Reebok 2010 Annual Report Download - page 197

Download and view the complete annual report

Please find page 197 of the 2010 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Consolidated Financial Statements Notes 193

The recoverable amount of a cash-generating unit is determined on the basis of value in use.

This calculation uses cash flow projections based on the financial planning covering a five-year

period in total. The planning is based on the strategic business plan of the adidas Group “Route

2015” as communicated on November 8, 2010 see Subsequent Events and Outlook, p. 174 and reflects

an expected mid- to high-single-digit sales increase for the majority of the cash-generating units

(or groups of units). For a few emerging markets, we expect, on average, a low-double-digit sales

growth rate. Furthermore, we expect the operating margin to improve primarily driven by a slight

improvement in the gross margin as well as lower operating expenses as a percentage of sales.

The planning for capital expenditure and working capital is primarily based on past experience.

The planning for future tax payments is based on current statutory corporate tax rates of the

single cash-generating units (or groups of units). Cash flows beyond this period are extrapolated

using steady growth rates of 1.7% (2009: 1.7%). According to our expectations, these growth rates

do not exceed the long-term average growth rate of the business in which each cash-generating

unit operates.

Discount rates are based on a weighted average cost of capital calculation considering a five-

year average market-weighted debt/equity structure and financing costs referencing the Group’s

major competitors for each cash-generating unit (or group of units). The discount rates used are

after-tax rates and reflect the specific equity and country risk of the relevant cash-generating unit.

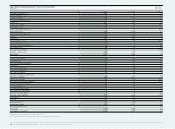

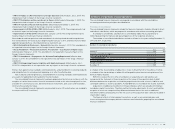

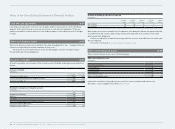

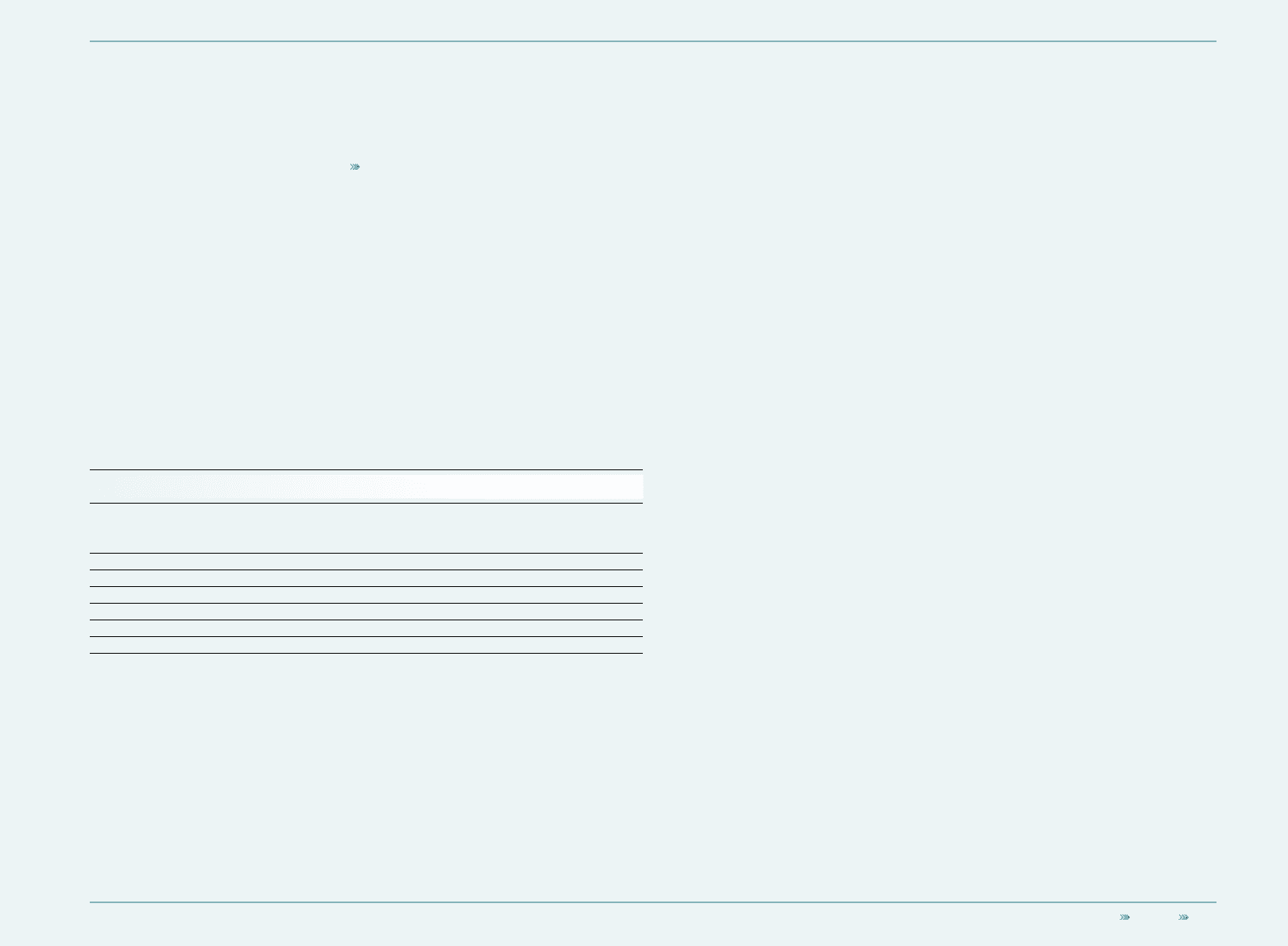

The carrying amounts of acquired goodwill as well as of intangible assets allocated to the

respective cash-generating unit (or group of units) and the respective discount rates applied to the

cash flow projections are as follows:

Allocation of goodwill

Goodwill

(€ in millions)

Intangible assets

with indefinite

useful lives

(€ in millions) Discount rate

TaylorMade-adidas Golf 284 27 7.6%

Greater China 221 247 8.3%

Other Asian Markets 167 169 7.9 – 11.0%

Western Europe 538 323 7.1 – 10.2%

Other Cash-generating Units 329 681 6.4 – 11.0%

Total 1,539 1,447

The goodwill shown in the table under Other Asian Markets, Western Europe and Other Cash-

generating Units is an aggregation of several cash-generating units, as the goodwill of each

individual cash-generating unit is insignificant compared to the total amount of goodwill. The

determination of the recoverable amounts of the cash-generating units aggregated under Other

Asian Markets as well as Western Europe is based on the same key parameter assumptions.

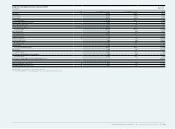

Research and development Research and development

Research costs are expensed in full as incurred. Development costs are also expensed as incurred

if they do not meet the recognition criteria of IAS 38 “Intangible Assets”.

The Group spent € 102 million and € 86 million on product research and development for the

years ending December 31, 2010 and 2009, respectively.

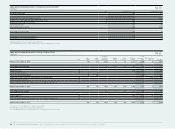

Financial assets Financial assets

All purchases and sales of financial assets are recognised on the trade date. Costs of purchases

include transaction costs. If the fair value of available-for-sale financial assets (i.e. non-derivative

financial assets which are not allocable under another category of IAS 39) can be measured

reliably, they are subsequently carried at fair value. Realised and unrealised gains and losses

arising from changes in the fair value of financial assets are included in the income statement

for the period in which they arise, except for available-for-sale financial assets where unrealised

gains and losses are recognised in equity unless they are impaired.

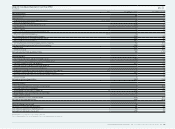

Borrowings and other liabilities Borrowings and other liabilities

Borrowings and other liabilities are recognised at fair value using the “effective interest method”,

net of transaction costs incurred. In subsequent periods, long-term borrowings are stated at

amortised cost using the “effective interest method”. Any difference between proceeds (net of

transaction costs) and the redemption value is recognised in the income statement over the term

of the borrowing.

Other provisions and accrued liabilitiesOther provisions and accrued liabilities

Other provisions are recognised where a present obligation (legal or constructive) to third parties

has been incurred as a result of a past event which can be estimated reliably and is likely to lead

to an outflow of resources, and where the timing or amount is uncertain. Other non-current

provisions are discounted if the effect of discounting is material.

Accrued liabilities are liabilities to pay for goods or services that have been received or

supplied but have not been paid, invoiced or formally agreed with the supplier, including amounts

due to employees. Here, however, the timing and amount of an outflow of resources is not

uncertain.