Reebok 2010 Annual Report Download - page 203

Download and view the complete annual report

Please find page 203 of the 2010 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

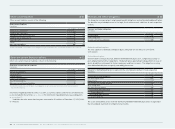

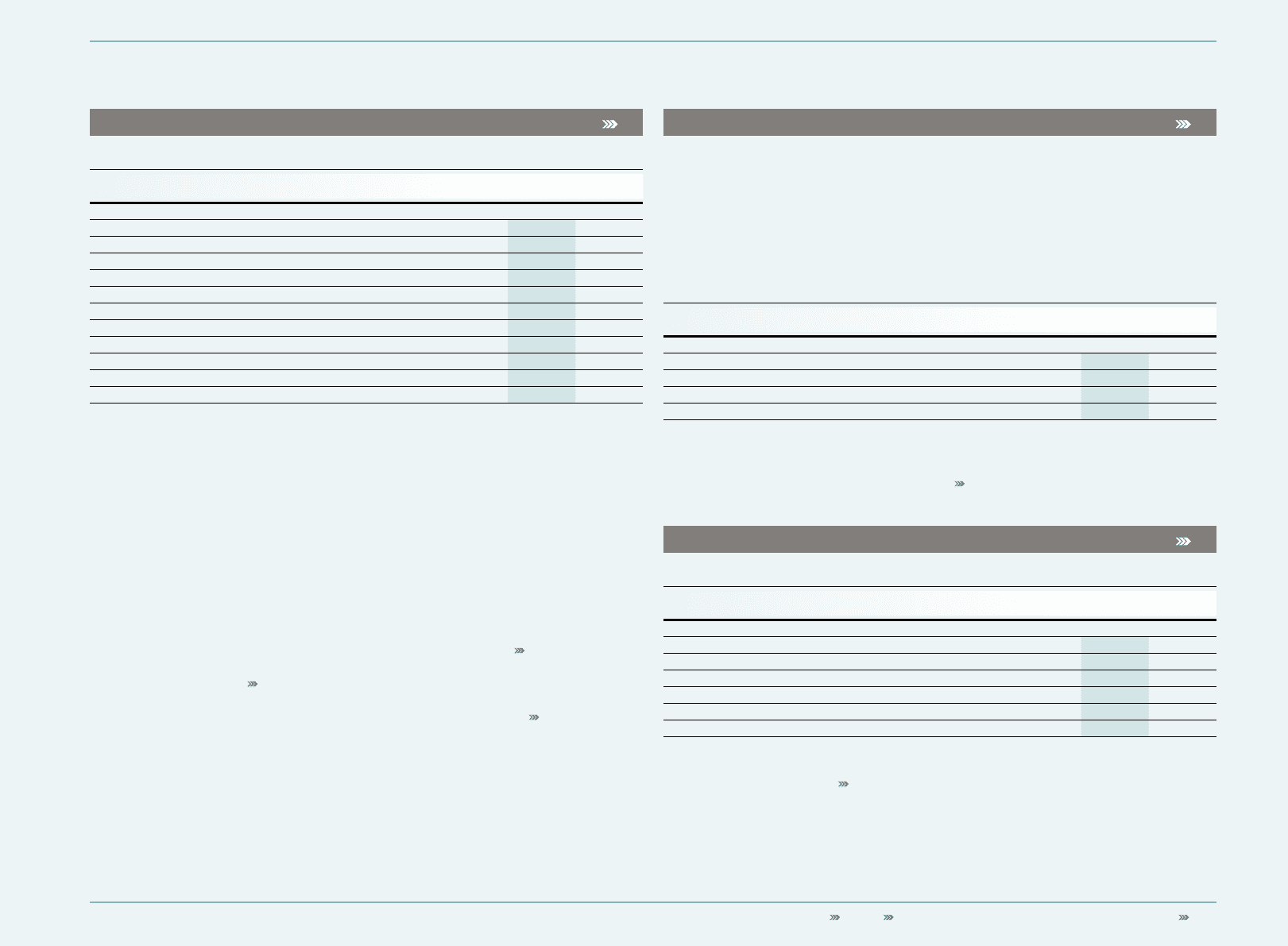

Consolidated Financial Statements Notes Notes to the Consolidated Statement of Financial Position 199

Trademarks and other intangible assets 13

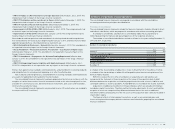

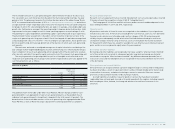

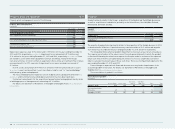

Trademarks and other intangible assets consist of the following:

Trademarks and other intangible assets

€ in millions

Dec. 31, 2010 Dec. 31, 2009

Reebok 1,159 1,075

Rockport 163 152

Reebok-CCM Hockey 98 90

TaylorMade-adidas Golf 27 25

Trademarks, gross 1,447 1,342

Less: accumulated amortisation and impairment losses 0 0

Trademarks, net 1,447 1,342

Software, patents and concessions, gross 600 538

Less: accumulated amortisation and impairment losses 458 378

Other intangible assets, net 142 160

Trademarks and other intangible assets, net 1,589 1,502

At December 31, 2010, trademarks, mainly related to the acquisition of Reebok International Ltd.

(USA) in 2006 and Ashworth, Inc. in 2008, have indefinite useful lives. This is due to the expectation

of permanent use of the acquired brand names.

The Group tests at least on an annual basis whether trademarks with indefinite useful lives

are impaired. This requires an estimation of the fair value less costs to sell of the trademarks.

Estimating the fair value less costs to sell requires the Group to make an estimate of the expected

future brand-specific sales and appropriate arm’s length notional royalty rates from the cash-

generating unit and also to choose a suitable discount rate in order to calculate the present value

of those cash flows. There was no impairment expense for the years ending December 31, 2010

and 2009.

Future changes in expected cash flows and discount rates may lead to impairments of the

accounted trademarks in the future.

Amortisation expenses for intangible assets with definite useful lives were € 55 million and

€ 66 million for the years ending December 31, 2010 and 2009, respectively see also Note 30.

Impairment losses amounted to € 11 million and € 19 million for the years ending December 31,

2010 and 2009, respectively see also Note 30. These are related to distribution and licensing rights,

for which no future economic benefit exists.

For details see Statement of Movements of Intangible and Tangible Assets see Attachment I

to these Notes.

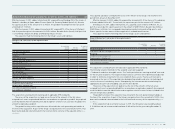

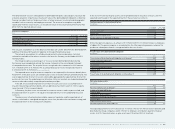

Long-term financial assets 14

Long-term financial assets include a 9.7% investment in FC Bayern München AG (2009: 10%) of

€ 79 million (2009: € 79 million). The percentage share held in the investment has decreased due

to the issuance of new shares which have been bought by another shareholder. This investment is

classified as “fair value through profit or loss” and recorded at fair value. This equity security does

not have a quoted market price in an active market, therefore existing contractual settlements

were used in order to calculate the fair value as at December 31, 2010. Dividends are distributed

by FC Bayern München AG instead of regular interest payments.

Additionally, long-term financial assets include investments which are mainly invested in

insurance products and are measured at fair value, as well as other financial assets.

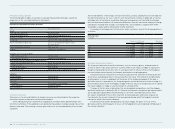

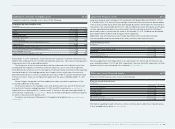

Long-term financial assets

€ in millions

Dec. 31, 2010 Dec. 31, 2009

Investment in FC Bayern München AG 79 79

Investments 14 12

Other financial assets 0 0

Long-term financial assets 93 91

Fair value adjustments from impairment losses amounted to € 0 million and € 5 million for the

years ending December 31, 2010 and 2009, respectively. These are related to impairments of other

financial assets to cover anticipated risks of default see also Note 32.

Other non-current financial assets 15

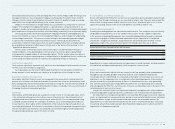

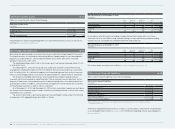

Other non-current financial assets consist of the following:

Other non-current financial assets

€ in millions

Dec. 31, 2010 Dec. 31, 2009

Interest rate derivatives 8 4

Currency options 12 19

Forward contracts 10 2

Security deposits 24 21

Other financial assets — 12

Other non-current financial assets 54 58

Information regarding forward contracts as well as currency options and interest rate derivatives

is also included in these Notes see also Note 28.