Reebok 2010 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2010 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

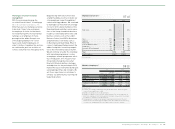

Group Management Report – Financial Review Internal Group Management System 129

Structured performance

measurement system

Our Group has developed an extensive

performance measurement system,

which utilises a variety of tools to

measure the performance of the adidas

Group. The Group’s key financial metrics

are monitored and compared against

budget on a monthly basis. The focus

is on operating cash flow, CACC, sales,

operating margin, operating working

capital and net debt development

see 02. When negative deviations

exist between actual and target numbers,

we perform a detailed analysis to

identify and address the cause. We also

benchmark our Group’s financial results

with those of our major competitors

on a quarterly basis. To assess current

sales and profitability development,

Management analyses sell-through

information from our own-retail

distribution as well as short-term

replenishment orders from retailers.

Taking into account year-to-date

performance as well as opportunities

and risks, the Group’s full year financial

performance is forecasted on a quarterly

basis.

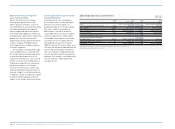

In this respect, backlogs comprising

orders received up to nine months in

advance of the actual sale are used as an

indicator. However, due to the growing

share of own retail in our business mix

as well as fluctuating order patterns

among our wholesale partners, our order

books are less indicative of anticipated

revenues compared to the past. As a

result of the growing share of at-once

business, qualitative feedback from

our retail partners on the success of

our collections at the point of sale is

becoming even more important. As an

early indicator for future performance,

we also conduct market research to

measure brand appeal, brand awareness

and resulting purchase intent.

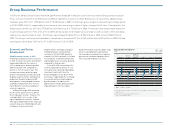

Management appraisal of

performance and targets

We communicate our Group’s financial

targets on an annual basis. We also

provide updates throughout the year as

appropriate. In 2010, Group sales and

net income increased significantly. While

Retail revenues increased at double-

digit rates, sales in the Wholesale

segment and in Other Businesses grew

at single-digit rates. Increased Retail

sales in the emerging markets resulted

in Group revenues exceeding our initial

guidance of a low- to mid-single-digit

increase. Group sales development

outperformed macroeconomic and global

industry growth see Economic and Sector

Development, p. 130, mainly due to strong

sales increases in most geographical

areas.

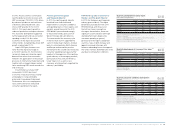

Profitability increased at a higher rate

than originally anticipated as a result

of higher gross margins partly due to

the strong performance of our Retail

segment. As a result of continued focus

on operating working capital and cash

management, we achieved all of our

goals related to balance sheet improve-

ments in 2010.

Our expectations for the Group’s

business performance in 2011 are based

on the assumption of an improvement in

the global economy, a strengthening of

our business in the emerging markets

and a strong product pipeline which

has received favourable reviews from

retailers. This, as well as an improved

balance sheet, should lead to increases

in sales and earnings per share in 2011.

Profitability improvements, however,

will be dampened by increasing raw

material and labour costs which our

industry is facing. In 2012 and beyond,

assuming further improvements in the

global economy, we are confident to

further increase sales and earnings per

share as outlined under our Route 2015

strategic business plan. We believe that

our outlook is realistic within the scope

of the current trading environment. No

material event between the end of 2010

and the publication of this report has

altered our view see Subsequent Events

and Outlook, p. 174.