Chrysler 2012 Annual Report Download - page 205

Download and view the complete annual report

Please find page 205 of the 2012 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes

204 Consolidated

Financial

Statements

at 31 December

2012

VM Motori

Following the acquisition of the 50% interest in the VM Motori group, the Fiat Group is party to a put and call agreement with General Motors under which

two years after the date of this acquisition Fiat will have the right to buy the residual interest in VM Motori from General Motors. Furthermore, General Motors

has a put option to sell its interest in VM Motori to Fiat if certain conditions occur.

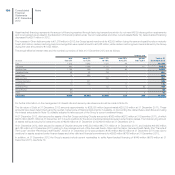

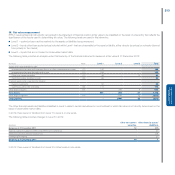

Operating lease contracts

The Group has entered operating lease contracts for the right to use industrial buildings and equipment with an average term of 10-20 years and 3-5 years,

respectively. At 31 December 2011 the total future minimum lease payments under non-cancellable lease contracts are as follows:

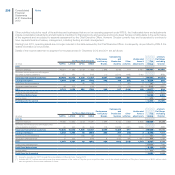

At 31 December 2012 At 31 December 2011

(€ million)

due within

one year

due between

one and

five years

due beyond

five years Total

due within

one year

due between

one and

five years

due beyond

five years Total

Future minimum lease payments

under operating lease agreements 147 347 222 716 136 325 227 688

During 2012, the Group has recorded costs for lease payments of € 184 million (€118 million in 2011).

Contingent liabilities

As a global group with a diverse business portfolio, the Group is exposed to numerous legal risks, particularly in the areas of product liability, competition

and antitrust law, environmental risks and tax matters, dealer and supplier relationships, intellectual property rights. The outcome of any proceedings

cannot be predicted with certainty. These proceedings seek recovery for damage to property, personal injuries and in some cases include a claim for

exemplary or punitive damage. It is therefore possible that legal judgments could give rise to expenses that are not covered, or not fully covered, by insurers’

compensation payments and could affect the Group’s financial position and results.

At 31 December 2012, contingent liabilities estimated by the Group for which no provisions have been recognised since an outflow of resources is not

considered to be probable and for which a reliably estimate can be made amount to approximately €100 million (approximately €100 million at 31 December

2011). Furthermore, contingent assets and expected reimbursement in connection with these contingent liabilities for approximately €16 million (€14 million

at 31 December 2011) have been estimated but not recognised.

Instead, when it is probable that an outflow of resources embodying economic benefits will be required to settle obligations and this amount can be reliably

estimated, the Group recognises specific provisions for this purpose (see Note 27).

Furthermore, in connection with significant asset divestitures carried out in prior years, the Group provided indemnities to purchasers with the maximum

amount of potential liability under these contracts generally capped at a percentage of the purchase price. These liabilities refer principally to potential

liabilities arising from possible breaches of representations and warranties provided in the contracts and, in certain instances, environmental or tax matters,

generally for a limited period of time. At 31 December 2012, potential obligations with respect to these indemnities were approximately €430 million

(approximately €430 million at 31 December 2011). Against these obligations, at 31 December 2012 provisions of €62 million (€66 million 31 December

2011) have been made which are classified as Other provisions. The Group has provided certain other indemnifications that do not limit potential payment;

it is not possible to estimate a maximum amount of potential future payments that could result from claims made under these indemnities.

33. Segment reporting

As a result of the acquisition of the majority ownership of Chrysler group and consistent with the objective of enhancing the operational integration of Fiat

and Chrysler, and as already announced, Fiat has undertaken significant organizational changes that became effective from 1 September 2011. The new

organization of the Mass-market Brands is based on four operating regions (the “regions”) that deal with the development, production and sale of “mass-

market brands” passenger cars, light commercial vehicles and related parts and services in specific geographical areas: NAFTA (U.S., Canada and Mexico),

LATAM (South and Central America, excluding Mexico), APAC (Asia and Pacific countries) and EMEA (Europe, Middle East and Africa). In addition, there

are two further operating segments, the first of which designs, manufactures and sells luxury and performance cars (Ferrari and Maserati) and the other

that produces and sells components and production systems for the automotive industry (Magneti Marelli, Teksid and Comau). Both segments operate on

a worldwide basis.