Chrysler 2012 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2012 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10 Letter from

the Chairman

and the Chief

Executive Officer

We capitalized on good trading conditions, particularly in the second semester of the year, and outperformed the market, closing the year with the highest

volumes ever recorded in Fiat’s long and successful history in Latin America.

In Brazil, we gained a full percentage point in market share, further strengthening the leadership position that we have now held for 11 years.

In APAC, we turned in a very strong performance on the back of higher demand in almost all our key markets, with revenues up 50% and trading profit

nearly double the prior year’s level.

In China, we opened a new plant in Changsha and began local production of the Fiat Viaggio, representing just the first step in our plans for development

in the world’s largest car market.

In India, we undertook several initiatives to strengthen our presence, including establishment of a new Group-owned distribution company to take over

direct management of our commercial activities and reorganize the dealer network.

Those results were possible because of what Fiat and Chrysler are today.

A strong, competitive group that possesses some of the most innovative technologies and one of the most extensive product ranges in the world.

A flexible yet cohesive group, solid enough to cope with any unexpected changes in market conditions and with a global footprint reducing the risk of over-

dependency on any one single market or region.

A group that draws its strength from the diversity of talent, experience and culture of its people – individuals working towards the future every day with the

determination that marks them as leaders.

We closed 2012 with a sense of accomplishment for the milestones reached and the platform they give us for the next phase of development.

At the same time, we have retained our sense of urgency, because we know it is just the beginning.

In Europe, we have partially reoriented our strategy in response to current market difficulties and trends in customer demand and preferences.

As announced on 30 October 2012, we plan to leverage the potential of our luxury and performance businesses to expand into the more profitable premium

end of the market and increasingly utilize the Group’s EMEA production base to develop our global brands, Alfa Romeo, Maserati, Jeep and the Fiat pillar

vehicles derived from the 500 “family” and the Panda.

This strategic path is open to us not only because of the prestige and quality associated with Group brands such as Ferrari, Maserati and Alfa Romeo, but

also because of the transformation that Fiat has undergone as a result of its alliance with Chrysler.

Over the past three years, the sharing of technical know-how has enabled us to develop relevant architectures and baseline powertrains that allow us to

be at the cutting edge of the premium end of the business and to shift a significant portion of our product portfolio towards better margin opportunities.

Our increased global reach provides the opportunity to utilize some of our excess production capacity in Europe to service export markets outside Europe.

That will enable us to redeploy the current production overcapacity from the mass-market segment and achieve breakeven in Europe by 2015-2016.

This process just kicked-off with the start of production of the New Maserati Quattroporte at the Avv. Giovanni Agnelli plant (Grugliasco), which will

be followed by the Maserati Ghibli in the summer of 2013. Investments have already started at the Melfi plant to install a new modular architecture for

production of the Fiat 500X and a new Jeep brand Sport Utility Vehicle, both destined for global markets in 2014.

In other regions, our efforts will focus on strengthening the business and expanding our geographic presence.

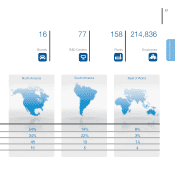

In NAFTA, we have established an ambitious product plan, with the launch of over 50 all-new or significantly refreshed models during the 2012-16 period.

In LATAM, our priority is to build on our leadership position through greater diversification of our product offering, while maintaining strong profitability. Our

future plans include development of the new industrial complex in Pernambuco, which is projected to reach a production between 200,000 and 250,000

vehicles per year and will also allow the extension of the Group’s product range into growing segments of the market.

In APAC, we have positioned ourselves to benefit from growing market demand, including continuing to capitalize on the success already achieved by the

Jeep brand whose sales nearly double in 2012 over the prior year and accounted for 64% of total Group sales in the region. In China, we are developing

our distribution capability and expect to double the number of dealers by the end of 2013. In India, we are also expanding our independent dealer network.