Reebok 2010 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2010 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36 To Our Shareholders Our Share

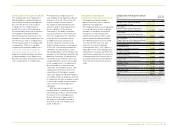

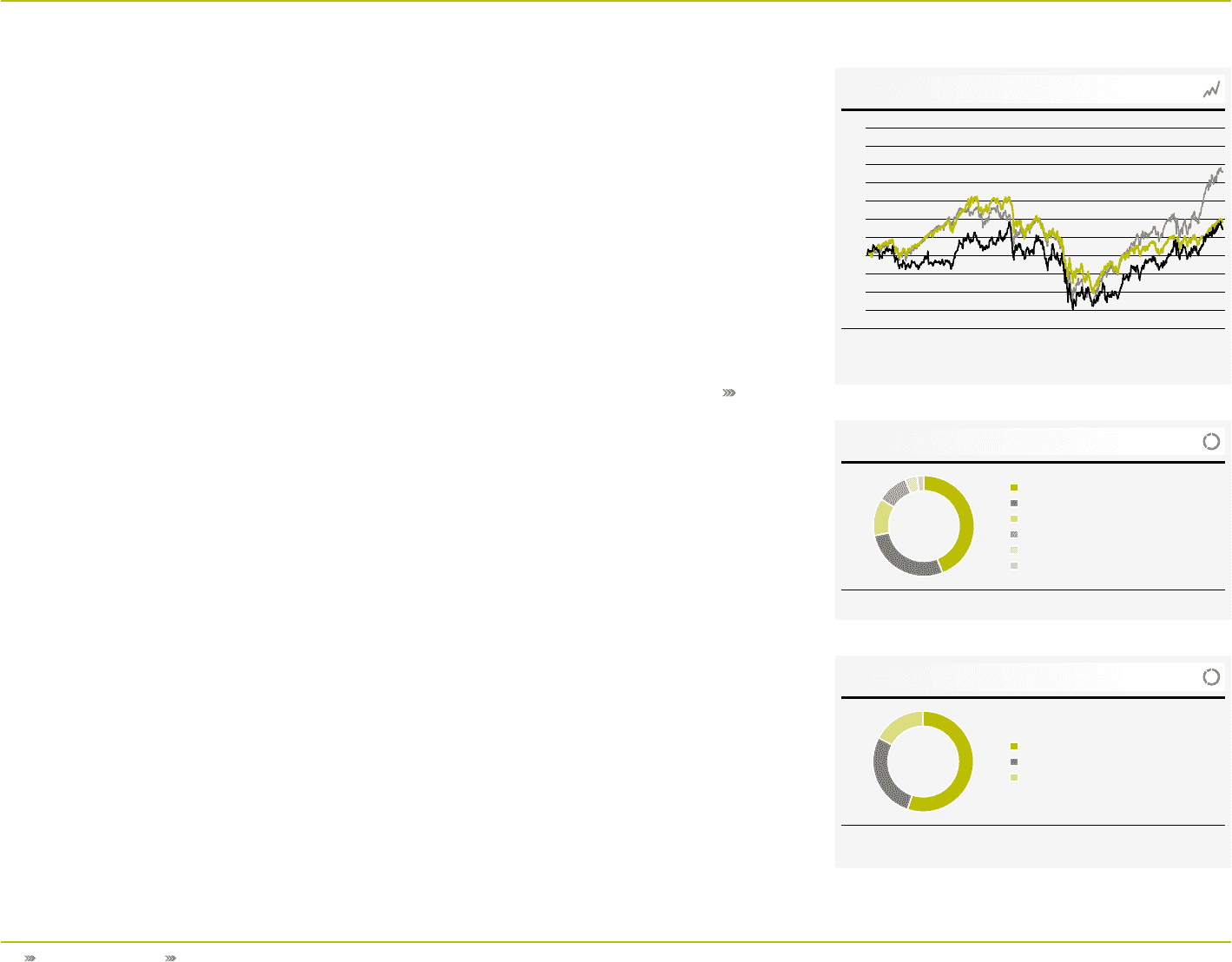

Shareholder structure 1 )

1) In February 2011.

Recommendation split 1 )

1) At year-end 2010.

Source: Bloomberg.

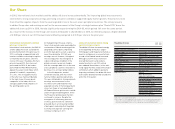

06

07

44% Rest of Europe

28% North America

12% Other, undisclosed holdings

10% Germany

4% Rest of the world

2% Management

55% Buy

28% Hold

17% Sell

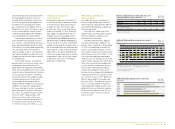

Strong sustainability track record Strong sustainability track record

reflected in index membershipsreflected in index memberships

In recognition of our social and environ-

mental efforts, adidas AG is listed in

several sustainability indices. For the

eleventh consecutive time, adidas AG

has been included in the Dow Jones

Sustainability Indexes (DJSI). The indexes

analyse and track the social, environ-

mental and financial performance of

more than 300 companies worldwide.

In addition, adidas AG was again

included in the FTSE4Good Europe Index.

This positive reassessment acknowledges

the Group’s social, environmental and

ethical engagement, and encourages us

to continue and intensify our efforts to

improve our sustainability performance.

Also, adidas AG was again included in

the Vigeo Group’s Ethibel Excellence

Sustainability Index Europe as well as

in the ASPI Eurozone Index. The Vigeo

Group is a leading European supplier of

extra-financial analysis that measures

companies’ performance in the fields

of sustainable development and social

responsibility. Further, the adidas Group

was included for the sixth consecutive

time in the list of The Global 100 Most

Sustainable Corporations in the World.

This is a project initiated by Corporate

Knights Inc. with Innovest Strategic Value

Advisors Inc., a research firm specialised

in analysing extra-financial drivers of risk

and shareholder value. Launched in 2005,

the annual list of The Global 100 Most

Sustainable Corporations in the World is

unveiled each year at the World Economic

Forum in Davos.

The less pronounced increase of the

Level 1 ADR price compared to the

ordinary share price was due to the

appreciation of the US dollar during 2010.

The number of Level 1 ADRs outstanding

increased to 6.4 million at year-end 2010

(2009: 5.4 million). The average daily

trading volume decreased 60% compared

to the prior year. Since November 2007,

the adidas AG ADR is quoted on the

OTCQX International Premier market,

the highest over-the-counter market tier.

This electronic trading forum includes

leading international companies with

substantial operating businesses and

credible disclosure policies. Further

information on our ADR Programme can

be found on our website at www.adidas-

Group.com/adr.

Dividend proposal of € 0.80 per shareDividend proposal of € 0.80 per share

The adidas AG Executive and Supervisory

Boards will recommend paying a dividend

of € 0.80 to shareholders at the Annual

General Meeting (AGM) on May 12, 2011

(2009: € 0.35). Subject to the meeting’s

approval, the dividend will be paid

on May 13, 2011. This represents an

increase of 129% and reflects the strong

improvement in profitability in 2010.

The total payout of € 167 million (2009:

€ 73 million) reflects a payout ratio of

30% of net income, as in the prior year.

This is in line with our dividend policy

where we intend to pay out between 20%

and 40% of net income attributable to

shareholders.

adidas AG historically outperforms adidas AG historically outperforms

benchmark indices benchmark indices

The adidas Group is committed to

continuously enhancing shareholder

value. The long-term development of our

share price reflects investor confidence

and the growth potential of our Group.

Over the last ten years, our share has

gained 196%. This represents a clear

out performance of both the DAX-30,

which increased 7%, and the MSCI Index,

which increased 154% during the period.

ADR performs in line with ADR performs in line with

common stockcommon stock

Since its launch on December 30, 2004,

our Level 1 American Depositary Receipt

(ADR) facility has enjoyed great popu-

larity among American investors. In

January 2010, we removed The Bank

of New York Mellon as depositary bank

and appointed Deutsche Bank Trust

Company Americas to run our Level 1

ADR Programme. Our Level 1 ADR closed

the year at US $ 32.60, representing an

increase of 20% versus the prior year

(2009: US $ 27.15).

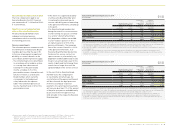

Five-year share price development 1 )

Dec 31, 2005 Dec 31, 2010

190

160

130

100

70

—

adidas AG

—

DAX-30

—

MSCI World Textiles, Apparel & Luxury Goods Index

1) Index: December 31, 2005 = 100%.

05