Reebok 2010 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2010 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

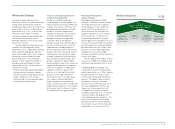

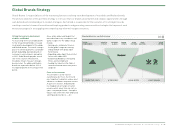

84 Group Management Report – Our Group Global Sales Strategy Wholesale Strategy / Retail Strategy

− Never-out-of-stock (NOOS): The

NOOS programme comprises a core

range of basic articles, mostly on an

18- to 24-month lifecycle, that are

selling across all channels and markets.

Overall, the NOOS replenishment model

secures high levels of product availability

throughout the season, allowing for

quick adaptation to demand patterns.

Retailers have to provide dedicated retail

space, co-invest in fixtures and fittings

and commit to a “first fill” representing

about 25% of total expected seasonal

demand to participate in this programme.

In return, customers can profit from

significantly reduced inventory risk on

these products. Most NOOS articles are

on an end-to-end supply chain, thus

limiting the adidas Group’s inventory risk

as we re-produce following customer

demand.

Harmonisation and standardisation

of processes to exploit leverage

Our Wholesale segment is constantly

working on further leveraging the size

of our Group and reducing complexity by

implementing best operational practices

across our wholesale activities. The

harmonisation and standardisation

particularly of back-end processes can

help to further reduce cost through

simplified IT systems and applications.

Similarly, and already started in Europe,

we are rolling out a trade terms policy

that rewards customer performance

either by higher efficiency (e.g. in

logistics) or better sell-out support

(e.g. by point-of-sale activation). As

part of this effort, we have established

regular reporting, delivering meaningful

benchmarks that allow us to tightly

control our third-party retail support

activities.

Innovation key to accelerate

speed-to-market

Accelerating product creation, while

reducing complexity is a key element to

gain competitive edge and ultimately to

increase shelf space at our customers.

We have therefore developed a virtual

sell-in tool which allows us to contin-

uously offer a holistic sample range to

our retail partners. This is giving the

customer the benefit of having a “full

range in his pocket”. The reduced amount

of samples used during the sell-in

process as well as the streamlined image

creation process increase speed-to-

market, while at the same time reducing

costs. This new tool has already been

piloted in several markets and is targeted

to cover 60% of all Wholesale pre-orders

by 2013.

Retail Strategy

Our Retail segment’s strategic vision

is to become one of the top retailers

in the world by delivering healthy,

sustainable growth with improved return

on investment see 02. Retail plays

an important role for the growth of our

Group and our brands. The reasons are

manifold:

– As a place to showcase the breadth of

our brands (i.e. concept stores)

– To create distribution in markets which

do not have traditional wholesale

structures

– The share of selling space via

wholesale is in decline due to industry

consolidation

– Everything we learn in own retail

benefits the rest of the organisation

– Need for a clearance channel (i.e.

factory outlets).

Over the past five years, the adidas Group

has evolved into a significant retailer,

operating 2,270 stores for the adidas and

Reebok brands worldwide see Retail

Business Performance, p. 153.

Reebok

Core Store in Warsaw

Going forward, we have simplified the

shape of our store chain, by clustering

it into three different formats, namely

brand centres, core stores and factory

outlets.

– Brand centres, i.e. large stores carrying

the full range of each of our adidas

sub-brands under one roof, are the

bold and powerful statements about

their strength, breadth and depth. This

format will be kept to a limited number

and only in exclusive locations.

– Core stores are the commercial engine

for sales and profit across the Group’s

retail organisation, upholding and

accentuating each brand’s reputation.

There will be adidas brand core stores,

Originals core stores and Reebok core

stores and, depending on their size,

they will be categorised and clustered

into A, B or C.

– Our factory outlets will facilitate

the controlled sale of excess stock

returned from our wholesale key and

field accounts, franchise partners,

e-commerce as well as own-retail

stores. Through improved management

of regional inventory and limited

planned production, we want to improve

and balance our product offering

and therefore further increase our

profitability.