Chrysler 2012 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2012 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

145

Consolidated

Financial Statements

at 31 December 2012

In addition, at the date of this Annual report, the European Union had not yet completed its endorsement process for these standards

and amendments:

On 12 November 2009, the IASB issued a new standard IFRS 9 – Financial Instruments that was subsequently amended. The

standard, having an effective date for mandatory adoption of 1 January 2015 retrospectively, represents the completion of the first

part of a project to replace IAS 39 and introduces new requirements for the classification and measurement of financial assets and

financial liabilities. The new standard uses a single approach to determine whether a financial asset is measured at amortised cost

or fair value, replacing the many different rules in IAS 39. The approach in IFRS 9 is based on how an entity manages its financial

instruments and the contractual cash flow characteristics of the financial assets. The most significant effect of the standard regarding

the classification and measurement of financial liabilities relates to the accounting for changes in fair value attributable to changes

in the credit risk of financial liabilities designated as at fair value through profit or loss. Under the new standard these changes are

recognised in Other comprehensive income and are not subsequently reclassified to the income statement.

On 17 May 2012, the IASB issued a set of amendments to IFRSs (“Annual Improvement to IFRS’s – 2009-2011 Cycle”) that are

applicable retrospectively from 1 January 2013; set out below are those that may lead to changes in the presentation, recognition

or measurement of financial statement items, excluding those that only regard changes in terminology or editorial changes having a

limited accounting effect and those that affect standards or interpretations that are not applicable to the Fiat Group.

IAS 1 – Presentation of Financial Statements: the amendment clarifies the way in which comparative information should be

presented when an entity changes accounting policies or retrospectively restates or reclassifies items in its financial statements

and when an entity provides comparative information in addition to the minimum comparative financial statements;

IAS 16 – Property, plant and equipment: the amendment clarifies that items such as spare parts, stand-by equipment and servicing

equipment, shall be recognised in accordance with IAS 16 when they meet the definition of Property, plant and equipment,

otherwise such items shall be classified as Inventory;

IAS 32 – Financial instruments: Presentation: the amendment eliminates an inconsistency between IAS 12 – Income Taxes and

IAS 32 concerning the recognition of taxation arising from distributions to shareholders, establishing that these shall be recognised

in profit or loss to the extent the distribution refers to income generated by transactions originally recognised in profit or loss.

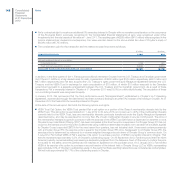

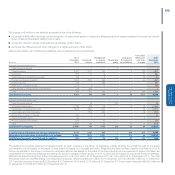

Scope of consolidation

Consolidated entities

The consolidated financial statements of the Fiat Group at 31 December 2012 include Fiat S.p.A. and 297 consolidated subsidiaries in

which Fiat S.p.A., directly or indirectly, has a majority of the voting rights, and over which it exercises control or from which it is able to

derive benefit by virtue of its power to govern their corporate financial and operating policies.

There were no significant changes in the scope of consolidation in 2012, although the following minor changes occurred:

in early January 2012, Fiat announced that the “Ecological Event” (Third performance event established in the Chrysler’s LLC

Operating Agreement, as amended) had been achieved, leading to a further 5% increase of its holding in Chrysler. At 31 December

2012 Fiat had a 58.5% ownership interest in Chrysler;

AKAT Automotive Distribution Company Private Limited, whose name was subsequently changed to Fiat Group Automobiles India

Private Limited, was established in India and will assume responsibility for all commercial, distribution and service related activities

from the current joint Tata Motors-Fiat dealerships assigned to manage the Fiat brand. The investment was initially measured at cost

and now is consolidated on a line by line basis;

Some minor subsidiaries belonging to the Components and Production System operating segment and the company FGA Austro

Car GmbH belonging to the EMEA region, whose total assets and revenues are not material for the Group, were consolidated on a

line-by-line basis.