Chrysler 2012 Annual Report Download - page 180

Download and view the complete annual report

Please find page 180 of the 2012 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

179

Consolidated

Financial Statements

at 31 December 2012

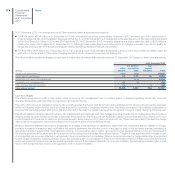

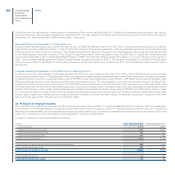

In this respect, capital means the value brought into Fiat S.p.A. by its shareholders (share capital plus the additional paid-in capital reserve less treasury

shares), equal to €5,289 million at 31 December 2012 (€5,259 million at 31 December 2011) and the value generated by the Group in terms of the results

achieved in operations (retained earnings and other reserves), equal in total, before the result for the year, to €3,252 million at 31 December 2012 and

€2,927 million at 31 December 2011, excluding gains and losses recognised directly in equity and non-controlling interests.

Treasury Shares

Treasury shares consist of 34,577,766 Fiat S.p.A. ordinary shares for an amount of €259 million (38,568,458 ordinary shares for an amount of €289 million

at 31 December 2011). The number of Treasury shares has decreased by 4,000,000 since 31 December 2011 due to the granting to the Chief Executive

Officer of the shares vested under the 2009 Stock Grant Plan (see Note 25 of the Consolidated Financial Statements at 31 December 2011) and has

increased by 9,308 shares as a result of the conversion of the preference and savings shares discussed above.

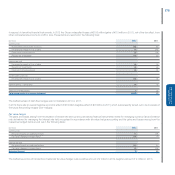

In addition, at their annual general meeting of 4 April 2012 Shareholders of Fiat S.p.A. renewed their authorisation for the purchase and sale of treasury

shares, including through subsidiaries. The previous authorisation provided on 30 March 2011 was revoked. The authorisation provides for the purchase

of a maximum number of shares not to exceed the legally established percentage of share capital or an aggregate value of €1.2 billion, inclusive of the

€259 million in Fiat S.p.A. shares already held and enabled Fiat to purchase certain preference and savings shares from the shareholders who exercised

their withdrawal right following the conversion. As announced, the buy-back program is currently on hold and Fiat has no obligation to buy back shares

under the authorisation. The buy-back authorisation is valid for a period of 18 months and any buy-backs must be carried out in the manner established by

law and at a price which is within 10% of the reference price published by Borsa Italiana on the date prior to the purchase.

On 20 February 2013, the Board of Directors proposed to Shareholders to revoke the previous resolution, for the part not already utilized at the date of the

General Meeting, and approve a new resolution for the purchase of own shares for a further period of 18 months and for an amount not to exceed the legally

established percentage of share capital (at the current par value of €3.58 per share) and the maximum counter value of approximately €1.2 billion, inclusive

of the reserves allocated for treasury shares already held for €259 million. Such authorisation is requested in order to service the incentive plans based on

financial instruments approved by Fiat S.p.A. and, more generally, in order for the Company to benefit from any eventual strategic investment opportunities

for all purposes permissible under applicable law.

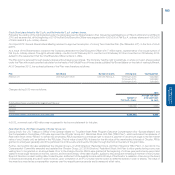

Capital reserves

At 31 December 2012, capital reserves amounting to €137 million (€147 million at 31 December 2011) were reduced by €10 million as a consequence of

the conversion of preference and saving shares.

Revenue reserves

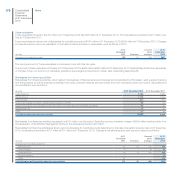

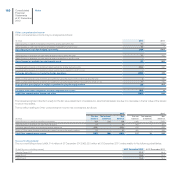

The main revenue reserves are as follows:

the legal reserve of Fiat S.p.A. of €529 million at 31 December 2012 (€524 million at 31 December 2011);

retained earnings of €3,256 million at 31 December 2012 (retained earnings of €1,952 million at 31 December 2011);

the profit attributable to owners of the parent of €348 million at 31 December 2012 (a profit of €1,334 million for the year ended 31 December 2011);

the reserve for share-based payments of €54 million at 31 December 2012 (€52 million at 31 December 2011).

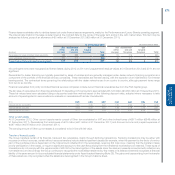

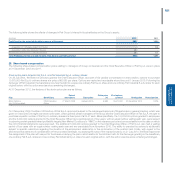

Please note that, as discussed in Notes 25 e 26 of the Annual report at 31 December 2011, with the Demerger by Fiat Industrial, the equity awards underlying

the outstanding stock option and stock grant plans at 31 December 2010 was adjusted by allowing the beneficiaries to receive one ordinary Fiat share and

one ordinary Fiat Industrial share for each right held, with the pre-established option exercise price (for stock option plans) and the free granting of shares

(for the stock grant plan) remaining unchanged. In accordance with IFRS 2 – Share based payment, this change required that the stock option and stock

grant plans be accounted for as compound financial instruments and in particular that the Reserve for share-based payments at that date be separated into

a liability component (the counterparty’s right to receive one Fiat Industrial S.p.A. share) and an equity component (the counterparty’s right to receive one

Fiat S.p.A. share). All stock option and stock grant plans, with the exception of the portion of the 2006 Plan relating to managers for which a capital increase

was approved, will additionally be serviced by the use of Treasury shares held by Fiat S.p.A. and the Fiat Industrial ordinary shares that were allotted as a

result of the Demerger. The alignment of the equity awards underlying the above plans had led to the reclassification of a portion of this reserve (amounting to

€62 million) to Other provisions for employees and liabilities for share-based payments. On the day on which the Fiat Industrial S.p.A. shares were first listed,

this amount represented the portion of the book value of the Reserve for share-based payments attributable to each plan and relating to the component of

the plans which will be serviced by Fiat Industrial S.p.A. shares, calculated on the basis of the weighting of the quotations of the two shares at that date.