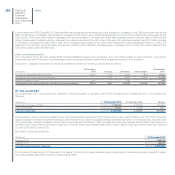

Chrysler 2012 Annual Report Download - page 282

Download and view the complete annual report

Please find page 282 of the 2012 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

281

Fiat S.p.A. - Statutory

Financial Statements

at 31 December 2012

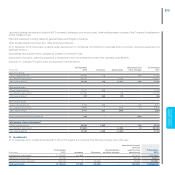

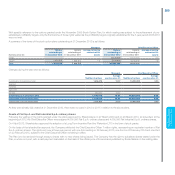

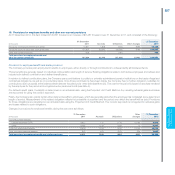

Italian regulations regarding share capital and reserves for a joint stock corporation establish the following:

Share capital must be a minimum of €120,000

All changes in the amount of share capital must be approved by Shareholders, who may give the Board of Directors the authority, for a maximum period

of 5 years, to increase share capital up to a pre-determined amount. Shareholders are also required to adopt appropriate measures when share capital

is reduced by more than one-third as a result of recognized losses and to reduce share capital if, by the end of the following financial year, such losses

have not been reduced to less than one-third of share capital. If, as a result of a loss of more than one-third, share capital falls below the legal minimum,

Shareholders must approve both a reduction and simultaneous increase of share capital to a level at least equivalent to the legal minimum or change the

company’s legal form

A share premium reserve is established if a company issues shares at a price above their par value. This reserve is not distributable until the legal reserve

has reached one-fifth of share capital

A company may not purchase own shares for an amount exceeding distributable profits and available reserves reported in its latest approved financial

statements. Purchases must be approved by shareholders and in no case may the par value of the shares acquired exceed one-fifth of share capital

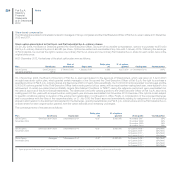

Pursuant to resolutions adopted by the Board of Directors on 3 November 2006, the demerger of activities to Fiat Industrial S.p.A., and resolutions adopted

by Shareholders at the Extraordinary Meeting on 4 April 2012, share capital may be increased, through paid capital contributions, by a maximum of

€34,249,412.50 through the issue of up to 9,566,875 new ordinary shares, exclusively to managers employed by the Company and/or its subsidiaries in

accordance with the relevant incentive plan.

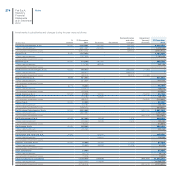

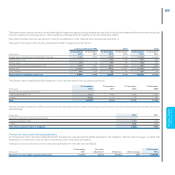

In consideration of the Company’s intention to maintain a high level of liquidity and the restrictions that exist on Chrysler’s ability to distribute dividends, the

Board of Directors has recommended to Shareholders that no dividend be paid in relation to the 2012 financial year.

Fiat’s stated objectives for capital management are to create value for Shareholders as a whole, to ensure business continuity and to support the growth of

the Group. Accordingly, Fiat intends to maintain an adequate level of capital that enables it to achieve a satisfactory economic return for Shareholders, as

well as ensuring access to affordable sources of external financing (including through the achievement of an adequate rating).

Fiat constantly monitors its debt-equity balance, particularly in relation to the level of net debt and the level of cash generated from the Group’s industrial

activities.

To achieve these objectives, Fiat aims at a continuous improvement in the profitability of its business activities. In addition, it could sell assets to reduce the

level of debt, or the Board of Directors could propose a capital increase or reduction to Shareholders or, where permitted by law, a distribution of reserves.

The Company may also repurchase its own shares, within the limits approved by Shareholders, compatible with the objectives of financial equilibrium and

an improvement in credit rating.

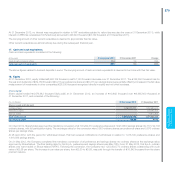

The term capital is used to refer both to the value contributed by Shareholders (share capital and share premium less own shares held, for a total value of

€5,288,888 thousand at 31 December 2012 and €5,258,962 thousand at 31 December 2011), and the value generated by Fiat S.p.A. in terms of results

achieved (retained profit and other reserves, before allocation of profit for the year, equal in total to €3,630,591 thousand at 31 December 2012 and

€3,837,987 thousand at 31 December 2011, excluding gains and losses recognized directly in equity).

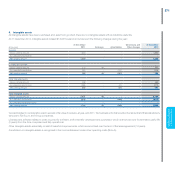

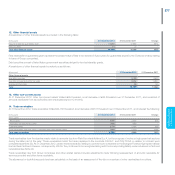

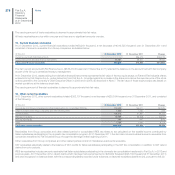

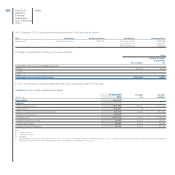

Share premium reserve

At 31 December 2012, the share premium reserve totaled €1,071,403 thousand. The decrease of €10,842 thousand over 31 December 2011 was

attributable to the free capital increase associated with the conversion of the Fiat S.p.A. preference and savings shares into ordinary shares on 21 May 2012.

Legal reserve

At 31 December 2012, this reserve totaled €528,577 thousand, an increase of €4,958 thousand over 31 December 2011, following the allocation of 2011

profit approved by Shareholders on 4 April 2012.