Chrysler 2012 Annual Report Download - page 197

Download and view the complete annual report

Please find page 197 of the 2012 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes

196 Consolidated

Financial

Statements

at 31 December

2012

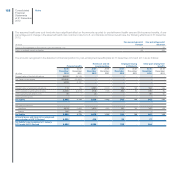

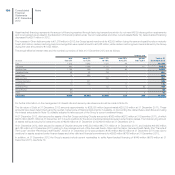

as the result of the reopening of the €600 million 7.75% notes issue due October 2016, as part of the Global Medium Term Notes Programme, Fiat

Finance and Trade Ltd S.A. has issued a further €400 million of notes with an issue price of 101.116% and a yield to maturity of 7.40%, increasing the

total principal amount of the bond to €1 billion;

the repayment on maturity of a bond having a nominal value of €1,250 million issued by Fiat Finance and Trade Ltd S.A. in 2009 as part of the Global

Medium Term Notes Programme;

the repayment on maturity of a bond having a nominal value of €200 million issued by Fiat Finance and Trade Ltd S.A. in 2009 as part of the Global

Medium Term Notes Programme.

Following the repayment on 15 February 2013 of the bond issued by Fiat Finance and Trade Ltd. S.A. having a nominal value of €1 billion, bearing fixed

interest at 6.625%, the bonds issued by the Fiat Group excluding Chrysler are currently governed by the terms and conditions of the Global Medium Term

Note Programme (GMTN Programme). A maximum of €15 billion may be used under this Program, of which notes of approximately €8.8 billion have been

issued to 31 December 2012; the Program is guaranteed by Fiat S.p.A. The issuers taking part in the program include, amongst others, Fiat Finance and

Trade Ltd. S.A. for an amount outstanding of €7.8 billion and Fiat Finance North America Inc. with a bond having a nominal value of €1 billion.

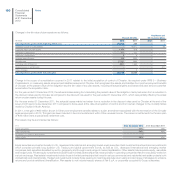

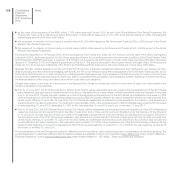

Whereas Chrysler remains separate from the rest of the Fiat Group from a financial management standpoint and manages its own treasury services,

obtaining funding from the market and managing cash directly, the Fiat Group intends to repay the bonds issued by Fiat Finance and Trade Ltd S.A. and by

Fiat Finance North America Inc. in cash at maturity by utilising available liquid resources. The companies in the Fiat Group may from time to time buy back

bonds on the market that have been issued by the Group, also for purposes of their cancellation. Such buybacks, if made, depend upon market conditions,

the financial situation of the Group and other factors which could affect such decisions.

Chrysler may redeem, at any time, all or any portion of the Secured Senior Notes on not less than 30 and not more than 60 days’ prior notice mailed to the

holders of the Notes to be redeemed.

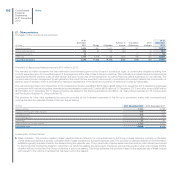

Prior to 15 June 2015, the 2019 Secured Senior Notes (“2019 Notes”) will be redeemable at a price equal to the principal amount of the 2019 Notes

being redeemed, plus accrued and unpaid interest to the date of redemption and a “make−whole” premium calculated under the indenture. At any time

prior to 15 June 2014, Chrysler may also redeem up to 35% of the aggregate principal amount of the 2019 Notes, at a redemption price equal to 108%

of the principal amount of the 2019 Notes being redeemed, plus accrued and unpaid interest to the date of redemption with the net cash proceeds from

certain equity offerings. On and after 15 June 2015, the 2019 Notes are redeemable at redemption prices specified in the indenture, plus accrued and

unpaid interest to the date of redemption. The redemption price is initially 104% of the principal amount of the 2019 Notes being redeemed for the twelve

months beginning 15 June 2015, decreasing to 102% for the year beginning 15 June 2016 and to par on and after 15 June 2017.

Prior to 15 June 2016, the 2021 Secured Senior Notes (“2021 Notes”) will be redeemable at a price equal to the principal amount of the 2021 Notes being

redeemed, plus accrued and unpaid interest to the date of redemption and a “make−whole” premium calculated under the indenture. At any time prior

to 15 June 2014, Chrysler may also redeem up to 35% of the aggregate principal amount of the 2021 Notes, at a redemption price equal to 108.25% of

the principal amount of the 2021 Notes being redeemed, plus accrued and unpaid interest to the date of redemption with the net cash proceeds from

certain equity offerings. On and after 15 June 2016, the 2021 Notes are redeemable at redemption prices specified in the indenture, plus accrued and

unpaid interest to the date of redemption. The redemption price is initially 104.125% of the principal amount of the 2021 Notes being redeemed for the

twelve months beginning 15 June 2016, decreasing to 102.75% for the year beginning 15 June 2017, to 101.375% for the year beginning 15 June 2018

and to par on and after 15 June 2019.

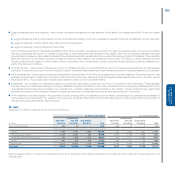

The bonds issued by Fiat and Chrysler are subject to different terms and conditions, which vary by issuer and, in some cases, by individual issuance. The

prospectuses and/or indentures relating to the principal bond issues are available on the Group’s website at www.fiatspa.com under “Investor Relations –

Financial Publications” and at www.chryslergroupllc.com under “Investor Relations – SEC filings”. These documents are unaudited.