Chrysler 2012 Annual Report Download - page 213

Download and view the complete annual report

Please find page 213 of the 2012 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes

212 Consolidated

Financial

Statements

at 31 December

2012

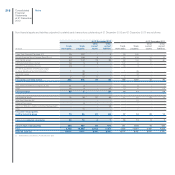

Quantitative information on interest rate risk

The manufacturing companies and treasuries of the Group make use of external funds obtained in the form of financing and invest in monetary and financial

market instruments. In addition, Group companies make sales of receivables resulting from their trading activities on a continuing basis. Changes in market

interest rates can affect the cost of the various forms of financing, including the sale of receivables, or the return on investments, and the employment of

funds, causing an impact on the level of net financial expenses incurred by the Group.

In addition, the financial services companies provide loans (mainly to customers and dealers), financing themselves using various forms of direct debt or

asset-backed financing (e.g. factoring of receivables). Where the characteristics of the variability of the interest rate applied to loans granted differ from

those of the variability of the cost of the financing obtained, changes in the current level of interest rates can affect the Operating result of those companies

and the Group as a whole.

In order to manage these risks, the Group uses interest rate derivative financial instruments, mainly interest rate swaps and forward rate agreements, when

available in the market, with the object of mitigating, under economically acceptable conditions, the potential variability of interest rates on net profit/(loss).

In assessing the potential impact of changes in interest rates, the Group separates out fixed rate financial instruments (for which the impact is assessed in

terms of fair value) from floating rate financial instruments (for which the impact is assessed in terms of cash flows).

The fixed rate financial instruments used by the Group consist principally of part of the portfolio of the financial services companies (basically customer

financing and financial leases) and part of debt (including subsidised loans and bonds).

The potential loss in fair value of fixed rate financial instruments (including the effect of interest rate derivative financial instruments) held at 31 December

2012, resulting from a hypothetical, unfavourable and instantaneous change of 10% in market interest rates, would have been approximately €100 million

(€140 million at 31 December 2011). The change over the previous year is mainly attributable to interest rate levels used as based for sensitivity analysis.

Floating rate financial instruments consist principally of cash and cash equivalents, loans provided by the financial services companies to the sales network

and part of debt. The effect of the sale of receivables is also considered in the sensitivity analysis as well as the effect of hedging derivative instruments.

A hypothetical, unfavourable and instantaneous change of 10% in short-term interest rates at 31 December 2012, applied to floating rate financial assets

and liabilities, operations for the sale of receivables and derivative financial instruments, would have caused increased net expenses before taxes, on an

annual basis, of approximately €10 million (€10 million at 31 December 2011).

This analysis is based on the assumption that there is a general and instantaneous change of 10% in interest rates across homogeneous categories. A

homogeneous category is defined on the basis of the currency in which the financial assets and liabilities are denominated.

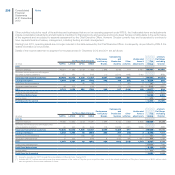

Quantitative information on commodity price risk

The Group has entered into derivative contracts for certain commodities to hedge its exposure to commodity price risk associated with buying raw materials

used in its normal operations.

In connection with the commodity price derivative contracts outstanding at 31 December 2012, a hypothetical, unfavourable and instantaneous change of

10% in the price of the commodities at that date would have caused a fair value loss of €51 million (€58 million at 31 December 2011).

Quantitative information on other risks on derivative financial instruments

As described in Note 21, the Group holds derivative financial instruments, whose value is linked to the price of listed shares (equity swaps on Fiat S.p.A. and

Fiat Industrial S.p.A. shares). Although these transactions were entered into for hedging purposes, they do not qualify for hedge accounting under IFRS. As

a consequence, the variability of the underlying values could have an effect on the Group’s net profit/(loss).

In the event of a hypothetical, unfavourable and instantaneous change of 10% in the underlying values, the potential loss in fair value of outstanding

derivative financial instruments at 31 December 2012 linked to the Fiat S.p.A. and Fiat Industrial S.p.A share price would have been approximately

€20 million (€17 million at 31 December 2011). The change over the previous year is due to the different price of the share at the end of the year

(which is used as a basis for the simulation).