Chrysler 2012 Annual Report Download - page 204

Download and view the complete annual report

Please find page 204 of the 2012 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

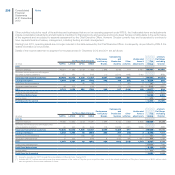

203

Consolidated

Financial Statements

at 31 December 2012

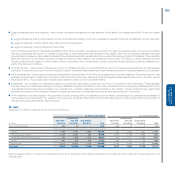

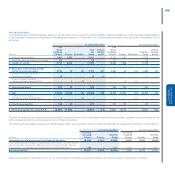

Other commitments and important contractual rights

The Group has important commitments and rights deriving from outstanding agreements, summarised in the following.

Teksid

Fiat S.p.A. is subject to a put contract with Renault in reference to the original investment of 33.5% in Teksid, now 15.2%. In particular, Renault would

acquire the right to exercise a sale option to Fiat on its interest in Teksid, in the following cases:

in the event of non-fulfilment in the application of the protocol of the agreement and admission to receivership or any other redressement procedure;

in the event Renault’s investment in Teksid falls below 15% or Teksid decides to invest in a structural manner outside the foundry sector;

should Fiat be the object of the acquisition of control by another car manufacturer.

The exercise price of the option is established as follows:

for the original 6.5% of the share capital of Teksid, the initial investment price as increased by a given interest rate;

for the remaining amount of share capital of Teksid, the share of the accounting net equity at the exercise date.

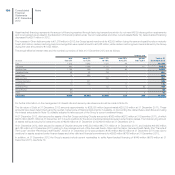

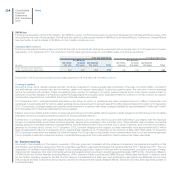

Chrysler

As a result of the occurrence of the Ecological Event in early January 2012, at the date of this Annual report, Fiat holds a 58.5% membership interest in

Chrysler; the remaining 41.5% is held by the VEBA Trust, the fund that provides certain health benefits to former employees of Chrysler. In addition Fiat

is the holder of the VEBA Trust Call Option, pursuant to which it is entitled to acquire 40% of the membership interests currently held by the VEBA Trust,

provided that Fiat is entitled to purchase no more than 8% of such membership interests in any six-month period. This option may be exercised from 1

July 2012 to 30 June 2016. For the VEBA Trust Call Option, prior to a Chrysler IPO the exercise price is determined using a defined market-based multiple

(the average multiple of a basket of certain automotive manufacturers, not to exceed the trading multiple for Fiat) applied to Chrysler’s EBITDA for the

four most recent quarters less Chrysler’s net industrial debt. If there has been a Chrysler IPO, the price is to be based on the trading price for Chrysler’s

ordinary shares. On 3 July 2012, Fiat notified VEBA of Fiat’s exercise of its option to purchase a portion of VEBA’s ownership interest in Chrysler. That

tranche represents approximately 3.3% of Chrysler’s outstanding equity. On 26 September 2012, Fiat announced that Fiat North America (a wholly-owned

subsidiary) was seeking a declaratory judgment from the Delaware Court of Chancery to confirm the price to be paid for the stake, since the parties had

not reached an agreement on the purchase price. On 3 January 2013, Fiat notified VEBA of its exercise of its option to purchase a second tranche of the

interest held in Chrysler Group LLC by VEBA, representing approximately 3.3% of Chrysler’s outstanding equity. In the event the transactions are completed

as contemplated, Fiat will hold 65.17% of the outstanding equity in Chrysler.

In addition, on 21 July 2011 the U.S. Treasury assigned Fiat its rights under the Equity Recapture Agreement. The Equity Recapture Agreement provides

Fiat the rights to the economic benefit associated with the membership interests held by the VEBA Trust once the VEBA Trust receives proceeds, including

certain distributions, in excess of $4.25 billion plus interest of 9% per annum from 1 January 2010 (“Threshold Amount”). Once the VEBA Trust receives

the Threshold Amount, any additional proceeds payable to the VEBA trust for Chrysler membership interest and any membership interest retained by the

VEBA Trust are to be transferred to Fiat for no further consideration. In addition, Fiat has the right to acquire VEBA Trust’s entire membership interest in

Chrysler at a price equivalent to the specified Threshold Amount, less any proceeds already received by the VEBA Trust on that interest. These rights have

been recognised in the Group’s Statement of Financial Position at €57 million ($75 million).

If the VEBA Trust seeks to transfer its membership interests, it must provide notice to Fiat and Fiat will have an irrevocable non−transferable first option to

purchase all or a portion of the offered securities at the same price and on the same terms and conditions as those negotiated by the VEBA Trust.

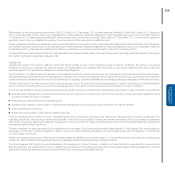

In accordance with paragraph AG81 of IAS 39 – Financial Instruments: recognition and measurement, both of options and rights have been recognised in

the Consolidated financial statements at cost, since (i) the variability in the range of reasonable fair value estimates is significant for these instruments and (ii)

the probabilities that are used to weight the various estimates in the range of fair values cannot be reasonably established and used in estimating fair value.