Chrysler 2012 Annual Report Download - page 210

Download and view the complete annual report

Please find page 210 of the 2012 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

209

Consolidated

Financial Statements

at 31 December 2012

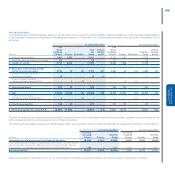

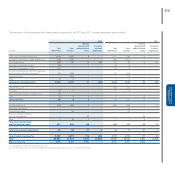

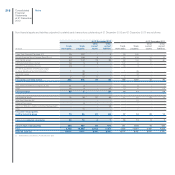

Receivables for financing activities amounting to €3,727 million at 31 December 2012 contain balances totalling €7 million (€5 million at 31 December

2011), which have been written down on an individual basis. Of the remainder, balances totalling €107 million are past due by up to one month (€70 million at

31 December 2011), while balances totalling €62 million are past due by more than one month (€62 million at 31 December 2011). In the event of instalment

payments, even if only one instalment is overdue, the whole amount of the receivable is classified as such.

Trade receivables and Other receivables amounting to €4,478 million at 31 December 2012 contain balances totalling €39 million (€78 million at 31 December

2011) which have been written down on an individual basis. Of the remainder, balances totalling €216 million are past due by up to one month (€314 million at

31 December 2011), while balances totalling €307 million are past due by more than one month (€313 million at 31 December 2011).

Provided that Current securities and Cash and cash equivalents are measured at fair value, there was no exposure to sovereign debt securities at 31 December

2011 which might lead to significant repayment risk.

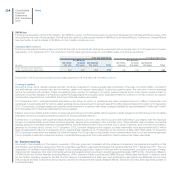

Liquidity risk

Liquidity risk arises if the Group is unable to obtain the funds needed to carry out its operations under economic conditions. Any actual or perceived

limitations on the Group’s liquidity may affect the ability of counterparties to do business with the Group or may require additional amounts of cash and

cash equivalents to be allocated as collateral for outstanding obligations.

The continuation of a difficult economic situation in the markets in which the Group operates and the uncertainties that characterise the financial markets,

necessitate giving special attention to the management of liquidity risk. In that sense measures taken to generate funds through operations and to maintain a

conservative level of available liquidity are an important factor for ensuring operational flexibility and addressing strategic challenges over the next few years.

The two main factors that determine the Group’s liquidity situation are on the one hand the funds generated by or used in operating and investing activities

and on the other the debt lending period and its renewal features or the liquidity of the funds employed and market terms and conditions.

The Group has adopted a series of policies and procedures whose purpose is to optimise the management of funds and to reduce liquidity risk as follows:

centralising the management of receipts and payments, where it may be economical in the context of the local civil, currency and fiscal regulations of the

countries in which the Group is present;

maintaining a conservative level of available liquidity;

diversifying the means by which funds are obtained and maintaining a continuous and active presence in the capital markets;

obtaining adequate credit lines;

monitoring future liquidity on the basis of business planning.

From an operating point of view the Group manages liquidity risk by monitoring cash flows and keeping an adequate level of funds at its disposal. The

operating cash flows, main funding operations and liquidity of the Fiat Group excluding Chrysler are centrally managed in the Group’s treasury companies

with the aim of ensuring effective and efficient management of the Group’s funds. These companies obtain funds on the financial markets by means which

may assume different technical forms.

Chrysler manages the cash generated by its operations and coverage of its funding requirements independently. In this respect Fiat has pledged no

guarantee, commitment or similar obligation in relation to any of Chrysler’s financing obligations, nor has it assumed any kind of obligation or commitment

to fund Chrysler in the future.

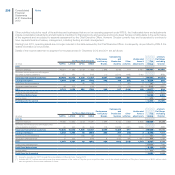

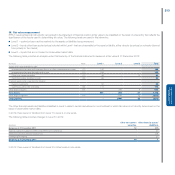

Details of the repayment structure of the Group’s financial assets and liabilities are provided in Note 19 - Current Receivables and Other current assets and

in Note 28 - Debt. Details of the repayment structure of derivative financial instruments are provided in Note 21.

The Group believes that the funds currently available to the treasuries of Fiat and Chrysler, in addition to those that will be generated from operating and

financing activities, will enable the Fiat Group to satisfy the requirements of its investing activities and working capital needs, fulfil its obligations to repay its

debt at the natural due dates and ensure an appropriate level of operating and strategic flexibility.