Chrysler 2012 Annual Report Download - page 262

Download and view the complete annual report

Please find page 262 of the 2012 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

261

Fiat S.p.A. - Statutory

Financial Statements

at 31 December 2012

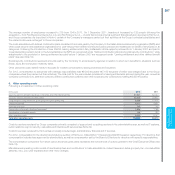

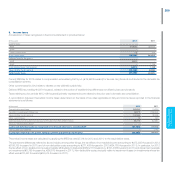

Current and deferred income taxes and liabilities are offset when there is a legal right to do so. Deferred tax assets and liabilities are

measured at the tax rates that are expected to apply to the period when the temporary difference is reversed.

Fiat S.p.A. and almost all its Italian subsidiaries elected to take part in the domestic tax consolidation program pursuant to Articles 117/129

of Presidential Decree 917/1986 for a three-year period beginning in 2004. The election was renewed in 2007 and again in 2010, on both

occasions for a minimum three-year period.

Under the program, Fiat S.p.A. is the consolidating company and calculates a single taxable base for the group of companies taking

part, enabling benefits from offsetting taxable income and tax losses in a combined tax return. Each company participating in the

consolidation transfers its taxable income or tax loss to the consolidating company. Fiat S.p.A. recognizes a receivable for companies

contributing taxable income, corresponding to the amount of IRES (corporate income tax) payable on their behalf. For companies

contributing a tax loss, Fiat S.p.A. recognizes a payable for the amount of the loss actually set off at group level.

Dividends payable

Dividends payable are recognized as changes in equity in the period in which they are approved by Shareholders.

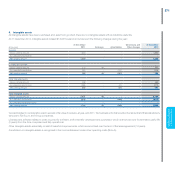

Use of estimates

The stand-alone company financial statements are prepared in accordance with IFRS which require the use of estimates, judgments

and assumptions that affect the carrying amount of assets and liabilities, the disclosures relating to contingent assets and liabilities and

the amounts of income and expense reported for the period.

The estimates and associated assumptions are based on elements that are known when the financial statements are prepared, on

historical experience and on any other factors that are considered to be relevant.

In this respect, the situation caused by the persisting difficulties of the economic and financial environment in the Euro-zone led

to the need to make assumptions regarding future performance which are characterized by significant levels of uncertainty; as a

consequence, therefore, it cannot be excluded that actual future results may differ from these estimates, and therefore give rise

to adjustments to book values in future periods, which may be significant, and which at the present moment can clearly neither be

estimated nor predicted. The line item most impacted by the use of estimates is “Investments in subsidiaries and associates” (non-

current assets), where estimates are used in determining impairment losses and reversals. No particular reliance was placed on the

use of estimates and no future significant issues are expected regarding the recognition of employee benefits, taxes or provisions, also

taking into account their relatively minor book values.

The use of estimates had a significant impact in the determination of the carrying amount of Fiat Group Automobiles S.p.A. (FGA) which

represents a substantial portion of the total “Investments in subsidiaries and associates”. For this purpose, measurement was based

on FGA’s estimated “value in use”, which took into consideration the expected performance for 2013 and 2014 consistent with the

updated financial plan communicated on 30 October 2012. The assumptions and results are also consistent with information provided in

“Subsequent Events and Outlook” (Report on Operations). For the forecasts for subsequent years, prudent assumptions have been made

considering the persistent difficult and uncertain trading environment. Future expected results also consider the effects of the process for

the continuing strategic realignment of the manufacturing and commercial activities of Fiat with those of Chrysler, which accelerated from

2011 following the acquisition of the control of Chrysler, and which is progressing in line with expectations. Given the strategy announced

on 30 October 2012, to redeploy the industrial assets in EMEA to produce a renewed product portfolio focused on upper-end segments

and international brands, it was considered reasonable to use cash flow projections for the period up to 2018. Given its current negative

equity position and loan covenants restricting dividend distributions, the contribution from Chrysler was taken into account only from 2017.

The normalized cash flow used for calculation of the terminal value was based on a weighted average of the expected contributions

from each geographic market, which take into account the cyclicality and maturity of the auto business in each market. The estimate

of terminal value assumes a long-term growth rate of zero.