rate (Treasury and swap) and equity futures transactions, the Company agrees to purchase or sell a

specified number of contracts, the value of which is determined by the different classes of interest rate and equity securities, and to post

variation margin on a daily basis in an amount equal to the difference in the daily market values of those contracts. The Company enters into

exchange-traded futures with regulated futures commission merchants that are members of the exchange.

Exchange-traded interest rate (Treasury and swap) futures are used primarily to hedge mismatches between the duration of assets in a

portfolio and the duration of liabilities supported by those assets, to hedge against changes in value of securities the Company owns or

anticipates acquiring, and to hedge against changes in interest rates on anticipated liability issuances by replicating Treasury or swap curve

performance. The value of interest rate futures is substantially impacted by changes in interest rates and they can be used to modify or

hedge existing interest rate risk.

Exchange-traded equity futures are used primarily to hedge liabilities embedded in certain variable annuity products offered by the

Company.

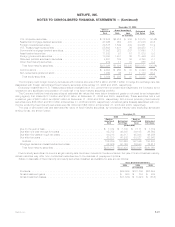

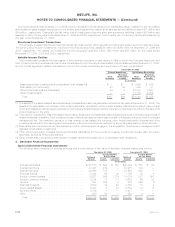

Foreign currency derivatives, including foreign currency swaps, foreign currency forwards and currency option contracts, are used by

the Company to reduce the risk from fluctuations in foreign currency exchange rates associated with its assets and liabilities denominated

in foreign currencies. The Company also uses foreign currency forwards and swaps to hedge the foreign currency risk associated with

certain of its net investments in foreign operations.

In a foreign currency swap transaction, the Company agrees with another party to exchange, at specified intervals, the difference

between one currency and another at a forward exchange rate calculated by reference to an agreed upon principal amount. The principal

amount of each currency is exchanged at the inception and termination of the currency swap by each party.

In a foreign currency forward transaction, the Company agrees with another party to deliver a specified amount of an identified currency

at a specified future date. The price is agreed upon at the time of the contract and payment for such a contract is made in a different

currency at the specified future date.

The Company enters into currency option contracts that give it the right, but not the obligation, to sell the foreign currency amount in

exchange for a functional currency amount within a limited time at a contracted price. The contracts may also be net settled in cash, based

on differentials in the foreign exchange rate and the strike price. Currency option contracts are included in options in the preceding table.

F-35MetLife, Inc.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)