Chrysler 2012 Annual Report Download - page 258

Download and view the complete annual report

Please find page 258 of the 2012 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

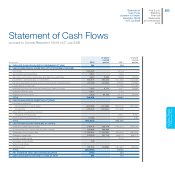

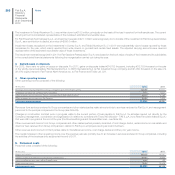

257

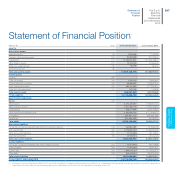

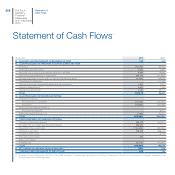

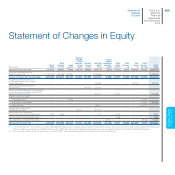

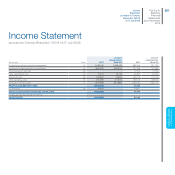

Fiat S.p.A. - Statutory

Financial Statements

at 31 December 2012

Measurement

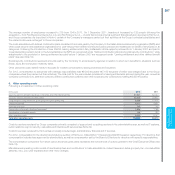

Investments in subsidiaries and associates are recognized at cost and adjusted for any impairment losses.

Any positive difference, arising on acquisition, between the purchase cost and fair value of net assets acquired in an investee company

is included in the carrying amount of the investment.

Investments in subsidiaries and associates are tested annually for impairment, or more frequently if evidence of impairment exists.

Where an impairment loss exists, it is recognized immediately through the income statement. If the Company’s share of losses of

the investee exceeds the carrying amount of the investment and if the Company has an obligation or intention to cover those losses,

the investment is written down to zero and a liability is recognized for the Company’s share of any additional losses. If an impairment

loss is subsequently reversed, the increase in carrying amount (up to a maximum of purchase cost) is recognized through the income

statement.

Investments in other companies, which consists of non-current financial assets that are not held for trading (i.e., available-for-sale

financial assets), are initially measured at fair value. Any subsequent gains or losses resulting from changes in fair value determined by

the market price are recognized directly in equity until the investment is sold or an impairment loss is recognized. If an investment is

sold, cumulative gains or losses previously recognized in equity are recycled through profit and loss. If an impairment loss is recognized

on the investment, any accumulated losses recognized in equity are recycled through profit and loss. Investments in companies for

which a market price is not available are measured at cost and adjusted for any impairment losses.

The Fiat Industrial ordinary shares allocated to servicing the stock option and stock grant plans are linked to the liability recognized for

share-based compensation (i.e., provisions for stock options and stock grants) and, as such, are measured at fair value through profit

or loss consistent with the valuation of the associated liability.

Other financial assets, which the Company intends to hold to maturity, are initially recognized on the settlement date at purchase cost

(considered representative of their fair value) which, with the exception of held-for-trading financial assets, is inclusive of transaction

costs. Subsequent measurement is at amortized cost using the effective interest method.

Other non-current assets, trade receivables, current financial receivables and other current receivables, excluding those based

on a derivative financial instrument, as well as all other unquoted financial assets whose fair value cannot be reliably determined,

are measured at amortized cost using the effective interest method, if they have a fixed term, or at cost, if they have no fixed term.

Receivables with maturities of over one year which bear no interest or an interest rate significantly lower than market rates are

discounted using market rates.

Regular assessments are made to determine whether there is objective evidence that financial assets, separately or within a group of

assets, have been impaired. Where such evidence exists, an impairment loss is recognized in the income statement for the period.

Non-current debt, other non-current liabilities, trade payables, current debt and other debt are initially recognized at fair value

(normally represented by the cost of the transaction from which the liability arises), in addition to any transaction costs.

With the exception of derivative instruments and liabilities arising from financial guarantees, financial liabilities are subsequently

measured at amortized cost using the effective interest method. Measurement of financial liabilities hedged by derivative instruments

follows the principles of hedge accounting for fair value hedges. Gains and losses arising from subsequent measurement at fair value,

caused by fluctuations in interest rates, are recognized through the income statement and are offset by the effective portion of the gain

or loss arising from subsequent measurement at fair value of the hedging instrument.

Liabilities arising from financial guarantees are measured at the higher of the estimate of the contingent liability (determined in

accordance with IAS 37 - Provisions, Contingent Liabilities and Contingent Assets) and the amount initially recognized less any

amounts already released to profit and loss.