MetLife 2006 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

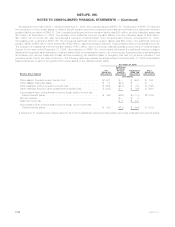

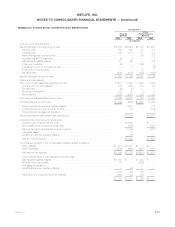

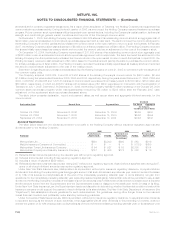

The aggregate projected benefit obligation and aggregate fair value of plan assets for the pension plans were as follows:

2006 2005 2006 2005 2006 2005

Qualified Plan Non-Qualified

Plan Total

December 31,

(In millions)

Aggregate fair value of plan assets (principally Company contracts) . . $6,305 $5,518 $ — $ — $6,305 $5,518

Aggregate projected benefit obligation . . . . . . . . . . . . . . . . . . . . . 5,381 5,258 578 508 5,959 5,766

Over (under) funded . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 924 $ 260 $(578) $(508) $ 346 $ (248)

The accumulated benefit obligation for all defined benefit pension plans was $5,505 million and $5,349 million at December 31, 2006

and 2005, respectively.

Information for pension plans with an accumulated benefit obligation in excess of plan assets is as follows:

2006 2005

December 31,

(In millions)

Projectedbenefitobligation........................................................ $594 $538

Accumulatedbenefitobligation ..................................................... $501 $449

Fairvalueofplanassets.......................................................... $ — $ 19

Information for pension and other postretirement plans with a projected benefit obligation in excess of plan assets is as follows:

2006 2005 2006 2005

Pension

Benefits

Other

Postretirement

Benefits

December 31,

(In millions)

Projectedbenefitobligation .......................................... $623 $538 $2,073 $2,176

Fairvalueofplanassets ............................................ $ 25 $ 19 $1,172 $1,093

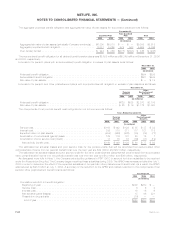

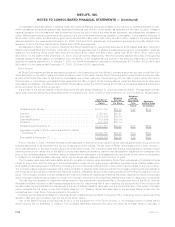

The components of net periodic benefit cost recognized in net income were as follows:

2006 2005 2004 2006 2005 2004

Pension

Benefits

Other

Postretirement

Benefits

Years Ended December 31,

(In millions)

Servicecost........................................... $163 $142 $129 $ 35 $ 37 $ 32

Interestcost........................................... 335 318 311 117 121 119

Expectedreturnonplanassets .............................. (454) (446) (428) (79) (79) (77)

Amortizationofnetactuarial(gains)losses ....................... 125 116 101 23 15 7

Amortizationofpriorservicecost(credit) ........................ 11 16 16 (36) (17) (19)

Netperiodicbenefitcost ................................. $180 $146 $129 $ 60 $ 77 $ 62

The estimated net actuarial losses and prior service cost for the pension plans that will be amortized from accumulated other

comprehensive income into net periodic benefit cost over the next year are $54 million and $12 million, respectively.

The estimated net actuarial losses and prior service credit for the other postretirement plans that will be amortized from accumulated

other comprehensive income into net periodic benefit cost over the next year are $14 million and $36 million, respectively.

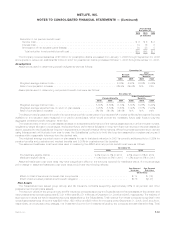

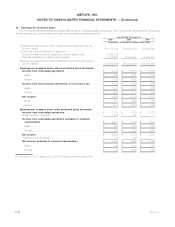

As discussed more fully in Note 1, the Company adopted the guidance in FSP 106-2 to account for future subsidies to be received

under the Prescription Drug Act. The Company began receiving these subsidies during 2006. The APBO was remeasured effective July 1,

2004 in order to determine the effect of the expected subsidies on net periodic other postretirement benefit cost. As a result, the APBO

was reduced by $213 million at July 1, 2004. A summary of the reduction to the APBO and related reduction to the components of net

periodic other postretirement benefit cost is as follows:

2006 2005 2004

December 31,

(In millions)

Cumulative reduction in benefit obligation:

Beginningofyear ....................................................... $298 $230 $ —

Servicecost........................................................... 6 6 3

Interestcost........................................................... 19 16 6

Netactuarialgains(losses) ................................................. 15 46 221

Prescriptiondrugsubsidy .................................................. (10) — —

Endofyear.......................................................... $328 $298 $230

F-62 MetLife, Inc.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)