MetLife 2006 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chairman’s Letter

Dear Shareholders:

Last year was an excellent one for MetLife and was equally exciting for me as I assumed the roles of

Chairman & CEO. Although I have more than 35 years’ tenure with MetLife, I nonetheless have found these

past months enormously informative and enriching.

Mypassionforourbusinessandtheamazingrolethatourindustrycanplayinthelivesofindividualsis

well known among my colleagues at MetLife. And, as I traveled to our operations around the globe for the

first time as Chairman and CEO in 2006, I was struck by the strong feeling of excitement by all who touch

MetLife—the feeling that we are on the verge of a new era in our evolution, intently focused on growth. I am

more confident than ever about our opportunities. Established firmly in the giant league of financial services

companies, MetLife is the largest life insurer in the United States and counts more than 70 million customers around the world. Building from a

position of strength and a consistent growth record, MetLife continues to have enormous opportunities to extend its leadership in the

marketplace.

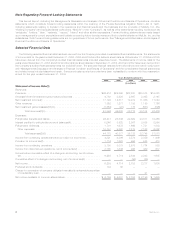

There’s no doubt that MetLife had a strong 2006: record financial results, including continued return on common equity growth,

$6.2 billion in net income available to common shareholders, an asset base of more than $500 billion and strong results in our core

businesses. Our performance has resulted in a strong return to the shareholder, with MetLife outperforming both the S&P 500 and the

S&P Insurance Index. And of course, we completed the historic sale of Peter Cooper Village and Stuyvesant Town—the largest real estate

sale in U.S. history—for $5.4 billion.

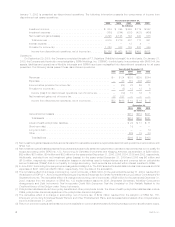

Multiple earnings sources continue to provide MetLife with an important competitive advantage, allowing us to remain financially strong

and deliver good results, despite market challenges that may arise from time to time in any of our businesses. A tradition of strong

underwriting, best-in-class products and services, depth and breadth of excellent customer relationships and attention to expense

management, are hallmarks of how we manage MetLife for the long-term.

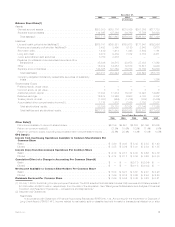

We also recognize how paramount a company’s financial strength is to both customers and shareholders. Without a doubt, MetLife’s

strong financials were further improved by our focus on effective capital management, which was demonstrated in part through the

company’s lower debt ratio at year end. During the year, we also increased the 2006 common stock dividend by 13% to $0.59 per share

and resumed share repurchases in the fourth quarter. And we continue to focus on ways that we can return value to you—MetLife’s

shareholders. Most importantly, we see investing in the growth of our businesses as something that will not only benefit our customers, but

you as well.

Creating a new generation of solutions globally

Focusing on our core competencies will not only enable us to meet customer needs around the world but, I believe, will also assure our

growth and long-term success. While circumstances vary across markets and geographies, people share common needs: to provide for

loved ones in the event of death, to protect against disability and to plan for a secure retirement—these are universal. This is why, in 2006,

we placed a strong focus on building our global growth strategy. My first international tours as Chairman and CEO to visit our operations in

East Asia and India affirmed my belief that we have enormous opportunities in these regions, and the talent, skills and ability to leverage our

leadership worldwide. For example, in 2006, we prepared to enter the United Kingdom pension closeout business to tap into a market

undergoing significant transformation and for which we are uniquely suited as a leader in the U.S. pension business. With a global mindset,

we are identifying additional ways to utilize our long experience around the world, incorporating principles of cultural understanding into our

training and performance management programs, as well as in our everyday dialogue.

At MetLife, when we talk about “creating a new generation of solutions,” one of the greatest areas of opportunity lies in the retirement

arena. Given an aging population, MetLife is now facing a tremendous challenge to develop innovative solutions that can help people take

care of the risks that they simply can’t self-insure. This is just one reason why, in 2006, we began to align our businesses to work

cohesively on developing strategies to capture the tremendous opportunities in this market.

Thought leadership also was a major focus last year as many of my colleagues and I sought to raise awareness and visibility of MetLife

as a leader in the U.S. retirement market. We participated in a number of industry events, including the Longevity Summit in Washing-

ton, D.C. and provided testimony to the Senate Committee on Aging.

Other opportunities for MetLife lie in another area in which we are already a powerhouse: voluntary benefits. As the employee benefits

framework continues to shift from employer-financed to employee-paid, we are well prepared to deliver innovative solutions to both our

corporate and individual customers.