Chrysler 2012 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2012 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes

142 Consolidated

Financial

Statements

at 31 December

2012

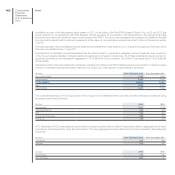

Pension plans and other post-retirement benefits

Employee benefit liabilities together with the related assets, costs and net interest expense are measured on an actuarial basis which

requires the use of estimates and assumptions to determine the net liability or net asset. The actuarial method takes into consideration

parameters of a financial nature such as the discount rate and the expected long term rate of return on plan assets, the rates of salary

increases and the rates of health care cost increases and the likelihood of potential future events estimated by using demographic

assumptions such as mortality rates, dismissal and retirement rates.

In particular, the discount rates selected are based on yield curves of high quality corporate bonds in the relevant market. The expected

returns on plan assets are determined considering various inputs from a range of advisors concerning long-term capital market returns,

inflation, current bond yields and other variables, adjusted for any specific aspects of the asset investment strategy. Rates of salary

increases reflect the Group’s long-term actual expectation in the reference market and inflation trends. Trends in health care costs are

developed on the basis of historical experience, the near-term outlook for costs and likely long-term trends. Changes in any of these

assumptions may have an effect on future contributions to the plans.

As a result of adopting the corridor method for the recognition of the actuarial gains and losses arising from the valuation of employee

benefit liabilities and assets (see the above paragraph - Employee benefits), the effects resulting from revising the estimates of the

above parameters are not recognised in the statement of financial position and income statement when they arise. The disclosure of

the effects of changes in estimates is discussed in Note 26.

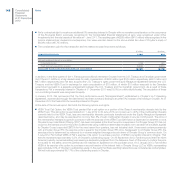

Allowance for obsolete and slow-moving inventory

The allowance for obsolete and slow-moving inventory reflects management’s estimate of the loss in value expected by the Group, and

has been determined on the basis of past experience and historical and expected future trends in the used vehicle market. A worsening

of the economic and financial situation could cause a further deterioration in conditions in the used vehicle market compared to that

already taken into consideration in calculating the allowances recognised in the financial statements.

Incentives

The Group recognises the estimated cost of sales allowances in the form of dealer and customer incentives as a reduction of revenue at

the moment revenue is recognised and later if new or changed incentives are subsequently announced to dealers . There are numerous

types of incentives used in the Group, and these change frequently in response to market conditions; for this reason several factors

are used to estimate the amount of incentives and a change in any one of these factors could have a significant effect on the amount

of revenue recognised.

Product warranties

The Group makes provisions for estimated expenses related to product warranties at the time products are sold. The estimate of the

provision is based on historical information concerning the nature, frequency and average cost of warranty claims. The Group seeks to

improve vehicle quality and minimise warranty expenses arising from claims.

Contingent liabilities

The Group makes a provision for pending disputes and legal proceedings when it is considered probable that there will be an outflow of

funds and when the amount of the losses arising from such can be reasonably estimated. If an outflow of funds becomes possible but

the amount cannot be estimated, the matter is disclosed in the notes. The Group is the subject of legal and tax proceedings covering

a range of matters which are pending in various jurisdictions. Due to the uncertainty inherent in such matters, it is difficult to predict the

outflow of funds which will result from such disputes with any certainty. Moreover, the cases and claims against the Group often derive

from complex and difficult legal issues which are subject to a different degree of uncertainty, including the facts and circumstances of

each particular case, the jurisdiction and the different laws involved. In the normal course of business, the Group monitors the status

of pending legal procedures and consults with legal counsel and experts on legal and tax matters. It is therefore possible that the

provisions for the Group’s legal proceedings and litigation may vary as the result of future developments of the proceedings in progress.