Chrysler 2012 Annual Report Download - page 184

Download and view the complete annual report

Please find page 184 of the 2012 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341 -

342

342 -

343

343 -

344

344 -

345

345 -

346

346

|

|

183

Consolidated

Financial Statements

at 31 December 2012

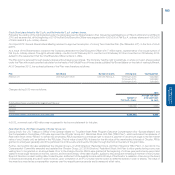

Stock Grant plans linked to Fiat S.p.A. and Fiat Industrial S.p.A ordinary shares.

Following the vesting of the rights granted under the plans approved by Shareholders in their Annual General Meeting on 27 March 2009 and on 26 March

2010 and as amended, at the beginning of 2012 the Fiat Chief Executive Officer was assigned with 4,000,000 of Fiat S.p.A. ordinary shares and 4,000,000

of Fiat Industrial S.p.A. ordinary shares.

On 4 April 2012, General Shareholders Meeting resolved to approve the adoption of a Long Term Incentive Plan (the “Retention LTI”), in the form of stock

grants.

As a result of the Shareholders’ resolution the Company attributed the Chief Executive Officer with 7 million rights, representative of an equal number of

Fiat S.p.A. ordinary shares. The rights will vest ratably, one third on 22 February 2013, one third on 22 February 2014 and one third on 22 February 2015,

subject to the requirement that the Chief Executive Officer remains in office.

The Plan is to be serviced through treasury shares without issuing new shares. The Company has the right to substitute, in whole or in part, shares vested

under the Plan with a cash payment calculated on the basis of the Official Price of those shares published by Borsa Italiana on the date of vesting fulfilment.

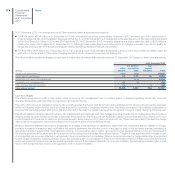

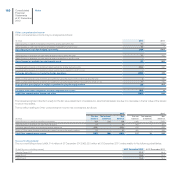

At 31 December 2012, the contractual terms of the Plan were therefore as follows:

Plan Beneficiary Number of shares Vesting date Vesting portion

Retention LTI Chief Executive Officer 7,000,000 Fiat S.p.A. 22 February 2013

22 February 2014

22 February 2015

2,333,333

2,333,333

2,333,333

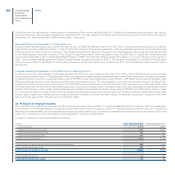

Changes during 2012 were as follows:

2012

Number of

Fiat S.p.A. shares

Average Fair value

at the grant date

(in euro)

Outstanding shares unvested at the beginning of the year - -

Granted 7,000,000 4.205

Forfeited - -

Vested - -

Outstanding shares unvested at the end of the year 7,000,000 4.205

In 2012, a nominal cost of €9 million was recognised in the income statement for this plan.

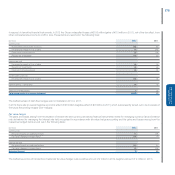

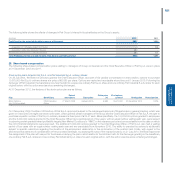

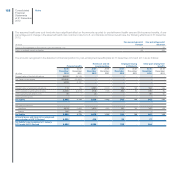

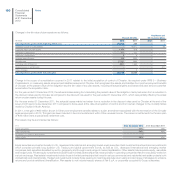

Restricted Stock Unit Plans issued by Chrysler Group LLC

During 2009, the U.S. Treasury’s Office of the Special Master for Troubled Asset Relief Program Executive Compensation (the “Special Master”) and

the Compensation Committee of Chrysler approved the Chrysler Group LLC Restricted Stock Unit Plan (“RSU Plan”), which authorised the issuance of

Restricted Stock Units (“RSUs”) to certain key employees. RSUs represent a contractual right to receive a payment in an amount equal to the fair market

value of one Chrysler unit, as defined in the RSU plan. The fair value of each RSU is based on the fair value of the membership interests of Chrysler. RSUs

granted to employees generally vest if the participant is continuously employed by Chrysler through the third anniversary of the grant date.

Further, during 2009 Chrysler established the Chrysler Group LLC 2009 Directors’ Restricted Stock Unit Plan (“Directors’ RSU Plan”). In April 2012, the

Compensation Committee amended and restated the Chrysler Group LLC 2009 Directors’ Restricted Stock Unit Plan to allow grants having a one year

vesting term to be granted on an annual basis. Prior to the change, Director RSUs were granted at the beginning of a three-year performance period and

vested in three equal tranches on the first, second, and third anniversary of the date of grant, subject to the participant remaining a member of the Chrysler

Board of Directors on each vesting date. Under the plan, settlement of the awards is made within 60 days of the Director’s cessation of service on the board

of directors and awards are paid in cash; however, upon completion of an IPO, Chrysler has the option to settle the awards in cash or shares. The value of

the awards is recorded as compensation expense over the requisite service periods and is measured at fair value.