Chrysler 2012 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2012 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes

130 Consolidated

Financial

Statements

at 31 December

2012

materiality, the nature of the counterparty, the object of the transaction, the method for determination of the transfer price or the timing

of the event (e.g., close to year end) – could give rise to doubts regarding the accuracy/completeness of the information in the financial

statements, conflicts of interest, the proper safeguarding of corporate assets or protection of non-controlling interests.

For the Statement of Financial Position, a mixed format has been selected to present current and non-current assets and liabilities,

as permitted by IAS 1. More specifically, the Group’s financial statements include both industrial companies and financial services

companies. The investment portfolios of financial services companies are included in current assets, as the investments will be realised

in their normal operating cycle. However, the financial services companies only obtain a portion of their funding from the market; the

remainder is obtained from Fiat S.p.A. through the Group’s treasury companies (included under industrial activities), which provide

funding both to industrial companies and financial services companies in the Group, as the need arises. Chrysler, on the other hand,

continues to remain separate from a financial management standpoint and manages its own treasury services, obtaining funding from

the market and managing its cash directly. This financial service structure within the Group means that any attempt to separate current

and non-current debt in the consolidated Statement of Financial Position would not be meaningful. Suitable disclosure as to the due

date of liabilities is however provided in the notes.

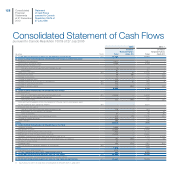

The Statement of Cash Flows is presented using the indirect method.

In connection with the requirements of Consob Resolution No. 15519 of 27 July 2006 relating to the format of the financial statements,

specific supplementary Income Statement, Statement of Financial Position and Statement of Cash Flows formats have been added for

related party transactions so as not to compromise an overall reading of the statements.

Basis of consolidation

Subsidiaries

Subsidiaries are enterprises controlled by the Group, as defined in IAS 27 – Consolidated and Separate Financial Statements. Control

exists when the Group has the power, directly or indirectly, to govern the financial and operating policies of an enterprise so as to obtain

benefits from its activities. The financial statements of subsidiaries are combined in the consolidated financial statements from the date

that control commences until the date that control ceases. Non-controlling interests in the net assets of consolidated subsidiaries and

non-controlling interests in the profit or loss of consolidated subsidiaries are presented separately from the interests of the owners of

the parent in the consolidated statement of financial position and income statement respectively. Losses applicable to non-controlling

interests which exceed the minority’s interests in the subsidiary’s equity are allocated against the non-controlling interests.

Changes in the Group’s ownership interests in subsidiaries that do not result in the loss of control are accounted for as equity

transactions. The carrying amounts of the Equity attributable to owners of the parent and Non-controlling interests are adjusted to

reflect the changes in their relative interests in the subsidiaries. Any difference between the book value of the non-controlling interests

and the fair value of the consideration paid or received is recognised directly in the equity attributable to the owners of the parent.

If the Group loses control of a subsidiary, a gain or loss is recognised in profit or loss and is calculated as the difference between (i) the

aggregate of the fair value of the consideration received and the fair value of any retained interest and (ii) the carrying amount of the

assets (including goodwill) and liabilities of the subsidiary and any non-controlling interests. Any profits or losses recognised in other

comprehensive income in respect of the measurement of the assets of the subsidiary are accounted for as if the subsidiary had been

sold (i.e. reclassified to profit or loss or transferred directly to retained earnings depending on the applicable IFRS). The fair value of

any investment retained in the former subsidiary is measured in accordance with IAS 39, IAS 28 or IAS 31, depending on the type of

investment.

Jointly controlled entities

Jointly controlled entities are enterprises in which the Group has contractually agreed sharing of control or for which a contractual

arrangement exists whereby two or more parties undertake an economic activity that is subject to joint control. Investments in jointly

controlled entities are accounted for using the equity method from the date that joint control commences until the date that joint control

ceases.