Chrysler 2012 Annual Report Download - page 206

Download and view the complete annual report

Please find page 206 of the 2012 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

205

Consolidated

Financial Statements

at 31 December 2012

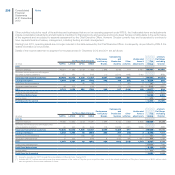

Under the Group’s new organization, these regions and operating segments reflect the elements of the Group that are regularly reviewed by the Group’s

Chief Executive Officer together with the Group Executive Council for making strategic decisions, allocating resources and assessing performance. The

Group Executive Council was formed on 1 September 2011 and includes the senior operating and corporate leadership of Fiat and Chrysler.

Based on the new structure of the Group, starting from 2012, the operations of the mass-market brands, which were previously reported under the sectors

Fiat Group Automobiles, Fiat Powertrain and Chrysler, are now attributed to the four regions as described above. The Luxury and Performance Brands,

as well as the Components and Production Systems sectors are reported under two groupings based on their similarities and relative size. The figures for

2011 presented for comparative purposes have been restated accordingly.

In more details, the regions and the operating segments identified by the Group are the following:

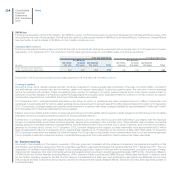

NAFTA primarily earns its revenues from the design, development, production, distribution and sale of automobiles under the Chrysler, Jeep, Dodge,

Ram, SRT and Fiat brand names, and from sales of the related parts and accessories (under the Mopar brand name) in the United States, Canada and

Mexico.

LATAM mainly earns its revenues from the production and sale of passenger cars and light commercial vehicles and related spare parts under the Fiat

and Fiat Professional brand names in South and Central America, excluding Mexico, and from the distribution of Chrysler group brand cars in the same

region; in addition, it provides financial services to the dealer network in Brazil and Argentina, and to the dealer network and end customers of Fiat

Industrial group for the sale of trucks and commercial vehicles in the same countries.

APAC mainly earns its revenues from the sale of cars, engines and transmissions and related spare parts under the Chrysler group and Fiat brands mostly

in China, Japan, Australia and India. These activities are carried out by the region through both subsidiaries and joint ventures.

EMEA earns its revenues from the design, development, production and sale of passenger cars and light commercial vehicles under the Fiat, Alfa

Romeo, Lancia/Chrysler, Abarth and Fiat Professional brand names and the sale of the related spare parts in Europe, Middle East and Africa, and from

the distribution of Chrysler group brand vehicles in the same areas. In addition, the region provides financial services related to the sale of cars and light

commercial vehicles in Europe, primarily through the 50/50 joint venture FGA Capital set up with the Crédit Agricole group included within associates

consolidated with the equity method.

The Luxury and Performance Brands grouping (Ferrari and Maserati sectors) earns its revenues from the production and sale of luxury sport cars under

the Ferrari and Maserati brands, from managing the Ferrari racing team and from providing financial services offered in conjunction with the sale of Ferrari

brand cars.

The Components and Production Systems (Magneti Marelli, Teksid and Comau) grouping earns its revenues from the production and sale of lighting

components, engine control units, suspensions, shock absorbers, electronic systems, and exhaust systems and from activities in the plastic moulding

components and in the after-market carried out under the Magneti Marelli brand name, cast iron components for engines, gearboxes, transmissions

and suspension systems, and aluminium cylinder heads (Teksid), in addition to the design and production of industrial automation systems and related

products for the automotive sector (Comau).

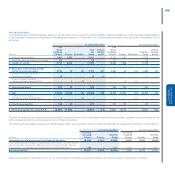

As stated in the Section Format of the financial statements, in addition to assessing the performance of its operating segments on the basis of Trading

profit, beginning 2012, the Group also began assessing performance on the basis of Earnings before Interest and Taxes (EBIT) and has decided to report

it as a separate line item in the income statement in place of Operating profit. The comparative amounts have been restated accordingly. EBIT consists of

Trading profit/(loss), Result from investments, and other income/(expense) classified as unusual and was deemed more appropriate than Operating profit

as an indicator of performance for the Group and its operating segments, since it also takes into account the Result from investments. Trading profit, on the

other hand, which remains unchanged, reflects the result from normal operating activities before taking account of the Result from investments and unusual

items such as Gains/(losses) on the disposal of investments, Restructuring costs and other income/(expense) classified as unusual.

Transactions among regions generally are presented on a “where-sold” basis, which reflects the profit/(loss) on the ultimate sale to the external customer

sale within the region. This presentation generally eliminates the effect of the legal entity transfer price within the regions. For the regions which also provide

financial services activities, revenues and costs also include interest income and expense and other financial income and expense arising from those

activities.

Revenues, Trading profit/(loss) and EBIT of the other operating segments are those directly generated by or attributable to the segment as the result of its

usual business activities and include revenues from transactions with third parties as well as those arising from transactions with regions and other operating

segments, recognised at normal market prices. For Luxury and Performance Brands segment which also provides financial services activities, revenues and

costs include interest income and expense, and other financial income and expense arising from those activities.