Chrysler 2012 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2012 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

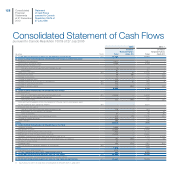

137

Consolidated

Financial Statements

at 31 December 2012

Inventories

Inventories of raw materials, semi-finished products and finished goods, (including assets sold with a buy-back commitment) are stated

at the lower of cost and net realisable value, cost being determined on a first in-first-out (FIFO) basis. The measurement of inventories

includes the direct costs of materials, labour and indirect costs (variable and fixed). Provision is made for obsolete and slow-moving

raw materials, finished goods, spare parts and other supplies based on their expected future use and realisable value. Net realisable

value is the estimated selling price in the ordinary course of business less the estimated costs of completion and the estimated costs

for sale and distribution.

The measurement of construction contracts is based on the stage of completion determined as the proportion that cost incurred to

the balance sheet date bears to the estimated total contract cost. These items are presented net of progress billings received from

customers. Any losses on such contracts are fully recorded in the income statement when they become known.

Assets and liabilities held for sale and Discontinued Operations

Assets and liabilities held for sale and Discontinued Operations are classified as such if their carrying amounts will be recovered

principally through a sale transaction rather than through continuing use. This condition is regarded as met only when the sale is highly

probable and the non-current asset (or disposal group) is available for immediate sale in its present condition.

When the Group is committed to a sale plan involving loss of control of a subsidiary, all of the assets and liabilities of that subsidiary

are classified as held for sale when the criteria described above are met, regardless of whether the Group will retain a non-controlling

interest in its former subsidiary after the sale.

Assets classified as held for sale are measured at the lower of their carrying amounts and fair value less costs to sell.

Employee benefits

The present value of a defined benefit obligation and the related current service cost for defined benefit pension plans and other long-

term benefits are determined on an actuarial basis using the projected unit credit method. Under this method, the Group attributes

benefits to periods in which the obligation to provide post-employment benefits arise. That obligation arises when employees render

services.

The present value of the defined benefit obligation is measured by using actuarial techniques and actuarial assumptions that are

unbiased and mutually compatible. Financial assumptions are based on market estimates that are known at the balance sheet date

regarding the period in which the obligations will be settled.

The fair value of plan assets is deducted from the present value of the obligation in determining the amount recognised in the statement

of financial position. This fair value is estimated, where possible, by referring to available market price of the assets. Where no market

price is available, the fair value of plan assets is estimated using a valuation technique.

Actuarial gains and losses comprise the effects of differences between the previous actuarial assumptions and the actual result,

together with the effects of changes in actuarial assumptions. In measuring the defined benefit liability, the Group recognises the portion

of net cumulative actuarial gains and losses that exceeds the greater of 10% of the present value of the defined benefit obligation and

10% of the fair value of plan assets at the end of the previous year. That portion is amortised over the average remaining service lives

of the employees who are covered by the plan (the “corridor method”). On IFRS first-time adoption, the Group elected to recognise all

cumulative actuarial gains and losses at 1 January 2004 even though deciding to use the corridor approach for subsequent actuarial

gains and losses.

The liability for employee benefits recognised in the statement of financial position represents the present value of the defined benefit

obligation as adjusted for deferred actuarial gains and losses arising from the application of the corridor method and unrecognised

past service cost, reduced by the fair value of plan assets. Any net asset resulting from this calculation is recognised at the lower of the

amount arising from this calculation and the total of any unrecognised net actuarial losses, unrecognised past service costs and the

present value of any refunds available and reductions in future contributions to the plan.