Chrysler 2012 Annual Report Download - page 209

Download and view the complete annual report

Please find page 209 of the 2012 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes

208 Consolidated

Financial

Statements

at 31 December

2012

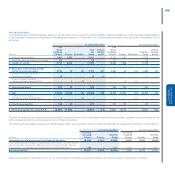

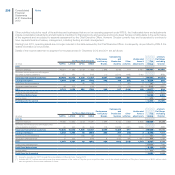

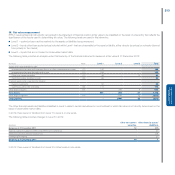

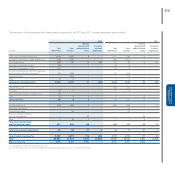

Total Non-current assets located in Italy (excluding financial assets, deferred tax assets and defined benefit assets) totalled €9,855 million at 31 December

2012 (€9,569 million at 31 December 2011). The total of such assets located in the Rest of the world totalled €33,352 million at 31 December 2012

(€31,360 million 31 December 2011). Non-current assets located in the Rest of the world may be analysed as follows (in €million): United States, Canada

and Mexico 26,733 (25,165 in 2011) Brazil 2,306 (2,463 in 2011) Poland 1,455 (1,511 in 2011) Serbia 985 (463 in 2011) China 273 (272 in 2011) France

204 (322 in 2011), and Germany 150 (170 in 2011).

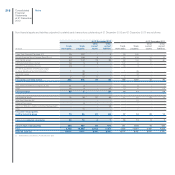

35. Qualitative and quantitative information on financial risks

The Group is exposed to the following financial risks connected with its operations:

credit risk, arising both from its normal commercial relations with final customers and dealers, and its financing activities;

liquidity risk, with particular reference to the availability of funds and access to the credit market and to financial instruments in general;

financial market risk (principally relating to exchange rates, interest rates and commodity prices), since the Group operates at an international level in

different currencies and uses financial instruments which generate interests. The Group is also exposed to the risk of changes in the price of certain

commodities and of certain listed shares.

These risks could significantly affect the Group’s financial position and results, and for this reason the Group systematically identifies, and monitors these

risks, in order to detect potential negative effects in advance and take the necessary action to mitigate them, primarily through its operating and financing

activities and if required, through the use of derivative financial instruments.

Financial instruments held by the funds that manage pension plan assets are not included in this analysis (see the Note 26).

The following section provides qualitative and quantitative disclosures on the effect that these risks may have upon the Group. The quantitative data

reported in the following do not have any predictive value, in particular the sensitivity analysis on finance market risks does not reflect the complexity of the

market or the reaction which may result from any changes that are assumed to take place.

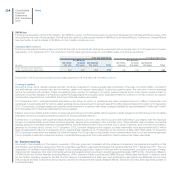

Credit risk

Credit risk is the risk of economic loss arising from the failure to collect a receivable. Credit risk encompasses the direct risk of default and the risk of a

deterioration of the creditworthiness of the counterparty, as well as concentration risks.

The Group’s credit risk differs in relation to the activities carried out. In particular, dealer financing and operating and financial lease activities that are carried

out through the Group’s financial services companies are exposed both to the direct risk of default and the deterioration of the creditworthiness of the

counterparty, while the sale of vehicles and spare parts is mostly exposed to the direct risk of default of the counterparty. These risks are however mitigated

by the fact that collection exposure is spread across a large number of counterparties and customers.

Taken overall, however, the credit risk regarding the Group’s trade receivables and receivables from financing activities is concentrated in the European

Union and Latin America markets for Fiat excluding Chrysler and in the North American market for Chrysler.

In order to test for impairment, significant receivables from corporate customers and receivables for which collectability is at risk are assessed individually,

while receivables from end customers or small business customers are grouped into homogeneous risk categories. A receivable is considered impaired

when there is objective evidence that the Group will be unable to collect all amounts due specified in the contractual terms. Objective evidence may be

provided by the following factors: significant financial difficulties of the counterparty, the probability that the counterparty will be involved in an insolvency

procedure or will default on its instalment payments, the restructuring or renegotiation of open items with the counterparty, changes in the payment status

of one or more debtors included in a specific risk category and other contractual breaches. The calculation of the amount of the impairment loss is based

on the risk of default by the counterparty, which is determined by taking into account all the information available as to the customer’s solvency, the fair

value of any guarantees received for the receivable and the Group’s historical experience.

The maximum credit risk to which the Group is theoretically exposed at 31 December 2012 is represented by the carrying amounts of financial assets in the

financial statements and the nominal value of the guarantees provided on liabilities and commitments to third parties as discussed in Note 32.

Dealers and final customers for which the Group provides financing are subject to specific assessments of their creditworthiness under a detailed scoring

system; in addition to carrying out this screening process, the Group also obtains financial and non-financial guarantees for risks arising from credit granted

for the sale of cars, whose amount depends on the amount of the assets sold. These guarantees are further strengthened where possible by reserve of title

clauses on financed vehicle sales to the sales network and on vehicles assigned under finance leasing agreements.