Chrysler 2012 Annual Report Download - page 276

Download and view the complete annual report

Please find page 276 of the 2012 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

275

Fiat S.p.A. - Statutory

Financial Statements

at 31 December 2012

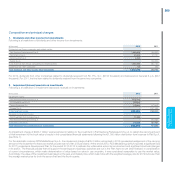

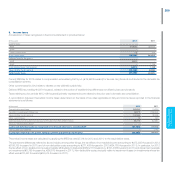

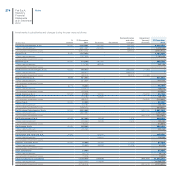

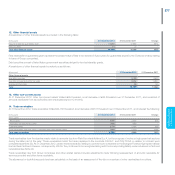

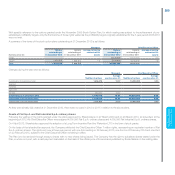

Significant changes to investments in subsidiaries during the year were as follows:

as part of the industrial reorganization aimed at consolidating the “passenger & light commercial vehicle” powertrain activities under the subsidiary Fiat

Group Automobiles S.p.A. (FGA), Fiat S.p.A. transferred, as a contribution to capital, its 100% shareholding in Fiat Powertrain Technologies S.p.A.

to FGA. Given that the transaction involved companies under the direct control of Fiat S.p.A., recognition was based on book values. Accordingly,

the increase in the investment in Fiat Group Automobiles S.p.A., totaling €590 million, corresponds to the carrying amount of the shareholding

transferred, net of accumulated impairment losses which were also transferred. As described in Note 2, there was a partial reversal of impairment

losses (€21.1 million) prior to the transfer

capital contributions were made to certain subsidiaries to strengthen their capital base in view of operating results. The capital contributions related to

Fiat Group Automobiles S.p.A. (€200.0 million), Maserati S.p.A. (€180.0 million), Editrice La Stampa S.p.A. (€39.0 million) and Teksid Aluminum S.r.l.

(€25.0 million)

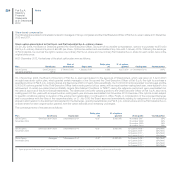

as part of an overall corporate rationalization of publishing activities, the following operations were undertaken:

merger of Itedi – Italiana Edizioni S.p.A. (a direct subsidiary of Fiat S.p.A.) with and into its subsidiary Editrice La Stampa S.p.A.

demerger of activities from Editrice La Stampa S.p.A. and transfer to Fiat Partecipazioni S.p.A.

As these transactions involved companies under the direct control of Fiat S.p.A., recognition was based on book values. Accordingly, the investment

in Editrice La Stampa S.p.A. was recognized at the same amount as the previous shareholding in Itedi – Italiana Edizioni S.p.A., while the €7.5 million

increase in the investment in Fiat Partecipazioni S.p.A. corresponds to the carrying amount of the assets and liabilities transferred from Editrice La Stampa

S.p.A., determined on a pro rata basis with reference to the book value of equity reported in the subsidiary’s financial statements for the year ended

31 December 2012.

The other increases related to the acquisition from Fiat Group Automobiles S.p.A. of the residual 3.29% holding in Fiat Partecipazioni S.p.A. (€15.3 million)

and the acquisition from Fiat Finance S.p.A. of its 40% stake in Fiat Finance and Trade Ltd. S.A. (€115.5 million)

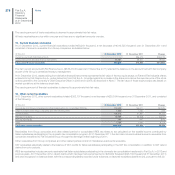

Impairment (losses)/reversals includes impairment losses and reversals arising from application of the cost method, as described in Note 2 above.

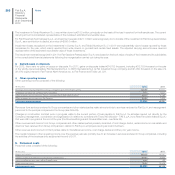

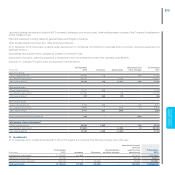

With regard to the shareholding in Fiat Group Automobiles S.p.A., the estimates and assumptions used in preparing the financial statements (see “Use of

Estimates”) provided reasonable support for maintaining the 31 December 2011 carrying amount, increased by the capital contribution and book value of

the investment in Fiat Powertrain Technologies S.p.A. transferred in 2012, as described above. The current book value of the shareholding in Fiat Group

Automobiles S.p.A. (€6,314 million at 31 December 2012) reflects impairment losses of €2,966 million, recognized prior to 2005 and again in 2009, that

could potentially be reversed in future periods.

Recoverability of the investment in Editrice La Stampa – recognized at a carrying amount of approximately €57 million – was analyzed on the basis of its

business plan and the nature of specific assets, in particular the newspaper La Stampa, as well as its positioning in the publishing sector in Italy. Based

on the assumptions and estimates made, the carrying amount of the investment at 31 December 2012 was deemed lower than the recoverable amount.

For the remaining significant shareholdings – in particular, Magneti Marelli S.p.A. and Ferrari S.p.A. (recognized at historic cost) – no indications of

impairment were identified. This also takes into consideration the carrying amounts of equity recognized in the consolidated statement of financial position,

for which the recoverability of assets has already been adequately assessed.

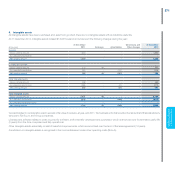

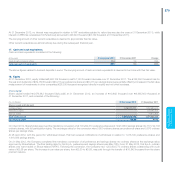

A breakdown of investments in associates and changes during the year is as follows:

(€ thousand)

%

interest

31 December

2011 Increases Decreases

Impairment (losses)/

reversals

31 December

2012

RCS MediaGroup S.p.A. 10.09 131,785 - - (35,266) 96,519

- Gross carrying amount 131,785 - - - 131,785

- Accumulated impairment losses - - - (35,266) (35,266)

Total investments in associates 131,785 - - (35,266) 96,519