Chrysler 2012 Annual Report Download - page 283

Download and view the complete annual report

Please find page 283 of the 2012 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes

282 Fiat S.p.A.

Statutory

Financial

Statements

at 31 December

2012

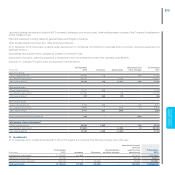

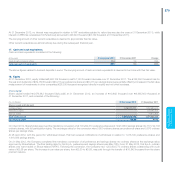

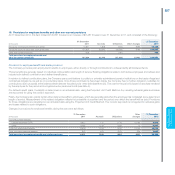

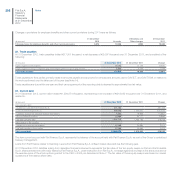

Reserve available for the purchase of own shares

This reserve was created through a transfer from the retained profit reserve, following Shareholder approval for share repurchases.

At 31 December 2012, the reserve available for the purchase of own shares totaled €941,043 thousand, an increase of €29,926 thousand over 31

December 2011 attributable to:

a resolution approved by Shareholders on 4 April 2012, as described below, revoking the existing share repurchase authorization, to the extent not

already exercised, and renewing authorization for the purchase of own shares up to a maximum of €1.2 billion, including existing reserves for own shares

of €259 million. As a consequence, the reserve available for the purchase of own shares was increased €29,960 thousand through a transfer from the

retained profit reserve

transfer of €34 thousand to the reserve for own shares relating to own shares purchased following the conversion of preference and savings shares into

ordinary shares

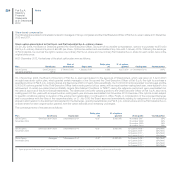

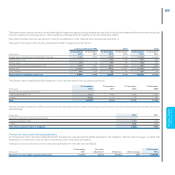

On 4 April 2012, Shareholders renewed the authorization for the purchase and disposal of own shares, including through subsidiaries, while at the same

time revoking the authorization given on 30 March 2011. The renewed authorization was for the purchase of a maximum number of shares, not to exceed

the legally established percentage of share capital or a total value of €1.2 billion, inclusive of the €259 million in own shares already held. The authorization

permitted the Company to purchase preference and savings shares redeemed as a result of shareholders exercising their right of withdrawal in relation

to the conversion. As announced, the buy-back program is currently on hold and buy-backs are not obligatory under the authorization. The buy-back

authorization is valid for a period of 18 months and any buy-backs must be executed in the manner established by law and at a price which is within 10%

of the reference price published by Borsa Italiana on the date prior to the purchase.

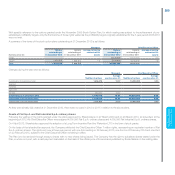

Finally, on 20 February 2013, the Board of Directors voted to submit a proposal to Shareholders to renew, for a period of 18 months, the authorization to

purchase a maximum number of shares not to exceed the legally-established percentage of share capital or an aggregate amount of €1.2 billion, inclusive

of the existing reserve for own shares of €259 million. The authorization is intended to ensure coverage of incentive plans based on Fiat S.p.A. shares, in

addition, more generally, to providing the Company a strategic investment opportunity for other purposes permitted by law.

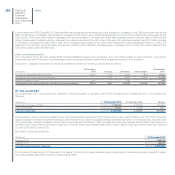

Reserve for own shares

At 31 December 2012, the reserve for own shares totaled €258,957 thousand, a decrease of €29,926 thousand over 31 December 2011. The reserve is

subject to certain restrictions imposed by Article 2357-ter of the Civil Code and changes for the period were as follows:

a decrease of €29,960 thousand following the assignment of 4,000,000 own shares to the Chief Executive Officer in January 2012 upon vesting of rights

under the 2009 stock grant plan, net of

an increase of €34 thousand for the transfer from the reserve available for purchase of own shares related to the own shares acquired following the

conversion of preference and savings shares into ordinary shares

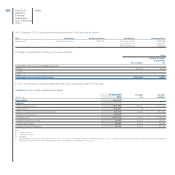

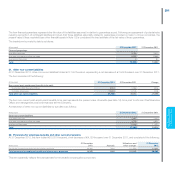

Retained profit

At 31 December 2012, retained profit totaled €1,910,973 thousand, an increase of €37,891 thousand over 31 December 2011 resulting from:

an increase of €13,209 thousand, representing the fair value of rights on Fiat S.p.A. shares, through the transfer from the stock option reserve related to

the 4,000,000 shares granted to the Chief Executive Officer in January 2012 for rights vested under the 2009 stock grant plan

an increase of €54,452 thousand, representing the allocation of prior year’s profit approved by Shareholders on 4 April 2012, following allocations to the

Legal reserve and dividend distributions

a decrease of €29,960 thousand, representing the transfer to the reserve available for the purchase of own shares, pursuant to the renewed authorization

from Shareholders on 4 April 2012, as described above

an increase following the transfer of €190 thousand from the stock option reserve, which represented the fair value of options on Fiat S.p.A. shares

expiring during the year in relation to the November 2006 stock option plan for managers