MetLife 2006 Annual Report Download

Download and view the complete annual report

Please find the complete 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc. 2006

annual report

Table of contents

-

Page 1

annual report MetLife, Inc. 2006 -

Page 2

...our growth and long-term success. While circumstances vary across markets and geographies, people share common needs: to provide for loved ones in the event of death, to protect against disability and to plan for a secure retirement-these are universal. This is why, in 2006, we placed a strong focus... -

Page 3

... risks associated with new product development, and consistency of financial reporting processes. Likewise, in the case of MetLife's investment portfolio, we implemented a new risk limit system designed to deliver strong returns while maintaining appropriate risk to the enterprise. The MetLife brand... -

Page 4

...'s Annual Report on Internal Control Over Financial Reporting ...Attestation Report of the Company's Registered Public Accounting Firm ...Financial Statements ...Board of Directors ...Executive Officers ...Contact Information ...Corporate Information ...2 2 5 74 78 78 78 80 81 81 82 82 MetLife... -

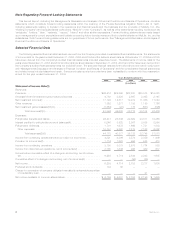

Page 5

...: Premiums ...Universal life and investment-type product policy fees ...Net investment income(2) ...Other revenues ...Net investment gains (losses)(2)(3)(4) ...Total revenues(2)(5) ...Expenses: Policyholder benefits and claims ...Interest credited to policyholder account balances(4) ...Policyholder... -

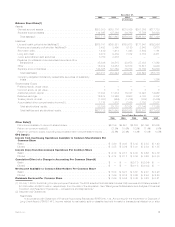

Page 6

... Sheet Data(1) Assets: General account assets ...Separate account assets ...Total assets(2) ...Liabilities: Life and health policyholder liabilities(7) ...Property and casualty policyholder liabilities(7) ...Short-term debt ...Long-term debt ...Junior subordinated debt securities ...Payables for... -

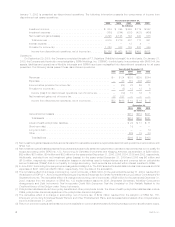

Page 7

... General account assets ...Total assets ...Life and health policyholder liabilities ...Short-term debt ...Long-term debt ...Other ...Total liabilities ... $410 $410 $ 24 19 - 225 $268 $210 $210 $ 17 - - 73 $ 90 $221 $221 $ 11 - 14 83 $108 (3) Net investment gains (losses) exclude amounts related... -

Page 8

... homeowners insurance, retail banking and other financial services to individuals, as well as group insurance, reinsurance and retirement & savings products and services to corporations and other institutions. MetLife is organized into five operating segments: Institutional, Individual, Auto & Home... -

Page 9

... net investment income primarily due to an overall increase in the asset base, an increase in fixed maturity security yields, improved results on real estate and real estate joint ventures, mortgage loans, and other limited partnership interests, as well as higher short-term interest rates on cash... -

Page 10

... retirement & savings-type products. Group insurance premium growth, with respect to life and disability products, for example, is closely tied to employers' total payroll growth. Additionally, the potential market for these products is expanded by new business creation. Bond portfolio credit losses... -

Page 11

... life insurance industry. Regulations recently adopted or currently under review can potentially impact the reserve and capital requirements of the industry. In addition, regulators have undertaken market and sales practices reviews of several markets or products, including equity-indexed annuities... -

Page 12

... extent, the Company also uses credit derivatives to synthetically replicate investment risks and returns which are not readily available in the cash market. The Company also purchases investment securities, issues certain insurance policies and engages in certain reinsurance contracts that have... -

Page 13

...policy issue expenses. VOBA is an intangible asset that reflects the estimated fair value of in-force contracts in a life insurance company acquisition and represents the portion of the purchase price that is allocated to the value of the right to receive future cash flows from the business in-force... -

Page 14

...Future Policy Benefits The Company establishes liabilities for amounts payable under insurance policies, including traditional life insurance, traditional annuities and non-medical health insurance. Generally, amounts are payable over an extended period of time and related liabilities are calculated... -

Page 15

...of the contracts, incorporating expectations concerning policyholder behavior. These riders may be more costly than expected in volatile or declining equity markets, causing an increase in the liability for future policy benefits, negatively affecting net income. The Company periodically reviews its... -

Page 16

...2004 Revenues Premiums ...Universal life and investment-type product policy fees ...Net investment income ...Other revenues ...Net investment gains (losses) ...Total revenues ...Expenses Policyholder benefits and claims ...Interest credited to policyholder account balances ...Policyholder dividends... -

Page 17

... due to an increase in net investment losses, a decline in interest margins, an increase in operating expenses, which included a charge associated with costs related to the sale of certain small market recordkeeping businesses, a charge associated with non-deferrable LTC commissions expense and... -

Page 18

... in the dental, disability, accidental death & dismemberment ("AD&D") products, as well as growth in the long-term care ("LTC") and individual disability insurance ("IDI") businesses, all within the non-medical health & other business. Additionally, growth in the group life business is attributable... -

Page 19

... expense, corporate support expenses, interest credited to bankholder deposits at MetLife Bank, National Association ("MetLife Bank" or "MetLife Bank, N.A.") and legal-related costs, partially offset by lower integration costs. The Reinsurance segment also contributed to the increase in other... -

Page 20

... debt, integration costs associated with the acquisition of Travelers, higher interest credited on bank holder deposits and legal-related liabilities. The Reinsurance segment contributed $1 million, net of income tax, to this increase primarily due to premium growth and higher net investment income... -

Page 21

...'s premiums, fees and other revenues increased due to the new bank distribution channel established in 2005. The Individual segment contributed $446 million, or 17%, to the year over year increase primarily due to higher fee income from variable annuity and universal life products, active marketing... -

Page 22

... foreign net operating loss carryforwards in South Korea, and the contribution of appreciated stock to the MetLife Foundation. In addition, the 2004 effective tax rate reflects an adjustment for the resolution of all issues relating to the Internal Revenue Service's audit of Metropolitan Life's and... -

Page 23

...2004 Revenues Premiums ...Universal life and investment-type product policy fees ...Net investment income ...Other revenues ...Net investment gains (losses) ...Total revenues ...Expenses Policyholder benefits and claims ...Interest credited to policyholder account balances ...Policyholder dividends... -

Page 24

... to increases in the non-medical health & other business of $408 million, primarily due to growth in the dental, disability and AD&D products of $255 million. In addition, continued growth in the LTC and IDI businesses contributed $117 million and $25 million, respectively. Group life increased by... -

Page 25

... in the disability, dental and AD&D products of $360 million. In addition, continued growth in the LTC business contributed $138 million, of which $25 million was related to the 2004 acquisition of TIAA-CREF's LTC business. Group life insurance premiums, fees and other revenues increased by $481... -

Page 26

...2004 Revenues Premiums ...Universal life and investment-type product policy fees ...Net investment income ...Other revenues ...Net investment gains (losses) ...Total revenues ...Expenses Policyholder benefits and claims ...Interest credited to policyholder account balances ...Policyholder dividends... -

Page 27

...account portion of investment type products. Management attributed this increase to higher crediting rates of $37 million, partially offset by $21 million due to lower average PABs. Partially offsetting these decreases in total expenses was a $27 million increase in policyholder dividends associated... -

Page 28

... in policyholder accounts. The value of these assets can fluctuate depending on equity performance. In addition, management attributed higher premiums of $170 million in 2005 to the active marketing of income annuity products. Although premiums associated with the Company's closed block of business... -

Page 29

... million increase in income as a result of a slightly higher asset base with slightly higher yields. Other revenues decreased by $11 million due to slower than anticipated claims payments resulting in a slower recognition of deferred income related to a reinsurance contract. Expenses Total expenses... -

Page 30

...allocation of economic capital, offset by a lower yield on a slightly higher invested asset base and an increase in earned premium of $6 million primarily due to rate increases, higher inflation guard endorsements and higher insurance-to-value programs, all in the homeowners business. Expenses Total... -

Page 31

...2004 Revenues Premiums ...Universal life and investment-type product policy fees ...Net investment income ...Other revenues ...Net investment gains (losses) ...Total revenues ...Expenses Policyholder benefits and claims ...Interest credited to policyholder account balances ...Policyholder dividends... -

Page 32

... million and the current year benefited by $16 million. South Korea's premiums, fees and other revenues increased by $156 million primarily due to business growth driven by strong sales of its variable universal life product, as well as the favorable impact of foreign currency exchange rates of $56... -

Page 33

... due to a loss recognition adjustment resulting from low interest rates relative to product guarantees coupled with high persistency rates on certain blocks of business, an increase of $17 million related to the termination of the agency distribution channel in Taiwan, an increase of $9 million... -

Page 34

...interest credited to policyholder accounts increased by $86 million due to the business growth primarily in the bank distribution channel business, as well as to an increase in the liabilities for annuity benefits, which, like net investment income on related assets, are linked to the inflation rate... -

Page 35

... a 21% increase in net investment income while interest credited to PABs increased by 15%, and a 14% increase in other revenues. The increase in premiums, net of the increase in policyholder benefits and claims, added $127 million to net income which was primarily due to added business in-force from... -

Page 36

...growth in insurance in-force of $245 billion, and a $34 million increase in interest credited due to growth in PABs associated with the coinsurance of annuity products, which is generally offset by a corresponding increase in net investment income. The increase in policyholder benefits and claims of... -

Page 37

... on fixed maturity securities due to improved yields from lengthening of the duration and a higher asset base, and the impact of higher short-term interest rates on cash equivalents and short term investments. The increase also resulted from a higher asset base invested in mortgage loans on real... -

Page 38

...of the acquisition of Travelers. Integration costs associated with the acquisition of Travelers were $120 million. As a result of growth in the business, interest credited to bank holder deposits increased by $70 million at MetLife Bank. In addition, legal-related liabilities increased by $5 million... -

Page 39

... based on market conditions and the amount and timing of the liquidity need. These options include cash flows from operations, the sale of liquid assets, global funding sources and various credit facilities. The Company's ability to sell investment assets could be limited by accounting rules... -

Page 40

... to support Regulation XXX statutory reserves on 1.5 million term life insurance policies with guaranteed level premium periods reinsured by RGA Reinsurance Company, a U.S. subsidiary of RGA. MetLife Bank has entered into several funding agreements with the Federal Home Loan Bank of New York (the... -

Page 41

... arising from its insurance activities primarily relate to benefit payments under the aforementioned products, as well as payments for policy surrenders, withdrawals and loans. Investment and Other. Additional cash outflows include those related to obligations of securities lending and dollar... -

Page 42

... related to conventional guaranteed investment contracts, guaranteed investment contracts associated with formal offering programs, funding agreements, individual and group annuities, total control accounts, bank deposits, individual and group universal life, variable universal life and company... -

Page 43

... withdrawals; policy lapses; surrender charges; annuitization; mortality; future interest credited; policy loans and other contingent events as appropriate to the respective product type. Such estimated cash payments are also presented net of estimated future premiums on policies currently in-force... -

Page 44

...by state insurance statutes, General American would assume as assumption reinsurance, subject to regulatory approvals and required consents, all of MetLife Investors' life insurance policies and annuity contract liabilities. As of the date of the most recent statutory financial statements filed with... -

Page 45

... 2004 period was primarily attributable to the acquisition of Travelers, growth in disability, dental, LTC business, group life and retirement & savings, as well as continued growth in the annuity business. Net cash provided by financing activities increased by $0.9 billion to $15.4 billion for the... -

Page 46

... cash used to acquire Travelers of $11.0 billion, less cash acquired of $0.9 billion for a net total cash paid of $10.1 billion, which was funded by $6.8 billion in securities issuances and $4.2 billion of cash provided by operations and the sale of invested assets. During the current year, cash... -

Page 47

... cash, cash equivalents, short-term investments and marketable fixed maturity securities. At December 31, 2006 and 2005, the Holding Company had $3.9 billion and $668 million in liquid assets, respectively. Global Funding Sources. Liquidity is also provided by a variety of both short-term and long... -

Page 48

... Shares, and any parity stock, have been declared and paid or provided for. The Holding Company is prohibited from declaring dividends on the Preferred Shares if it fails to meet specified capital adequacy, net income and shareholders' equity levels. In addition, under Federal Reserve Board policy... -

Page 49

...and Series B trust preferred securities, respectively, in payment of any accrued and unpaid distributions. Each stock purchase contract requires (i) the Holding Company to pay the holder of the common equity unit quarterly contract payments on the stock purchase contracts at the annual rate of 1.510... -

Page 50

... long-term earnings, financial condition, regulatory capital position, and applicable governmental regulations and policies. Furthermore, the payment of dividends and other distributions to the Holding Company by its insurance subsidiaries is regulated by insurance laws and regulations. Information... -

Page 51

..., its financial strength and credit ratings, general market conditions and the price of MetLife, Inc.'s common stock. Support Agreements. The Holding Company has net worth maintenance agreements with two of its insurance subsidiaries, MetLife Investors and First MetLife Investors Insurance Company... -

Page 52

...at December 31, 2006. The credit default swaps expire at various times during the next ten years. Other Commitments MetLife Insurance Company of Connecticut ("MICC") is a member of the Federal Home Loan Bank of Boston (the "FHLB of Boston") and holds $70 million of common stock of the FHLB of Boston... -

Page 53

... the applicable plans. Virtually all retirees or their beneficiaries contribute a portion of the total cost of postretirement medical benefits. Employees hired after 2003 are not eligible for any employer subsidy postretirement medical benefits. Financial Summary Statement of Financial Accounting... -

Page 54

...Funded status at end of year ...Unrecognized net actuarial (gains) losses ...Unrecognized prior service cost (credit) ...Unrecognized net asset at transition ...Net prepaid (accrued) benefit cost recognized ...Components of net amount recognized: Qualified plan prepaid benefit cost ...Non-qualified... -

Page 55

... of high-quality debt instruments available on the valuation date, which would provide the necessary future cash flows to pay the aggregate PBO when due. The yield of this hypothetical portfolio, constructed of bonds rated AA or better by Moody's Investors Services resulted in a discount rate of... -

Page 56

... accumulated pension fund assets in a particular year. iv) Amortization of Prior Service Cost - This cost relates to the increase or decrease to pension benefit cost for service provided in prior years due to amendments in plans or initiation of new plans. As the economic benefits of these costs are... -

Page 57

...amortization of net actuarial losses resulting largely from lower discount rates, partially offset by the impact of an increase in the expected return on plan assets due to a larger plan assets base. The estimated net actuarial losses and prior service cost for the defined benefit pension plans that... -

Page 58

... in a decrease (increase) in net periodic benefit cost of $3 million for the other postretirement plans. Pension and Other Postretirement Benefit Plan Assets Pension Plan Assets Substantially all assets of the pension plans are invested within group annuity and life insurance contracts issued by the... -

Page 59

... benefits owed pursuant to insurance policies issued by impaired, insolvent or failed life insurers. These associations levy assessments, up to prescribed limits, on all member insurers in a particular state on the basis of the proportionate share of the premiums written by member insurers... -

Page 60

... the cost of all stock-based transactions be measured at fair value and recognized over the period during which a grantee is required to provide goods or services in exchange for the award. The Company had previously adopted the fair value method of accounting for stock-based awards as prescribed... -

Page 61

... of a conversion option should be recognized upon the modification as a discount (or premium) associated with the debt, and an increase (or decrease) in additional paid-in capital. The adoption of EITF 05-7 did not have a material impact on the Company's consolidated financial statements. Effective... -

Page 62

... the adoption of SOP 03-1, effective January 1, 2004, the Company decreased the liability for future policyholder benefits for changes in the methodology relating to various guaranteed death and annuitization benefits and for determining liabilities for certain universal life insurance contracts by... -

Page 63

... No. 97, Accounting and Reporting by Insurance Enterprises for Certain Long-Duration Contracts and for Realized Gains and Losses from the Sale of Investments. SOP 05-1 defines an internal replacement as a modification in product benefits, features, rights, or coverages that occurs 60 MetLife, Inc. -

Page 64

..., property type and product type diversification and asset allocation. The Company manages interest rate risk as part of its asset and liability management strategies; product design, such as the use of market value adjustment features and surrender charges; and proactive monitoring and management... -

Page 65

......EQUITY SECURITIES AND OTHER LIMITED PARTNERSHIP INTERESTS Yield(1) ...Investment income ...Investment gains (losses) ...Ending carrying value ...CASH AND SHORT-TERM INVESTMENTS Yield(1) ...Investment income ...Investment gains (losses) ...Ending carrying value ...OTHER INVESTED ASSETS(5)(6) Yield... -

Page 66

..., related to settlement payments on derivatives used to hedge interest rate and currency risk on PABs that do not qualify for hedge accounting. Such amounts are included within interest credited to policyholder account balances. (6) Included in investment gains (losses) from other invested assets... -

Page 67

... ...Foreign corporate securities ...U.S. Treasury/agency securities ...Commercial mortgage-backed securities ...Asset-backed securities ...Foreign government securities ...State and political subdivision securities ...Other fixed maturity securities ...Total fixed maturity securities ...Common stock... -

Page 68

... equities, which are generally carried at cost and trading securities which are carried at fair value with subsequent changes in fair value recognized in net investment income. All securities with gross unrealized losses at the consolidated balance sheet date are subjected to the Company's process... -

Page 69

... are based on current conditions or the Company's need to shift the portfolio to maintain its portfolio management objectives including liquidity needs or duration targets on asset/liability managed portfolios. The Company attempts to anticipate these types of changes and if a sale decision has been... -

Page 70

... Company established a trading securities portfolio to support investment strategies that involve the active and frequent purchase and sale of securities, the execution of short sale agreements and asset and liability matching strategies for certain insurance products. Trading securities and short... -

Page 71

... 12.7% and 12.2% of the Company's total cash and invested assets at December 31, 2006 and 2005, respectively. The carrying value of mortgage and consumer loans is stated at original cost net of repayments, amortization of premiums, accretion of discounts and valuation allowances. The following table... -

Page 72

... mortgage loans as loans in which the Company, for economic or legal reasons related to the debtor's financial difficulties, grants a concession to the debtor that it would not otherwise consider. The Company defines potentially delinquent loans as loans that, in management's opinion, have a high... -

Page 73

...cost and valuation allowances for agricultural mortgage loans distributed by loan classification at: December 31, 2006 Amortized Cost(1) % of Total Valuation Allowance % of Amortized Amortized Cost Cost(1) (In millions) December 31, 2005 % of Total Valuation Allowance % of Amortized Cost Performing... -

Page 74

..., the Company closed the sale of its Peter Cooper Village and Stuyvesant Town properties located in Manhattan, New York for $5.4 billion. The Peter Cooper Village and Stuyvesant Town properties together make up the largest apartment complex in Manhattan, New York totaling over 11,000 units, spread... -

Page 75

..., assets supporting the reinsured policies equal to the net statutory reserves are withheld and continue to be legally owned by the ceding company. Interest accrues to these funds withheld at rates defined by the treaty terms and may be contractually specified or directly related to the investment... -

Page 76

... of equity options are included in options in the preceding table. Credit Risk. The Company may be exposed to credit-related losses in the event of nonperformance by counterparties to derivative financial instruments. Generally, the current credit exposure of the Company's derivative contracts is... -

Page 77

...risk associated with its invested assets and interest rate sensitive insurance contracts. It has developed an integrated process for managing risk, which it conducts through its Corporate Risk Management Department, ALM Committees and additional specialists at the business segment level. The Company... -

Page 78

... Affect Our Profitability" in MetLife, Inc.'s Annual Report on Form 10-K for the year ended December 31, 2006. Each of MetLife's business segments has an asset/liability officer who works with portfolio managers in the investment department to monitor investment, product pricing, hedge strategy and... -

Page 79

... using equity futures and options. Risk Measurement: Sensitivity Analysis The Company measures market risk related to its holdings of invested assets and other financial instruments, including certain market risk sensitive insurance contracts, based on changes in interest rates, equity market prices... -

Page 80

...millions) Assuming a 10% increase in the yield curve Assets Fixed maturity securities ...Equity securities ...Mortgage and consumer loans . . Policy loans ...Short-term investments ...Cash and cash equivalents ...Mortgage loan commitments ...Commitments to fund bank credit ...facilities and bridge... -

Page 81

... the opinion of management, MetLife, Inc. maintained effective internal control over financial reporting as of December 31, 2006. Deloitte & Touche LLP, an independent registered public accounting firm, has audited the consolidated financial statements and consolidated financial statement schedules... -

Page 82

... and an opinion on the effectiveness of the Company's internal control over financial reporting based on our audit. We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to... -

Page 83

Financial Statements INDEX TO CONSOLIDATED FINANCIAL STATEMENTS Page Report of Independent Registered Public Accounting Firm ...Financial Statements at December 31, 2006 and 2005 and for the years ended December 31, 2006, 2005 and 2004: Consolidated Balance Sheets ...Consolidated Statements of ... -

Page 84

... Company's management. Our responsibility is to express an opinion on the consolidated financial statements based on our audits. We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform... -

Page 85

...sale ...Other limited partnership interests ...Short-term investments ...Other invested assets ...Total investments ...Cash and cash equivalents ...Accrued investment income ...Premiums and other receivables ...Deferred policy acquisition costs and Goodwill ...Other assets ...Separate account assets... -

Page 86

...) 2006 2005 2004 Revenues Premiums ...Universal life and investment-type product policy fees Net investment income ...Other revenues ...Net investment gains (losses) ...Expenses Policyholder benefits and claims ...Interest credited to policyholder account Policyholder dividends ...Other expenses... -

Page 87

... Net Benefit Currency Additional Unrealized Treasury Plans Translation Paid-in Retained Stock Investment Capital Earnings at Cost Gains (Losses) Adjustment Adjustment Preferred Common Stock Stock Total Balance at January 1, 2004 ...Treasury stock transactions, net ...Dividends on common stock... -

Page 88

... to policyholder account balances ...Interest credited to bank deposits ...Universal life and investment-type product policy fees ...Change in accrued investment income ...Change in premiums and other receivables ...Change in deferred policy acquisition costs, net ...Change in insurance-related... -

Page 89

... assets disposed ...Plus: equity securities received ...Less: cash disposed ...Business disposition, net of cash disposed ...Contribution of equity securities to MetLife Foundation ...Accrual for stock purchase contracts related to common equity units ...Purchase money mortgage on real estate sale... -

Page 90

... and international subsidiaries and affiliates, MetLife, Inc. offers life insurance, annuities, automobile and homeowners insurance, retail banking and other financial services to individuals, as well as group insurance, reinsurance and retirement & savings products and services to corporations and... -

Page 91

... and information obtained from regulators and rating agencies. The Company purchases and receives beneficial interests in special purpose entities ("SPEs"), which enhance the Company's total return on its investment portfolio principally by providing equity-based returns on debt securities. These... -

Page 92

... from the sale of loans and changes in valuation allowances are reported in net investment gains (losses). Policy Loans. Policy loans are stated at unpaid principal balances. Interest income on such loans is recorded as earned using the contractually agreed upon interest rate. Generally, interest is... -

Page 93

.... To a lesser extent, the Company uses credit derivatives to synthetically replicate investment risks and returns which are not readily available in the cash market. The Company also purchases certain securities, issues certain insurance policies and investment contracts and engages in certain... -

Page 94

... may not be identified and reported at fair value in the consolidated financial statements and that their related changes in fair value could materially affect reported net income. Cash and Cash Equivalents The Company considers all highly liquid investments purchased with an original or remaining... -

Page 95

...policy issue expenses. VOBA is an intangible asset that reflects the estimated fair value of in-force contracts in a life insurance company acquisition and represents the portion of the purchase price that is allocated to the value of the right to receive future cash flows from the business in-force... -

Page 96

...mortality rates guaranteed in calculating the cash surrender values described in such contracts); and (ii) the liability for terminal dividends. Future policy benefits for non-participating traditional life insurance policies are equal to the aggregate of the present value of future benefit payments... -

Page 97

... and are reported in universal life and investment-type product policy fees. These riders may be more costly than expected in volatile or declining markets, causing an increase in liabilities for future policy benefits, negatively affecting net income. The Company periodically reviews its estimates... -

Page 98

... to insurance in-force or, for annuities, the amount of expected future policy benefit payments. Premiums related to non-medical health and disability contracts are recognized on a pro rata basis over the applicable contract term. Deposits related to universal life-type and investment-type products... -

Page 99

... and property and casualty insurance products. For each of its reinsurance contracts, the Company determines if the contract provides indemnification against loss or liability relating to insurance risk in accordance with applicable accounting standards. The Company reviews all contractual features... -

Page 100

... securities, for each account balance. As of December 31, 2006, virtually all the obligations are calculated using the traditional formula. The Subsidiaries also provide certain postemployment benefits and certain postretirement medical and life insurance benefits for retired employees. Employees... -

Page 101

...-based awards and settlement of the stock purchase contracts underlying common equity units is assumed to occur with the proceeds used to purchase common stock at the average market price for the period. See Notes 12, 17 and 19. Litigation Contingencies The Company is a party to a number of legal... -

Page 102

... the cost of all stock-based transactions be measured at fair value and recognized over the period during which a grantee is required to provide goods or services in exchange for the award. The Company had previously adopted the fair value method of accounting for stock-based awards as prescribed... -

Page 103

... of a conversion option should be recognized upon the modification as a discount (or premium) associated with the debt, and an increase (or decrease) in additional paid-in capital. The adoption of EITF 05-7 did not have a material impact on the Company's consolidated financial statements. Effective... -

Page 104

... revenue liability, under certain variable annuity and life contracts and income tax. Certain other contracts sold by the Company provide for a return through periodic crediting rates, surrender adjustments or termination adjustments based on the total return of a contractually referenced pool of... -

Page 105

... No. 97, Accounting and Reporting by Insurance Enterprises for Certain Long-Duration Contracts and for Realized Gains and Losses from the Sale of Investments. SOP 05-1 defines an internal replacement as a modification in product benefits, features, rights, or coverages that occurs by the exchange of... -

Page 106

... of the acquisition, management of the Company increased significantly the size and scale of the Company's core insurance and annuity products and expanded the Company's presence in both the retirement & savings' domestic and international markets. The distribution agreements executed with Citigroup... -

Page 107

... Trusts II and III Acquisition costs ...Purchase price paid to Citigroup ... Total purchase price ...Total uses of funds ...Total purchase price ...Net assets acquired from Travelers ...Adjustments to reflect assets acquired at fair value: Fixed maturity securities available-for-sale ...Mortgage... -

Page 108

... the purchase price that is allocated to the value of the right to receive future cash flows from the life insurance and annuity contracts in force at the acquisition date. VOBA is based on actuarially determined projections, by each block of business, of future policy and contract charges, premiums... -

Page 109

...16 years. CitiStreet Associates was integrated with MetLife Resources, a focused distribution channel of MetLife, which is dedicated to provide retirement plans and financial services to the same markets. See Note 22 for information on the disposition of P.T. Sejahtera ("MetLife Indonesia") and SSRM... -

Page 110

...is not exposed to any significant concentration of credit risk in its fixed maturity securities portfolio. The Company held fixed maturity securities at estimated fair values that were below investment grade or not rated by an independent rating agency that totaled $17.3 billion and $15.2 billion at... -

Page 111

... Total fixed maturity securities ...Equity securities ...Total number of securities in an unrealized loss position ... Aging of Gross Unrealized Loss for Fixed Maturity and Equity Securities Available-for-Sale The following tables present the cost or amortized cost, gross unrealized loss and number... -

Page 112

... are based on current conditions or the Company's need to shift the portfolio to maintain its portfolio management objectives including liquidity needs or duration targets on asset/liability managed portfolios. The Company attempts to anticipate these types of changes and if a sale decision has been... -

Page 113

... by properties primarily located in the United States. At December 31, 2006, 20%, 6% and 6% of the value of the Company's mortgage and consumer loans were located in California, New York and Texas, respectively. Generally, the Company, as the lender, only loans up to 75% of the purchase price of... -

Page 114

METLIFE, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) Mortgage and consumer loans with scheduled payments of 90 days or more past due on which interest is still accruing, had an amortized cost of $15 million and $41 million at December 31, 2006 and 2005, respectively. Mortgage and ... -

Page 115

...'s decision to sell securities based on current conditions or the Company's need to shift the portfolio to maintain its portfolio management objectives. Losses from fixed maturity and equity securities deemed other-than-temporarily impaired, included within net investment gains (losses), were $82... -

Page 116

... Company established a trading securities portfolio to support investment strategies that involve the active and frequent purchase and sale of securities, the execution of short sale agreements and asset and liability matching strategies for certain insurance products. Trading securities and short... -

Page 117

... FINANCIAL STATEMENTS - (Continued) During the years ended December 31, 2006 and 2005, interest and dividends earned on trading securities in addition to the net realized and unrealized gains (losses) recognized on the trading securities and the related short sale agreement liabilities totaled... -

Page 118

... currency amount in exchange for a functional currency amount within a limited time at a contracted price. The contracts may also be net settled in cash, based on differentials in the foreign exchange rate and the strike price. Currency option contracts are included in options in the preceding... -

Page 119

...index options are used by the Company primarily to hedge minimum guarantees embedded in certain variable annuity products offered by the Company. To hedge against adverse changes in equity indices, the Company enters into contracts to sell the equity index within a limited time at a contracted price... -

Page 120

... risk exposure to certain portfolios; (vi) equity futures, equity index options, interest rate futures and equity variance swaps to economically hedge liabilities embedded in certain variable annuity products; (vii) swap spread locks to economically hedge invested assets against the risk of changes... -

Page 121

... Risk The Company may be exposed to credit-related losses in the event of nonperformance by counterparties to derivative financial instruments. Generally, the current credit exposure of the Company's derivative contracts is limited to the fair value at the reporting date. The credit exposure of... -

Page 122

... STATEMENTS - (Continued) 5. Deferred Policy Acquisition Costs and Value of Business Acquired Information regarding DAC and VOBA is as follows: DAC VOBA (In millions) Total Balance at January 1, 2004 ...Capitalizations ...Acquisitions ...Subtotal ...Less: Amortization related to: Net investment... -

Page 123

... rate credited on these contracts were 5.1% at both December 31, 2006 and 2005. Fees charged to the separate accounts by the Company (including mortality charges, policy administration fees and surrender charges) are reflected in the Company's revenues as universal life and investment-type product... -

Page 124

... and improved loss ratios in non-medical health long-term care. Guarantees The Company issues annuity contracts which may include contractual guarantees to the contractholder for: (i) return of no less than total deposits made to the contract less any partial withdrawals ("return of net deposits... -

Page 125

... for guarantees (excluding base policy liabilities) relating to annuity and universal and variable life contracts is as follows: Annuity Contracts Guaranteed Death Benefits Guaranteed Annuitization Benefits Universal and Variable Life Contracts Secondary Guarantees Paid Up Guarantees Total (In... -

Page 126

... 31, 2006, relating to the reinsurance of investment-type contracts held by small market defined contribution plans. 9. Closed Block On April 7, 2000 (the "Demutualization Date"), Metropolitan Life converted from a mutual life insurance company to a stock life insurance company and became a wholly... -

Page 127

... ...Equity securities available-for-sale, at estimated fair value (cost: $1,184 and $1,180, respectively) ...Mortgage loans on real estate ...Policy loans ...Real estate and real estate joint ventures held-for-investment ...Short-term investments ...Other invested assets ...Total investments ...Cash... -

Page 128

... the closed block revenues and expenses is as follows: Years Ended December 31, 2006 2005 2004 (In millions) Revenues Premiums ...Net investment income and other revenues ...Net investment gains (losses) ...Total revenues ...Expenses Policyholder benefits and claims ...Policyholder dividends... -

Page 129

... assets. These costs are being amortized using the effective interest method over the term of the related senior notes. Repurchase Agreements with Federal Home Loan Bank MetLife Bank, National Association ("MetLife Bank" or "MetLife Bank, N.A.") is a member of the Federal Home Loan Bank of New York... -

Page 130

... commitments associated with letters of credit and financing arrangements may expire unused, these amounts do not necessarily reflect the Company's actual future cash funding requirements. 11. Junior Subordinated Debentures Junior Subordinated Debentures Underlying Common Equity Units In connection... -

Page 131

... at an annual rate of 4.82% and 4.91% on the Series A and Series B trust preferred securities, respectively, in payment of any accrued and unpaid distributions. Stock Purchase Contracts Each stock purchase contract requires the holder of the common equity unit to purchase, and the Holding Company to... -

Page 132

... units which fund the Series A and Series B trust preferred securities and $49.5 million relate to the expected issuance of the common stock under the stock purchase contracts. The $5.8 million in debt issuance costs have been capitalized, are included in other assets, and will be amortized using... -

Page 133

... vary by jurisdiction. In 2004, the Company recorded an adjustment of $91 million for the settlement of all federal income tax issues relating to the IRS's audit of the Company's tax returns for the years 1997-1999. Such settlement is reflected in the current year tax expense as an adjustment to... -

Page 134

... consisted of the following: December 31, 2006 2005 (In millions) Deferred income tax assets: Policyholder liabilities and receivables Net operating loss carryforwards ...Employee benefits ...Capital loss carryforwards ...Tax credit carryforwards ...Intangibles ...Litigation-related ...Other... -

Page 135

... against Metropolitan Life and the Holding Company, plaintiffs served a second consolidated amended complaint in 2004. Plaintiffs assert violations of the Securities Act of 1933 and the Securities Exchange Act of 1934 in connection with the Plan, claiming that the Policyholder Information Booklets... -

Page 136

... were known; and (v) the applicable time with respect to filing suit has expired. Since 2002, trial courts in California, Utah, Georgia, New York, Texas, and Ohio have granted motions dismissing claims against Metropolitan Life. Some courts have denied Metropolitan Life's motions to dismiss. There... -

Page 137

... American Life Insurance Company ("General American"), have faced numerous claims, including class action lawsuits, alleging improper marketing and sales of individual life insurance policies or annuities. In addition, claims have been brought relating to the sale of mutual funds and other products... -

Page 138

... by the Office of the Attorney General of the State of New York related to payments to intermediaries in the marketing and sale of group life and disability, group long-term care and group accidental death and dismemberment insurance and related matters. In the settlement, Metropolitan Life did not... -

Page 139

... The Travelers Life and Annuity Company (now known as MetLife Life and Annuity Company of Connecticut ("MLAC")), Travelers Equity Sales, Inc. and certain former affiliates. The amended complaint alleges Travelers Property Casualty Corporation, a former MLAC affiliate, purchased structured settlement... -

Page 140

... above and those otherwise provided for in the Company's consolidated financial statements, have arisen in the course of the Company's business, including, but not limited to, in connection with its activities as an insurer, employer, investor, investment advisor and taxpayer. Further, state... -

Page 141

... in exchange for cash and for which the FHLB of NY has been granted a blanket lien on MetLife Bank's residential mortgages and mortgage-backed securities to collateralize MetLife Bank's obligations under the repurchase agreements. MetLife Bank maintains control over these pledged assets, and may use... -

Page 142

... the applicable plans. Virtually all retirees, or their beneficiaries, contribute a portion of the total cost of postretirement medical benefits. Employees hired after 2003 are not eligible for any employer subsidy for postretirement medical benefits. In connection with the acquisition of Travelers... -

Page 143

METLIFE, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) As described more fully in Note 1, effective December 31, 2006, the Company adopted SFAS 158. The adoption of SFAS 158 required the recognition of the funded status of defined benefit pension and other postretirement plans and ... -

Page 144

...return on plan assets ...Divestitures ...Employer contribution ...Benefits paid ...year ... Fair value of plan assets at end of year ...Funded status at end of year ...Unrecognized net actuarial (gains) losses ...Unrecognized prior service cost (credit) ...Unrecognized net asset at transition ...Net... -

Page 145

... net actuarial losses and prior service credit for the other postretirement plans that will be amortized from accumulated other comprehensive income into net periodic benefit cost over the next year are $14 million and $36 million, respectively. As discussed more fully in Note 1, the Company adopted... -

Page 146

... One Percent Increase Decrease (In millions) Effect on total of service and interest cost components ...Effect of accumulated postretirement benefit obligation ... $ 14 $176 $ (12) $(147) Plan Assets The Subsidiaries have issued group annuity and life insurance contracts supporting approximately... -

Page 147

... made to target allocations based on an assessment of the impact of economic factors and market conditions. Cash Flows It is the Subsidiaries' practice to make contributions to the qualified pension plans to comply with minimum funding requirements of the Employee Retirement Income Security Act of... -

Page 148

... Shares, and any parity stock, have been declared and paid or provided for. The Holding Company is prohibited from declaring dividends on the Preferred Shares if it fails to meet specified capital adequacy, net income and shareholders' equity levels. In addition, under Federal Reserve Board policy... -

Page 149

... the distribution within 30 days of its filing. Under New York State Insurance Law, the Superintendent has broad discretion in determining whether the financial condition of a stock life insurance company would support the payment of such dividends to its shareholders. The New York State Department... -

Page 150

... disapprove the distribution within 30 days of its filing. Under Rhode Island State Insurance Code, the Rhode Island Commissioner has broad discretion in determining whether the financial condition of a stock property and casualty insurance company would support the payment of such dividends to its... -

Page 151

... lattice model over the contractual term of all Stock Options granted in the period. Dividend yield is determined based on historical dividend distributions compared to the price of the underlying common stock as of the valuation date and held constant over the life of the Stock Option. Use of... -

Page 152

... per share data) Net income available to common shareholders ...Add: Stock option-based employee compensation expense included in reported net income, net of income tax ...Deduct: Total stock option-based employee compensation determined under fair value based method for all awards, net of income... -

Page 153

... compensation costs related to Performance Share awards. It is expected that these costs will be recognized over a weighted average period of 1.59 years. Long-Term Performance Compensation Plan Prior to January 1, 2005, the Company granted stock-based compensation to certain members of management... -

Page 154

... acquisition costs to expense as incurred, establishing future policy benefit liabilities using different actuarial assumptions, reporting surplus notes as surplus instead of debt and valuing securities on a different basis. Statutory net income of Metropolitan Life, a New York domiciled insurer... -

Page 155

... 2004 (In millions, except share and per share data) Weighted average common stock outstanding for basic earnings common share ...Incremental common shares from assumed: Stock purchase contracts underlying common equity units . . Exercise or issuance of stock-based awards ... per ... 761,105,024... -

Page 156

... insurance and other financial services with operations throughout the United States and the regions of Latin America, Europe, and Asia Pacific. The Company's business is divided into five operating segments: Institutional, Individual, Auto & Home, International and Reinsurance, as well as Corporate... -

Page 157

... is credited to the segments based on the level of allocated equity. Institutional offers a broad range of group insurance and retirement & savings products and services, including group life insurance, non-medical health insurance, such as short and long-term disability, long-term care, and dental... -

Page 158

...869 Total Statement of Income: Premiums ...Universal life and investment- type product policy fees ...Net investment income ...Other revenues ...Net investment gains (losses) ...Policyholder benefits and claims ...Interest credited to policyholder account balances ...Policyholder dividends ...Other... -

Page 159

... net investment gains (losses) ...Interest expense Institutional ...Individual ...Corporate & Other ...Total interest expense ... $4,795 $ - - - - $146 $ - - 13 $ 13 $ $ In the fourth quarter of 2006, the Company closed the sale of its Peter Cooper Village and Stuyvesant Town properties located... -

Page 160

... of the Company's Asset Management segment. The remaining asset management business, which is insignificant, is reported in Corporate & Other. The Company's discontinued operations for the year ended December 31, 2005 included expenses of $6 million, net of income tax, related to the sale of SSRM... -

Page 161

...-term investments ...Cash and cash equivalents ...Accrued investment income ...Mortgage loan commitments ...Commitments to fund bank credit facilities and bridge loans ...Liabilities: Policyholder account balances ...Short-term debt ...Long-term debt ...Junior subordinated debt securities ...Shares... -

Page 162

...and long-term debt, junior subordinated debt securities , and shares subject to mandatory redemption are determined by discounting expected future cash flows using risk rates currently available for debt with similar terms and remaining maturities. Payables for Collateral Under Securities Loaned and... -

Page 163

... BURWELL Retired Chairman of the Board and Chief Executive Officer, Metropolitan Life Insurance Company Member, Executive Committee and Governance Committee HELENE L. KAPLAN Senior Fellow, The Brookings Institution Chair, Public Responsibility Committee Member, Audit Committee and Sales Practices... -

Page 164

.... The Annual Report on Form 10-K may also be accessed at http://investor.metlife.com and at the website of the U.S. Securities and Exchange Commission at http://www.sec.gov. Dividend Information and Common Stock Performance MetLife Inc.'s common stock is traded on the New York Stock Exchange (NYSE... -

Page 165

... by Section 303A.12(a) of the New York Stock Exchange Listed Company Manual was submitted to the NYSE in 2006. MetLife, Inc. has filed the CEO and CFO Certifications required by Sections 302 and 906 of the Sarbanes-Oxley Act of 2002 as exhibits to its Annual Report on Form 10-K for the year ended... -

Page 166

© 2007 METLIFE, INC. 0609-2245 PEANUTS © United Feature Syndicate, Inc. MetLife, Inc. 200 Park Avenue New York, NY 10166-0188 www.metlife.com