Reebok 2010 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2010 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

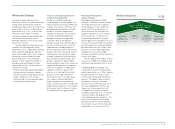

80 Group Management Report – Our Group Group Strategy

Group Strategy

Our goal as a Group is to lead the sporting goods industry with brands built upon a passion for sports and a sporting lifestyle.

Inspired by our heritage, we know that a profound understanding of the consumer and customer is essential to achieving this

goal. To anticipate and respond to their needs, we continuously strive to create a culture of innovation, challenging ourselves

to break with convention and embrace change. By harnessing this culture, we push the boundaries of products, services and

processes to strengthen our competitiveness and maximise the Group’s operational and financial performance. This, in turn,

will drive long-term value creation for our shareholders.

Creating shareholder value

Creating value for our shareholders

through significant cash flow generation

drives our overall decision-making

process see Internal Group Management

System, p. 126. Therefore, we are focused

on rigorously managing those factors

under our control, making strategic

choices that will drive sustainable

revenue and earnings growth, and

ultimately cash flow. For each of our

segments, we pursue the avenues for

growth which we expect to be most value-

enhancing, with particular emphasis

on improving profitability. In addition,

rigorously managing working capital

and optimising our capital structure

remain key priorities for us. As always,

we are committed to increasing returns

to shareholders with above-industry-

average share price performance and

dividends.

Presentation of Route 2015

In November 2010, the Group unveiled

its 2015 strategic business plan named

“Route 2015”. This plan is the most

comprehensive the adidas Group has ever

prepared, incorporating all brands, sales

channels and Group functions globally.

Based on our strong brands, premium

products, extensive global presence and

our commitment to innovation and the

consumer, we aspire to outperform total

market growth (both GDP and sporting

goods market) and to grow our bottom

line faster than our top line. In addition,

the Group plans to lay the foundation for

leadership in the sporting goods industry

by outgrowing our major competitor

over the next five years. The plan aims

at growing the revenues of the adidas

Group by 45% to 50% currency-neutral

from 2010 to 2015. In addition, the Group

targets a compounded annual earnings

growth rate of 15% and aims to reach an

operating margin of 11% sustainably by

2015 at the latest see Subsequent Events

and Outlook, p. 174. To achieve these goals,

we have made strategic choices and will

prioritise our investments under our six

key strategic pillars see 01.

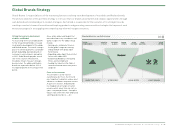

Diverse brand portfolio

Consumers want choice. Whether it is

the athlete looking for the best possible

equipment, or the casual consumer

searching for the next fashion trend,

we are inspired to develop and create

experiences that engage consumers

in long-lasting relationships with our

brands. To maximise our consumer

reach, we have embraced a multi-brand

strategy.

No matter in which market we operate,

we recognise that consumer buying

behaviour and the retail landscape are

unique. Therefore, to fully exploit market

opportunities, we tailor our distribution

strategy to present our brands to the

consumer in the most impactful way.

This is achieved by following a distinctive

but coordinated channel approach.

To this end, we strive to provide our

customers with superior service to

secure prime shelf space for our brands,

while continuing our commitment to

building a strategic competency in own

retail and e-commerce see Global Sales

Strategy, p. 82.

Creating a flexible supply chain

Speed and agility are key to outpacing

the competition. We are committed to

meeting the full range of customer and

consumer needs by ensuring product

availability in the correct size and colour,

providing game-changing technical

innovations and also the latest high-end

fashion product to the highest quality

standards.

This approach allows us to tackle oppor-

tunities from several perspectives, as

both a mass and a niche player, providing

distinct and relevant products to a wide

spectrum of consumers. In this way, each

brand is able to keep a unique identity

and focus on its core competencies, while

simultaneously providing our Group with

a broad product offering, increasing our

leverage in the marketplace see Global

Brands Strategy, p. 87.

Investments focused on highest-

potential markets and channels

As a Group, we target leading market

positions in all markets where we

compete. However, we have prioritised

our investments based on those

markets which offer the best medium-

to long-term growth and profitability

opportunities. In this respect, we

continue to place a considerable

emphasis on expanding our activities in

the emerging markets, particularly China

and Russia, as well as building market

share in underpenetrated markets such

as the United States see Subsequent

Events and Outlook, p. 174.