Chrysler 2012 Annual Report Download - page 186

Download and view the complete annual report

Please find page 186 of the 2012 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

185

Consolidated

Financial Statements

at 31 December 2012

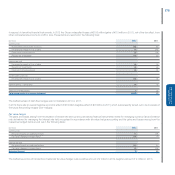

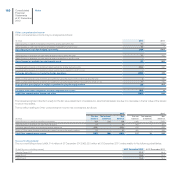

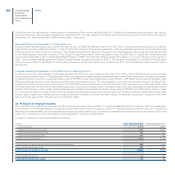

Provisions for employee benefits consist of the benefits which will be provided after the completion of employment such as pensions, health care and life

insurance plans and the benefits which will be provided during an employee’s working life.

The Group provides post-employment benefits for their active employees and retirees. The way these benefits are provided varies according to the legal,

fiscal and economic conditions of each country in which the Group operates and may change periodically. The plans are classified by the Group on the

basis of the type of benefit provided as follows: Pension benefits, health care and life insurance plans, Reserve for Employee leaving entitlements in Italy

(TFR) and Other post-employment benefits.

Moreover, Group companies additionally provide post-employment benefits under defined contribution plans. In this case, the Group pays contributions

to public or private pension insurance plans on a legally mandatory, contractual, or voluntary basis, and by paying these contributions the Group fulfils

all of its obligations. The Group recognises the cost for defined contribution plans over the period in which the employee renders service and classifies

this by function in Cost of sales, Selling, general and administrative costs and Research and development costs. In 2012 this costs totalled €807 million

(€938 million in 2011).

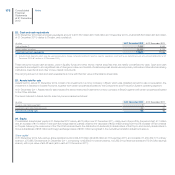

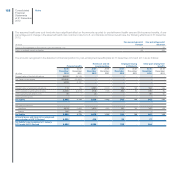

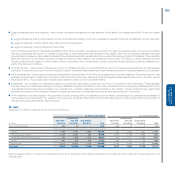

Pension benefits

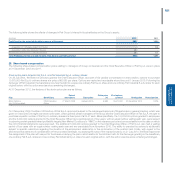

Group companies sponsor both non-contributory and contributory defined benefit pension plans. The non-contributory pension plans cover certain

employees (hourly and salaried) primarily in the United States, Canada and Mexico and certain employees and retirees in the UK. Benefits are based on a

fixed rate for each year of service. Additionally, contributory benefits are provided to certain salaried employees under the salaried employees’ retirement

plans. These plans provide benefits based on the employee’s cumulative contributions, years of service during which the employee contributions were made

and the employee’s average salary during the five consecutive years in which the employee’s salary was highest in the fifteen years preceding retirement.

Liabilities arising from these plans are usually funded by contributions made by the employer and, at times by the employees, into a separate company or

fund which independently administers the plan assets and from which the employee benefits are paid. The Group’s funding policy is to contribute amounts

to the plan equal to the amounts required to satisfy the minimum funding requirements prescribed by the laws and regulations of each individual country.

Prudently, the Group makes discretionary contributions in addition to the funding requirements. If these funds are overfunded, that is if they present a surplus

compared to the requirements of law, the Group companies concerned may not be required to contribute to the plan as long as the fund is in surplus.

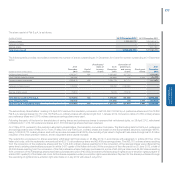

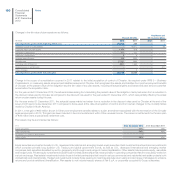

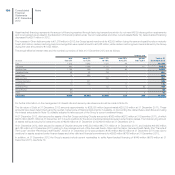

The investment strategies and objectives for pension assets reflect a balance of liability hedging and return-seeking investment consideration. The investment

objectives are to minimize the volatility of the value of the pension assets relative to pension liabilities and to ensure pension assets are sufficient to pay plan

obligations. The objective of minimizing the volatility of assets relative to liabilities is addressed primarily through asset diversification, partial asset−liability

matching and hedging. Assets are broadly diversified across many asset classes to achieve risk−adjusted returns that, in total, lower asset volatility relative

to the liabilities. Additionally, in order to minimize pension asset volatility relative to the pension liabilities, a portion of the pension plan assets are generally

allocated to fixed income investments.

Assets are actively managed, primarily, by external investment managers. Investment managers are not permitted to invest outside of the asset class or

strategy for which they have been appointed. The Group uses investment guidelines to ensure investment managers invest solely within the mandated

investment strategy. Certain investment managers use derivative financial instruments to mitigate the risk of changes in interest rates and foreign currencies

impacting the fair values of certain investments. Derivative financial instruments may also be used in place of physical securities when it is more cost effective

and/or efficient to do so.

Sources of potential risk in the pension plan assets relate to market risk, interest rate risk and operating risk. Market risk is mitigated by diversification

strategies and as a result, there are no significant concentrations of risk in terms of sector, industry, geography, market capitalization, or counterparty.

Interest rate risk is mitigated by partial asset−liability matching. The fixed income target asset allocation partially matches the bond−like and long−dated

nature of the pension liabilities. Interest rate increases generally will result in a decline in fixed income assets while reducing the present value of the liabilities.

Conversely, interest rate decreases generally will increase fixed income assets, partially offsetting the related increase in the liabilities.

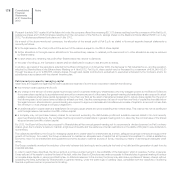

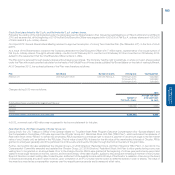

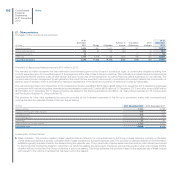

In the United Kingdom, the Group participates amongst others in a pension plan financed by various entities belonging to the Group, called the “Fiat Group

Pension Scheme”. Under this plan, participating employers make contributions on behalf of their active employees, retirees, and employees who have left

the Group but have not yet retired.