Reebok 2010 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2010 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Group Management Report – Financial Review Group Business Performance Economic and Sector Development 131

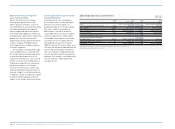

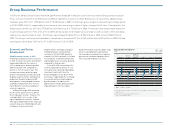

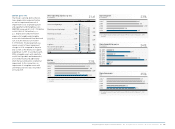

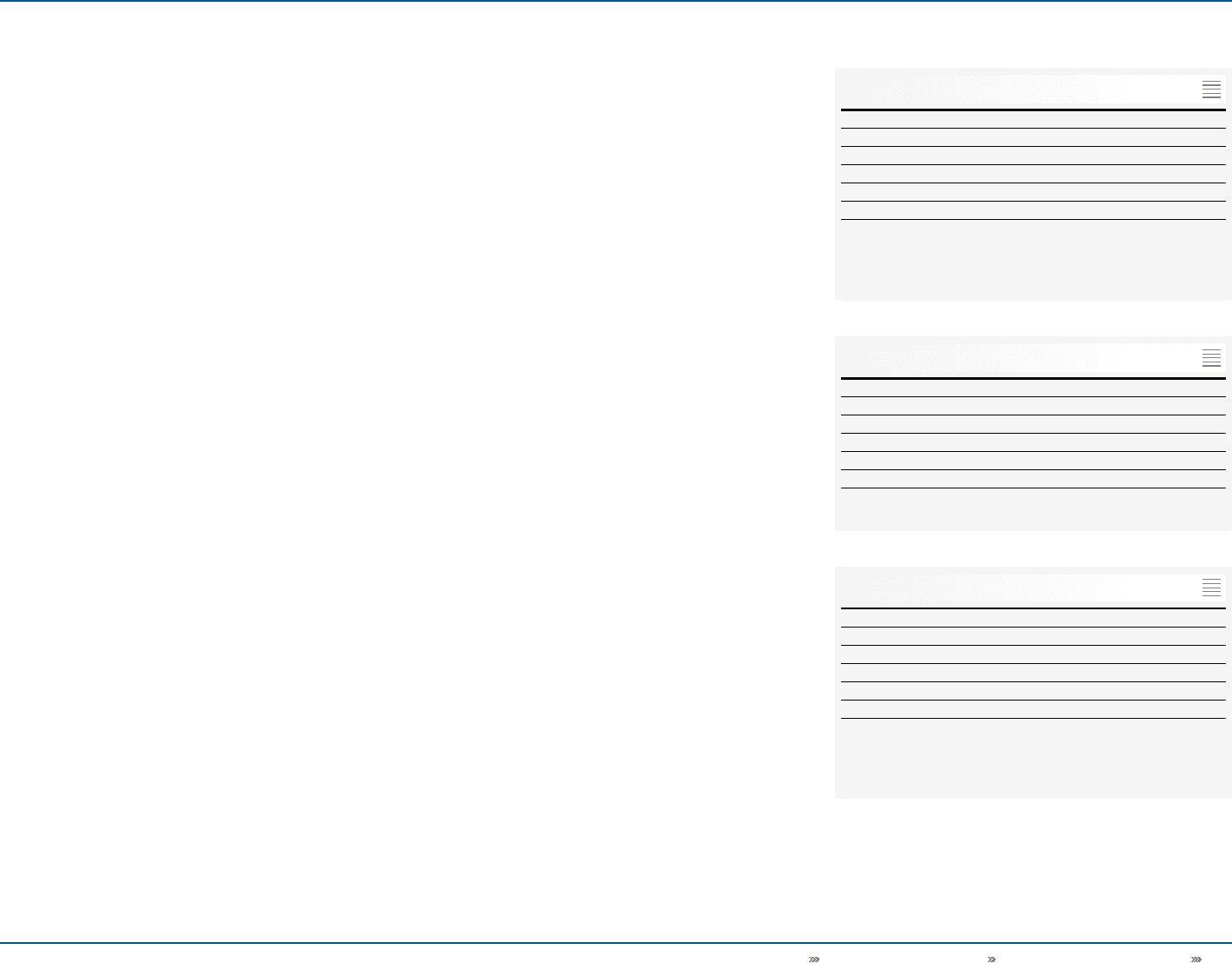

Quarterly unemployment rate by region

in % of total active population

Q4 2009 Q1 2010 Q2 2010 Q3 2010 Q4 2010

USA 1 ) 10.0 9.7 9.6 9.6 9.6

Euro Zone 2 ) 9.9 9.9 10.0 10.0 10.0

Japan 3 ) 5.2 5.0 5.3 5.0 4.9

China 4 ) 4.3 4.2 4.2 4.1 4.1

Russia 5 ) 8.2 8.6 6.8 6.6 7.2

1) Source: US Bureau of Labor Statistics.

2) Source: Eurostat.

3) Source: Japan Ministry of Internal Affairs and Communications.

4) Source: China National Bureau of Statistics.

5) Source: Russia Federal Service of State Statistics.

Quarterly consumer confidence development

by region

Q4 2009 Q1 2010 Q2 2010 Q3 2010 Q4 2010

USA 1 ) 53.6 52.3 54.3 48.6 53.3

Euro Zone 2 ) (16) (17) (17) (11) (11)

Japan 3 ) 37.9 41.0 43.6 41.4 40.2

China 4 ) 103.9 107.9 108.5 104.1 102.9

Russia 5 ) (20) (10) (7) (11) (10)

1) Source: Conference Board.

2) Source: European Commission.

3) Source: Economic and Social Research Institute, Government of Japan.

4) Source: China National Bureau of Statistics.

5) Source: Russia Federal Service of State Statistics.

Quarterly development of Consumer Price Index 1) 2)

by region

Q4 2009 Q1 2010 Q2 2010 Q3 2010 Q4 2010

USA 2.7 2.3 1.1 1.1 1.5

Euro Zone 0.9 1.4 1.4 1.8 2.2

Japan (1.7) (1.1) (0.7) (0.6) 0.0

China 1.9 2.4 2.9 3.6 4.6

Russia 8.8 6.5 5.8 7.0 8.8

1) Source: Bloomberg.

2) Quarter-end figures.

02

04

03

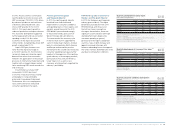

In 2010, Asian economies continued to

lead the global economic recovery, with

GDP increasing 6.7% (2009: 0.3%), driven

by industrial production and resilience

in domestic demand and retail sales.

China’s GDP grew by 10.0% in 2010

(2009: 9.1%), mainly due to growth in

industrial production and export volumes.

This economic development supported

further wage growth and saw consumer

spending rise by 9.5%. Most other

economies in the region also posted

similar trends, including India where GDP

growth is projected at 9.2%.

Japan’s GDP gain, however, was

lower than the regional average at

4.3% (2009: decline of 6.3%). Economic

recovery in Japan was driven by export

demand from other Asian economies.

However, the appreciation of the yen put

pressure on international trade levels and

together with a sluggish labour market

led to weakening GDP trends towards the

end of the year.

In Latin America, full year GDP

increased 6.6% (2009: decline of

3.4%). The strong recovery was mainly

attributable to rising commodity

prices and strong domestic demand.

Furthermore, the rise in employment

rates and income levels stimulated

consumer spending in the region.

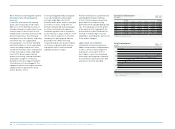

Positive growth in the global

sporting goods industry

In 2010, the sporting goods industry

benefited from the broad-based

improvement in consumer confidence

and spending levels in most regions and

markets around the world. The 2010

FIFA World Cup contributed strongly

to the positive trends, particularly in

Western Europe and Latin America.

The turnaround of the inventory cycle

in the first half of 2010 supported the

sector in many major markets. A robust

back-to-school period in North America

and Europe maintained the positive

momentum in the second half. Increasing

consumer spending levels gave further

impetus to the expansion of the sporting

goods industry in the emerging markets,

particularly in Asia and Latin America.

Lower input costs as well as less

clearance activity positively impacted the

industry’s profitability.

FIFA World Cup adds momentum to

Europe’s sporting goods industry

In 2010, the European sporting goods

industry grew modestly. The region

benefited sustainably from the 2010

FIFA World Cup, with three out of

the last four teams coming from

the region. Nevertheless, there was

significant country variation with high

unemployment levels depressing

consumer spending in general,

particularly in the region’s peripheral

countries. Sales in both footwear and

apparel increased in Europe, with

footwear rebounding faster than apparel.

The latter, however, benefited later in the

year due to cold weather conditions.