Reebok 2010 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2010 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248

|

|

Group Management Report – Financial Review Group Business Performance Statement of Financial Position and Statement of Cash Flows 141

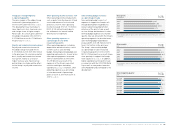

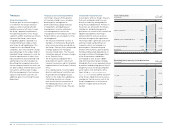

Accounts payable

€ in millions

1) Including Reebok, Rockport and Reebok-CCM Hockey from February 1, 2006

onwards.

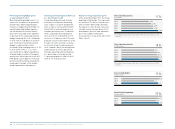

Shareholders’ equity

€ in millions

1) Including Reebok, Rockport and Reebok-CCM Hockey from February 1, 2006

onwards.

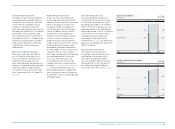

Total assets

€ in millions

1) Including Reebok, Rockport and Reebok-CCM Hockey from February 1, 2006

onwards.

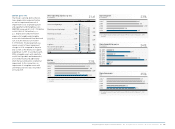

Inventories

€ in millions

1) Including Reebok, Rockport and Reebok-CCM Hockey from February 1, 2006

onwards.

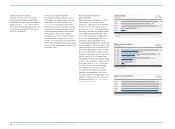

Accounts receivable

€ in millions

1) Including Reebok, Rockport and Reebok-CCM Hockey from February 1, 2006

onwards.

38

39

35

36

37

2006 1 )

2007

2008

2009

2010

2006 1 )

2007

2008

2009

2010

2006 1 )

2007

2008

2009

2010

2006 1 )

2007

2008

2009

2010

2006 1 )

2007

2008

2009

2010

752

849

1,218

1,166

1,694

2,828

3,023

3,386

3,771

4,616

8,379

8,325

9,533

8,875

10,618

1,607

1,629

1,995

1,471

2,119

1,415

1,459

1,624

1,429

1,667

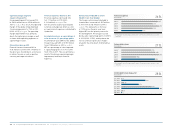

Other non-current assets down 20%

Other non-current assets decreased 20%

to € 100 million at the end of December

2010 from € 126 million in 2009, mainly

driven by a decline in prepaid promotion

partnerships see Note 16, p. 200.

Accounts payable increase 45%

Accounts payable were up 45% to

€ 1.694 billion at the end of December

2010 versus € 1.166 billion at the end of

2009 see 38. On a currency-neutral

basis, accounts payable increased 36%,

reflecting the growth in inventories

during the fourth quarter.

Other current financial liabilities

increase 21%

At the end of December 2010, other

current financial liabilities increased 21%

to € 123 million from € 101 million in

2009, primarily as a result of an increase

in the negative fair value of financial

instruments see Note 18, p. 200.

Other current provisions up 47%

Other current provisions were up 47%

to € 470 million at the end of 2010

versus € 320 million at the end of 2009.

This primarily relates to increases in

provisions for returns, allowances and

warranty see Note 19, p. 201.