MetLife 2006 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

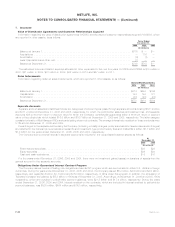

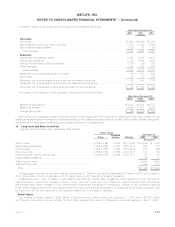

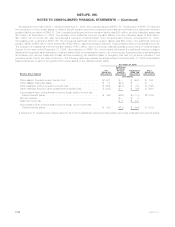

14. Income Tax

The provision for income tax from continuing operations is as follows:

2006 2005 2004

Years Ended December 31,

(In millions)

Current:

Federal ........................................................... $ 637 $ 559 $658

Stateandlocal ...................................................... 39 63 51

Foreign ........................................................... 156 111 154

Subtotal........................................................... 832 733 863

Deferred:

Federal ........................................................... $ 220 $ 470 $191

Stateandlocal ...................................................... 2 14 6

Foreign ........................................................... 62 11 (64)

Subtotal........................................................... 284 495 133

Provisionforincometax.................................................. $1,116 $1,228 $996

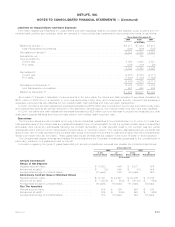

The reconciliation of the income tax provision at the U.S. statutory rate to the provision for income tax as reported for continuing

operations is as follows:

2006 2005 2004

Years Ended December 31,

(In millions)

TaxprovisionatU.S.statutoryrate.......................................... $1,477 $1,507 $1,251

Tax effect of:

Tax-exemptinvestmentincome .......................................... (296) (169) (131)

Stateandlocalincometax ............................................. 23 35 37

Prioryeartax ...................................................... (33) (31) (105)

Foreignoperations,netofforeignincometax ................................. (34) (44) (36)

Foreignoperationsrepatriation........................................... — (27) —

Other,net ........................................................ (21) (43) (20)

Provisionforincometax ................................................ $1,116 $1,228 $ 996

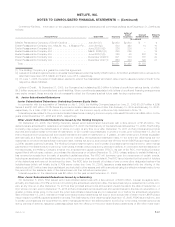

Included in the 2005 total tax provision was a $27 million tax benefit related to the repatriation of foreign earnings pursuant to Internal

Revenue Code Section 965 for which a U.S. deferred tax position had previously been recorded.

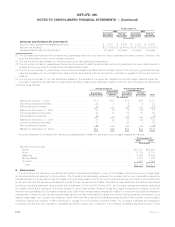

The Company is under continuous examination by the Internal Revenue Service (“IRS”) and other tax authorities in jurisdictions in which

the Company has significant business operations. The income tax years under examination vary by jurisdiction. In 2004, the Company

recorded an adjustment of $91 million for the settlement of all federal income tax issues relating to the IRS’s audit of the Company’s tax

returns for the years 1997-1999. Such settlement is reflected in the current year tax expense as an adjustment to prior year tax. The

Company also received $22 million in interest on such settlements and incurred an $8 million tax expense on such settlement for a total

impact to net income of $105 million. The current IRS examination covers the years 2000-2002 and the Company expects it to be

completed in 2007. The Company regularly assesses the likelihood of additional assessments in each taxing jurisdiction resulting from

current and subsequent years’ examinations. Liabilities for income tax have been established for future income tax assessments when it is

probable there will be future assessments and the amount thereof can be reasonably estimated. Once established, liabilities for uncertain

tax positions are adjusted only when there is more information available or when an event occurs necessitating a change to the liabilities.

The Company believes that the resolution of income tax matters for open years will not have a material effect on its consolidated financial

statements although the resolution of income tax matters could impact the Company’s effective tax rate for a particular future period.

F-50 MetLife, Inc.

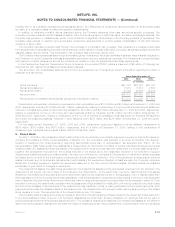

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)