Reebok 2010 Annual Report Download - page 211

Download and view the complete annual report

Please find page 211 of the 2010 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Consolidated Financial Statements Notes Notes to the Consolidated Statement of Financial Position 207

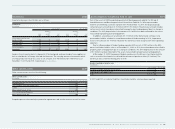

Distributable profits and dividends Distributable profits and dividends

Distributable profits to shareholders are determined by reference to the retained earnings of

adidas AG and calculated under German Commercial Law.

The dividend for 2009 was € 0.35 per share (total amount: € 73 million), approved by the 2010

Annual General Meeting. The Executive Board of adidas AG will propose to shareholders a dividend

payment of € 0.80 per dividend-entitled share for the year 2010 to be made from retained earnings

of € 368 million reported as at December 31, 2010. The subsequent remaining amount will be

carried forward.

209,216,186 dividend-entitled shares exist as at December 31, 2010, which would lead to a

dividend payment of € 167 million.

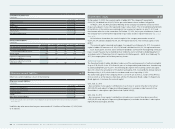

Non-controlling interests 26

This line item within equity comprises the non-controlling interests in several subsidiaries, which

are not directly or indirectly attributable to adidas AG.

Non-controlling interests are assigned to seven subsidiaries as at December 31, 2010 and 2009,

respectively see Shareholdings of adidas AG/Attachment II to these Notes. These subsidiaries were partly

acquired in connection with the acquisition of Reebok and partly through purchases or foundations

in the last years.

In compliance with IAS 32 “Financial Instruments: Presentation”, certain non-controlling interests

are not reported within non-controlling interests. These include non-controlling interests of GEV

Grundstücksgesellschaft Herzogenaurach mbH & Co. KG (Germany) as the company is a limited

partnership. The fair value of these non-controlling interests is shown within other liabilities and

the result for these non-controlling interests is reported within financial expenses see Note 32.

Leasing and service arrangements 27

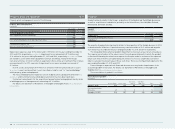

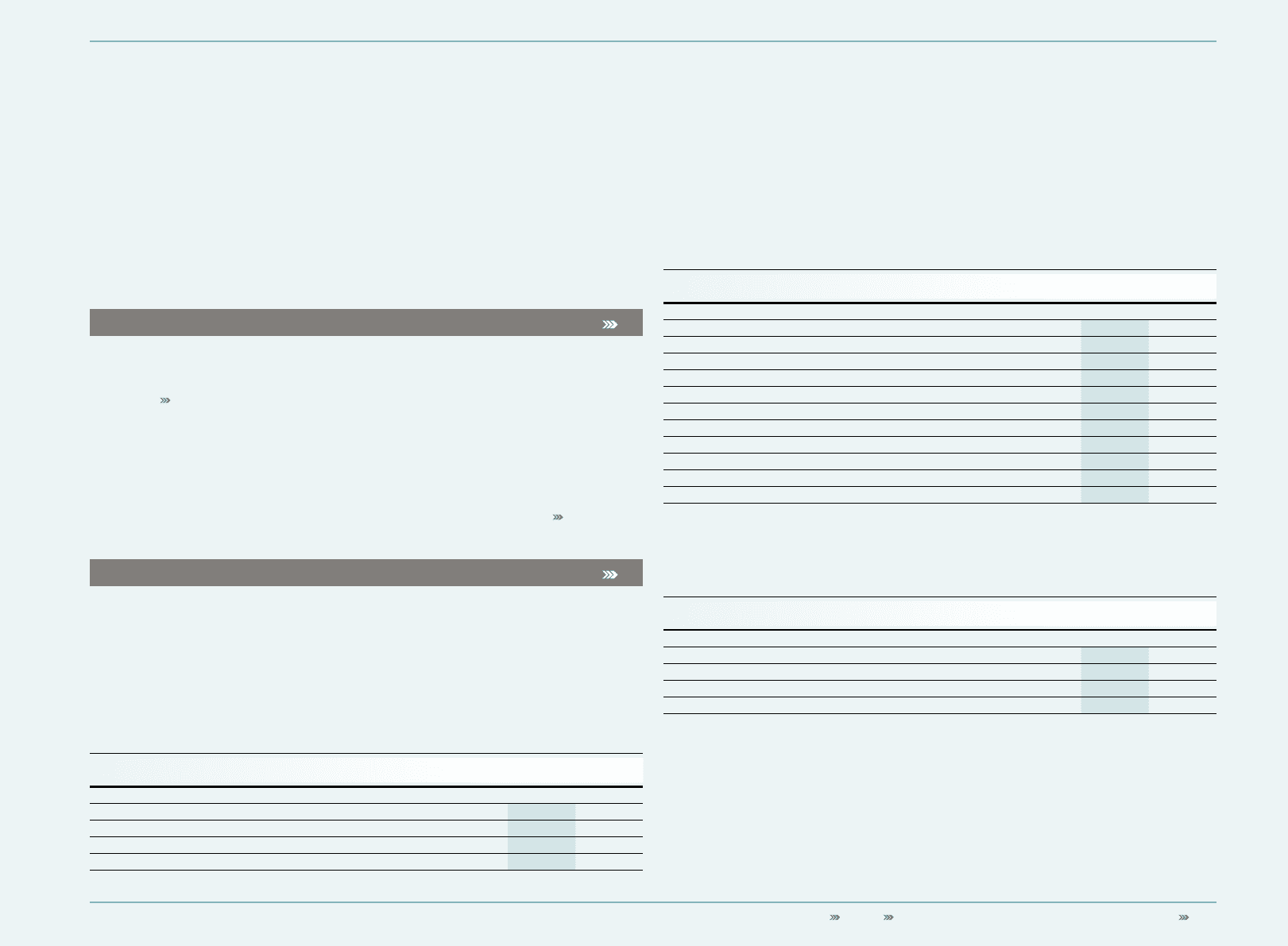

Operating leases Operating leases

The Group leases primarily retail stores as well as offices, warehouses and equipment. The

contracts regarding these leases with expiration dates of between one and fourteen years partly

include renewal options and escalation clauses. Rent expenses, which partly depend on net sales,

amounted to € 544 million and € 480 million for the years ending December 31, 2010 and 2009,

respectively.

Future minimum lease payments for minimum lease durations on a nominal basis are as

follows:

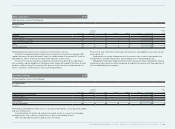

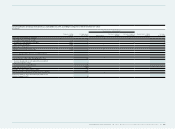

Minimum lease payments for operating leases

€ in millions

Dec. 31, 2010 Dec. 31, 2009

Within 1 year 404 360

Between 1 and 5 years 659 619

After 5 years 331 320

Total 1,394 1,299

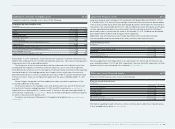

Finance leases Finance leases

The Group also leases various premises for administration, warehousing, research and

development as well as production, which are classified as finance leases.

The net carrying amount of these assets of € 7 million and € 7 million was included in property,

plant and equipment as at December 31, 2010 and 2009, respectively. For the year ending

December 31, 2010, interest expenses were € 1 million (2009: € 1 million) and depreciation

expenses were € 3 million (2009: € 1 million).

The minimum lease payments under these contracts over their remaining terms up to 2016 and

their net present values are as follows:

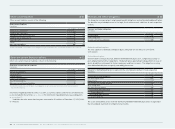

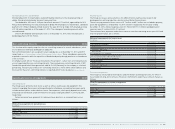

Minimum lease payments for finance leases

€ in millions

Dec. 31, 2010 Dec. 31, 2009

Lease payments falling due:

Within 1 year 2 1

Between 1 and 5 years 3 1

After 5 years 0 1

Total minimum lease payments 5 3

Less: estimated amount representing interest 0 0

Present value of minimum lease payments 5 3

Thereof falling due:

Within 1 year 2 1

Between 1 and 5 years 3 1

After 5 years 0 1

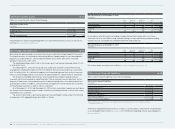

Service arrangements Service arrangements

The Group has outsourced certain logistics and information technology functions, for which it

has entered into long-term contracts. Financial commitments under these contracts mature as

follows:

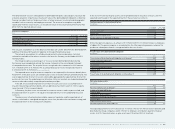

Financial commitments for service arrangements

€ in millions

Dec. 31, 2010 Dec. 31, 2009

Within 1 year 40 42

Between 1 and 5 years 65 59

After 5 years 44 —

Total 149 101